Apologies for sending this email at the absolute worst time to email anyone (Friday evening), but I’ve been rather busy …

Earlier this week, but what feels like a lifetime ago, Trump pulled the trigger on new steel and aluminium tariffs.

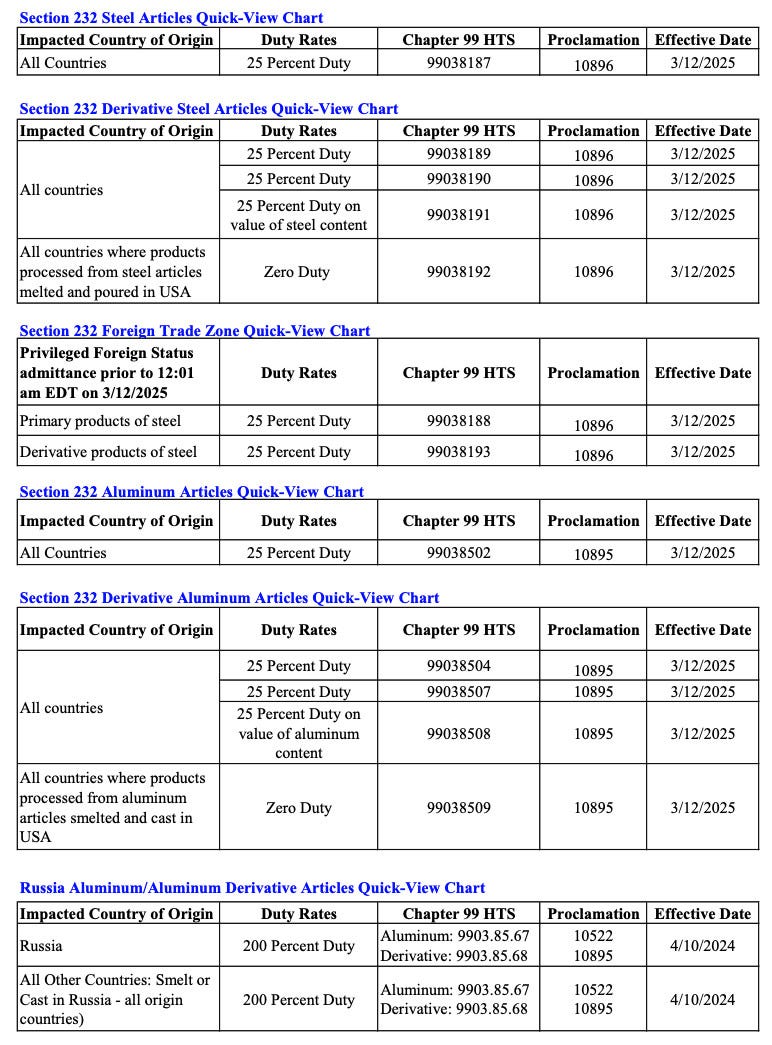

In summary (thank you, EU explainer) …

The US measures implemented on 12 March consist of three key elements:

Reinstating the June 2018 section 232 tariffs on steel and aluminium products. These covered different types of semifinished and finished products, such as steel pipes, wire and tin foil.

Increasing the tariffs imposed on aluminium from the original 10% to 25%.

Extending the tariffs to other products, notably:

Steel and aluminium products, such as household products like cooking ware or window frames.

Products that are only partly made of steel or aluminium, such as machinery, gym equipment, certain electrical appliances or furniture.

In addition, the US Secretary of Commerce will establish by 12 May 2025 a system whereby the US will continue to extend the list of steel and aluminium derivatives products subject to additional duties of up to 25%.

The various tariffs are neatly summarised in this table:

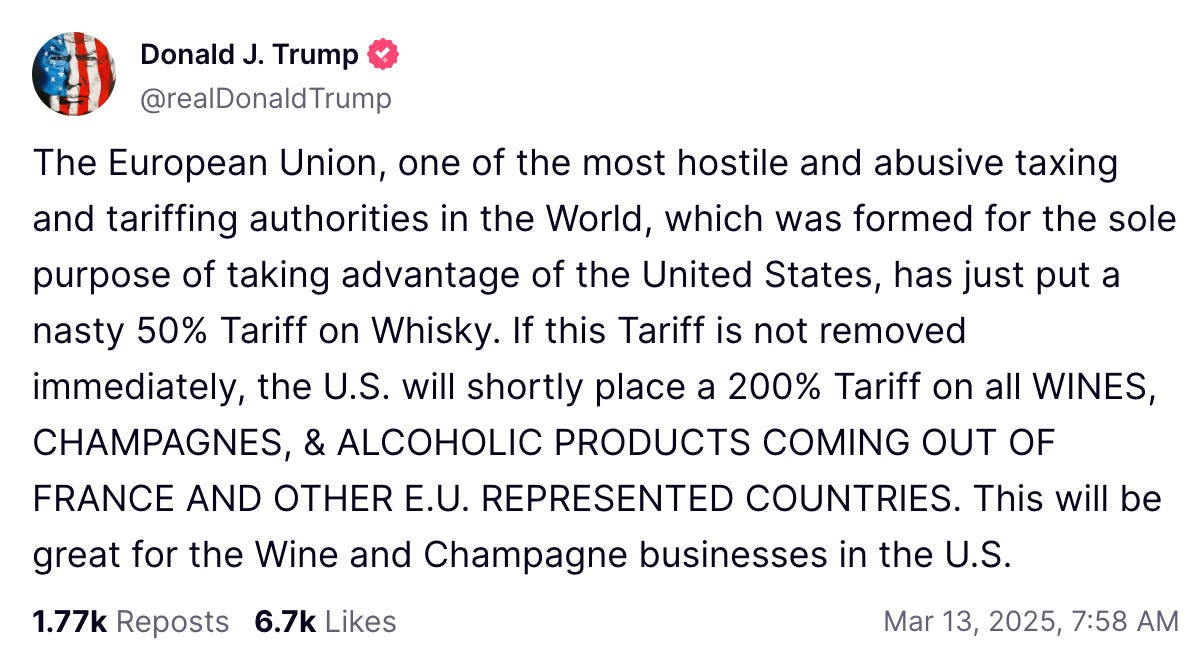

Obviously the media focus quickly moved onto the EU’s announced retaliation and then this Truth Social post by the poster-in-chief:

However, I want to talk about the original measures , particularly the extension of the steel/aluminium tariffs to downstream derivative products such as, for example, baseball bats.

Because it turns out that the 25 per cent tariff can, in some instances, apply exclusively to the steel/aluminium content of a product rather than the product’s total value.

See this US Customs and Border Protection Guidance (emphasis added):

Reporting Instructions for Duties Based on Steel Content

For new steel derivatives outside of Chapter 73, the 25 percent duty is to be reported with HTS 9903.81.91 based upon the value of the steel content.

If the value of the steel content is the same as the entered value or is unknown, the duty must be reported under HTS 9903.81.91 based on the entire entered value, and report on only one entry summary line.

If the value of the steel content is less than the entered value of the imported article, the good must be reported on two lines. The first line will represent the non-steel content, while the second line will represent the steel content.

This means that if the cost of your imported derivative product is $100, but the steel content is only valued at $25, the ultimate tariff would be 25% of $25 rather than 25% of $100. Assuming you can be bothered to do all the paperwork that is.

Anyhow, this approach makes me wonder if we might see something similar elsewhere.

For example, what if you were tariffed based on the Chinese value of your imported product?

For example, a European EV battery would normally be subject to a 3.4% US tariff. But what if the European EV battery’s China-originating cells (subject to a 25% tariff), account for 70% of the value?

Assuming the battery costs $1000, you could imagine a situation in which the US started asking importers to pay a 3.4% tariff on the EU value and a 25% tariff on the China content. [Assuming the alternative is to pay the full China tariff.]

This would result in a total tariff cost of ($300*0.034)+($700*0.25)] $185.2 rather than [$1000*0.034] $34.

It would also be MASSIVELY complicated and costly for firms. This makes me think it is exactly the type of thing this US administration might try to do.

Who gets whacked

My excellent Flint colleagues have produced some analysis looking at which countries are most exposed to Trump’s obsession with reciprocity and produced some differential US tariff estimates to go with it.

Check it out HERE.

More tariff estimates

The OEC has a fun/terrifying new tool, which allows you to estimate the impact of bilateral tariff increases on a country’s trade with another country. No idea why they have made this now. [/s]

Here, for example, is what happens if the US applies an additional 25% tariff on France:

No way out

For those of you hoping the US Congress might step in to curb some of Trump’s tariff disruption, sorry.

Former US ITC nominee Haile Craig has a very useful post on LinkedIn explaining how/why Congress just voted to limit its powers over Trump’s trade policy.

Today the House voted 216-214 to change its rules and turn off expedited procedures for disapproving President Trump's tariffs on Canada, Mexico, and China. This greatly reduces the chances that the House will hold a floor vote to nullify any of those tariffs.

For the trade and procedure nerds, here's how it works:

Current law allows Congress to vote to disapprove (i.e., terminate) a national emergency declared by a President using "privileged" procedures in the House and Senate. Such disapproval resolutions are available to Congress every six months for the duration of an emergency. After a disapproval resolution is introduced, it generally must be discharged from committee within 15 days and receive a floor vote within 3 days thereafter. See 50 U.S.C. 1622.

A big caveat is that … [Continue reading HERE]

Best,

Sam