Greenland

... what else?

As long-time readers of this blog will know, I have long been of the view that Trump would eventually threaten EU member states with differential tariff rates.

Why? Because he can, and doing so would create some pretty big political problems for the EU as a whole.

The obvious time to have done this would have been at “liberation” day last year, where the “reciprocal” duty could have been applied on a member-state by member-state basis. Some would have done relatively well from the equation, some cough Ireland cough would have done very very badly.

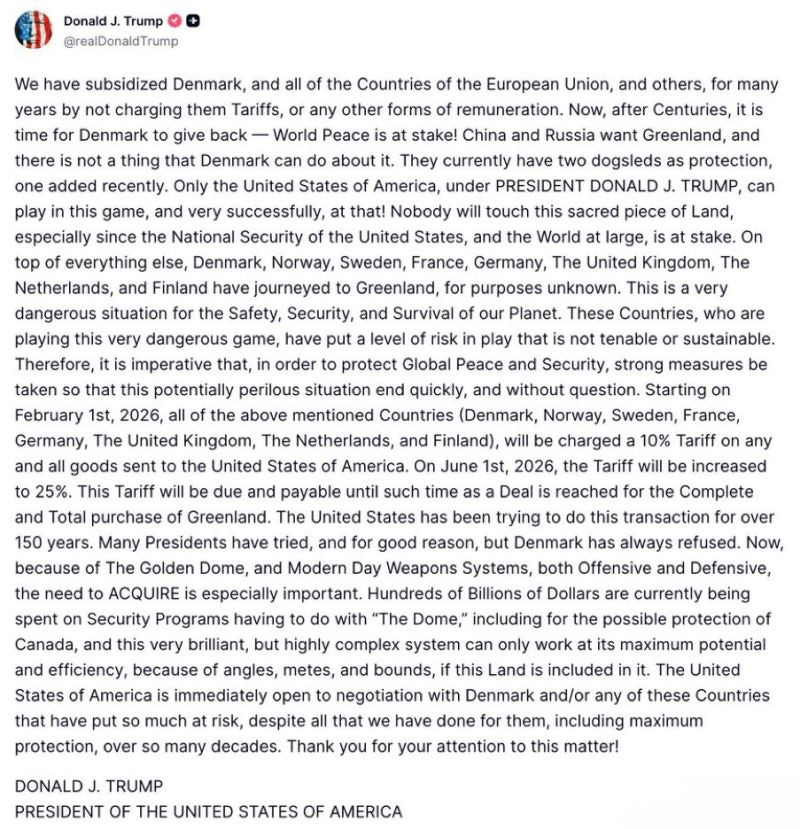

And … now he has:

In an attempt to force Denmark into selling him Greenland, he has threatened tariffs eventually raising to 25% on EU members Denmark, Sweden, France, Germany, the Netherlands and Finland. [As well as non-EU members, the UK and Norway.]

And … if he wanted to sow discord within the EU by singling out specific members for tariffs … he kinda picked the worst issue to lead on. While I do think that differential rates would normally create political chaos, this time I’m not so sure. This is because the “ask” is so egregious that even those member states who very much want to stay out of it are unlikely to have any other option but to go “Yeah, that’s not on”.

[Obviously Hungary might put this hypothesis to the test, but let’s ignore that for now.]

Since this was announced/posted on Truth Social, the one question I am repeatedly being asked is whether Trump is even able to apply tariffs on some EU members and not others. (Here in the Financial Times, for example.)

So … although I’m pretty sure I’ll be repeating myself from earlier MFN editions [apologies], I thought I’d address the question here.

The short, facetious-but-true, answer is: “Yes, who is going to stop him?”

The longer, also-true-but-less-facetious answer is as follows:

It is not actually that unusual for the US to apply tariffs to specific member states, rather than the whole EU.

Some examples:

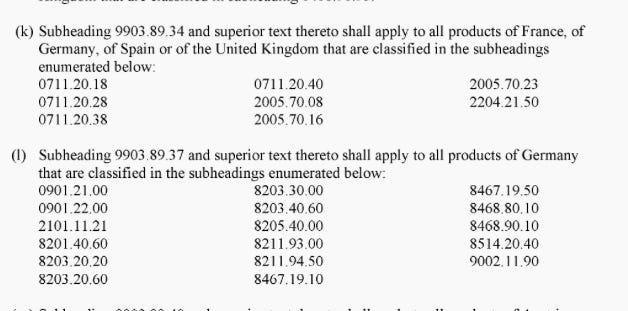

Boeing/Airbus. During the, currently suspended, Boeing/Airbus trade dispute between the US and EU, the US retaliated by, in some instances, applying tariffs to EU exports from the specific member states involved in the production of Airbus aircraft.

Here is a sample of HS codes subject to tariffs, taken from the original Federal Notice (10/09/2019):

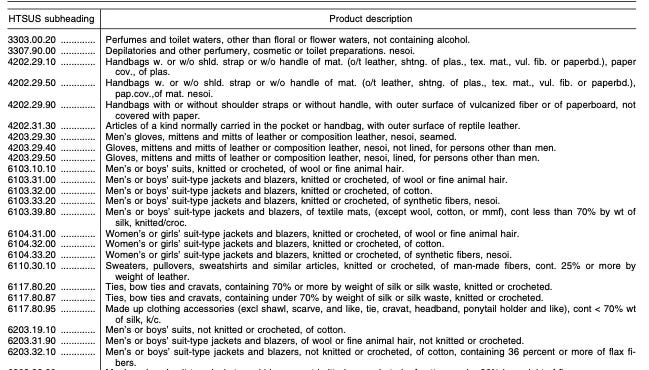

Digital Services Tax Tariffs. In 2019, the US initiated Section 301 investigations into a number of EU countries [and non-EU countries] that impose digital services taxes. This led to retaliatory tariffs being recommended on Austria, France, Spain and Italy, in particular.

While these were never applied (but may re-emerge in the near future), the proposed tariffs were member state specific.

Here is a sample of the Italian products set to be hit, for example:

Regular trade defence. The US often applies anti-dumping or countervailing tariffs to products from specific member states.

Here are some examples:

Anti-dumping and countervailing tariffs on ripe olives from Spain

Anti-dumping tariffs on pasta from Italy

Anti-dumping tariffs on citric acid and certain citrate salts from Belgium

Countervailing tariffs on wire rod from Italy

Anti-dumping tariffs on certain uncoated paper from Portugal

Anti-dumping tariffs on strontium chromate from Austria and France

Etc.

Of course, the follow-up question usually related to whether it is even possible for the US to apply tariffs to some member-states and not others given how integrated the EU market is and the possibility for tariff circumvention.

And the answer is … yeah, verification of origin would be difficult. Particularly given that I would not expect EU customs authorities to be particularly cooperative in this instance. But would it really be that much more difficult than verifying whether a product is from Singapore or Malaysia? Or Cambodia or Vietnam? I’m not so sure.

In other words, this is not a new problem for US customs—it’s a familiar, imperfectly enforced one.

The question itself tends to bely a slight misunderstanding of how origin is checked when entering the US [or any country]. To begin with, for the most part it is not checked at all because checking is really hard. Rather, the importer has a legal obligation to declare the correct country of origin.

In the context being discussed here, the origin is determined by the non-preferential rules of origin regime. Which in the US, unhelpfully, is often quite vibes based, but focuses on whether a product wholly originates in a single country (e.g. a cow), or where the “last substantial transformation” occurred. I’ve written more about non-preferential rules of origin here.

And, for the most part, companies try not to break the law. If they do, and are caught out, they get into trouble.

So anyway, if Trump applied tariffs to individual member states then the importers would have a legal obligation to declare the correct country of origin and pay the correct tariff. Would everyone do this? No. Would some get away with it? Yes. Would some get slapped? Yes.

Does any of this mean that Trump is definitely going to apply tariffs to individual member states? No. He may decide that it is ultimately too complicated or too much hassle. My point is simply that he could.

Note: The rest of this edition — chart of the week and other MFN extras — is for paid subscribers.