Programming Note: With apologies, MFN is still on a slightly haphazard publishing schedule due to the recent birth of my second child (customary photo at the end, for those interested). MFN will still be arriving weekly, but the exact day/time may vary …

Puffin wars

As per the Programming Note, I have been a bit distracted recently. But not so distracted that a mysterious WhatsApp with a photo of Puffin didn’t send me down a Google rabbit hole.

As far as I can tell, the UK has banned certain types of fishing in some of its territorial waters to protect seabirds. French fishermen are annoyed about this because … they want to eat Puffins? I dunno.

Anyhow, the French government, and thus the EU, is now under pressure to raise the issue with the UK in the context of the TCA. This is despite the UK’s ban being non-discriminatory [it applies to UK fishermen as well as French/others] and … seemingly a good thing?

Anyway, this is all a useful reminder that alongside talk of a future Labour government deepening ties with the EU, there are a load of these sorts of issues that will continually flare up and make things difficult for whoever is in charge. It is also worth remembering that in 2026, as well as the general TCA review, the EU and UK need to renegotiate their fishing quotas and energy market access. The UK’s data adequacy decision also gets reviewed in 2025. And while there’s no technical reason that any of these things should be linked … well … **waves at last six years**

Compliance ain’t easy

With thanks to SCMP’s Finbarr Bermingham for flagging, German newspaper Handlesblatt published an interesting story [in German] about China’s new anti-espionage rules leading to European pharmaceutical inspectors refusing to travel there to perform required on-site inspections.

This is a Pharma-specific story, but points to a wider problem for European firms (or firms selling into Europe) with China operations.

For example, take the EU’s new [almost signed off] corporate sustainability and due diligence directive (CSDDD). CSDDD requires covered firms to identify and address sustainability and human rights issues in their supply chains.

So far so good [if a bit expensive].

But what do you do if even acknowledging an issue — for example, human rights abuses in Xinjiang — is taboo? How do you get a proper answer out of your suppliers? What if it leads to retaliation?

In my twenties, I carried out some due diligence for an environmental charity I was working for at the time. Our Ugandan partner organisation was involved with some disputes related to land rights and forced land acquisition. We were considering providing financial support for the legal case but wanted to get a better sense of what was happening on the ground and to meet some of the impacted communities.

Meeting everyone was largely quite straightforward. But in one instance, we arrived on an island on Lake Victoria and were met by a police escort. We were then taken to a townhall where people from across the island stood up and told us there was nothing to worry about, and that those who had sold their land had done so deliberately and fairly.

On the way out, I asked one of the people telling us it was all fine if that was actually the case. They said no and that the reason no one wanted to say otherwise was because the people responsible for taking their land were those who had escorted us to the meeting.

Anyway, due diligence is hard.

Procurement Probe

One of the [many] open secrets in Brussels is that DG Trade has been sitting on an International Procurement Instrument (IPI) into Chinese medical devices since last summer.

To recap, the IPI is a new trade defence instrument that allows the EU to penalise foreign firms bidding for EU contracts if, subject to terms and conditions, their home market does not offer an equivalent level of access to bids to EU companies.

According to the SCMP (yes, Finbarr again), the EU is finally, definitely, maybe about to get on with it after giving up on trying to deal with the issue bilaterally:

The medical devices issue has been raised by EU officials with their counterparts in Beijing on a frequent basis. They point to the relatively free access Chinese firms have to public procurement tenders in the European market, versus the restrictions faced by European competitors in China.

The market was on the agenda when European Commission and Council Presidents Ursula von der Leyen and Charles Michel met Chinese President Xi Jinping and Premier Li Qiang late last year. Trade chief Valdis Dombrovskis also raised gripes during high-level economic dialogue last September.

After those talks, the sides agreed to continue talking about market access to China’s giant medical devices sector. But the European side has been frustrated by the lack of progress.The medical devices issue has been raised by EU officials with their counterparts in Beijing on a frequent basis. They point to the relatively free access Chinese firms have to public procurement tenders in the European market, versus the restrictions faced by European competitors in China.

The market was on the agenda when European Commission and Council Presidents Ursula von der Leyen and Charles Michel met Chinese President Xi Jinping and Premier Li Qiang late last year. Trade chief Valdis Dombrovskis also raised gripes during high-level economic dialogue last September.

After those talks, the sides agreed to continue talking about market access to China’s giant medical devices sector. But the European side has been frustrated by the lack of progress.

Let’s see.

On a related note, if you would like to read ~600 pages setting out which Chinese firms/industries are probably going to be targeted by EU trade defence measures in the coming months/years, read the Commission’s updated report on state-induced distortions in China’s economy.

Chart of the week

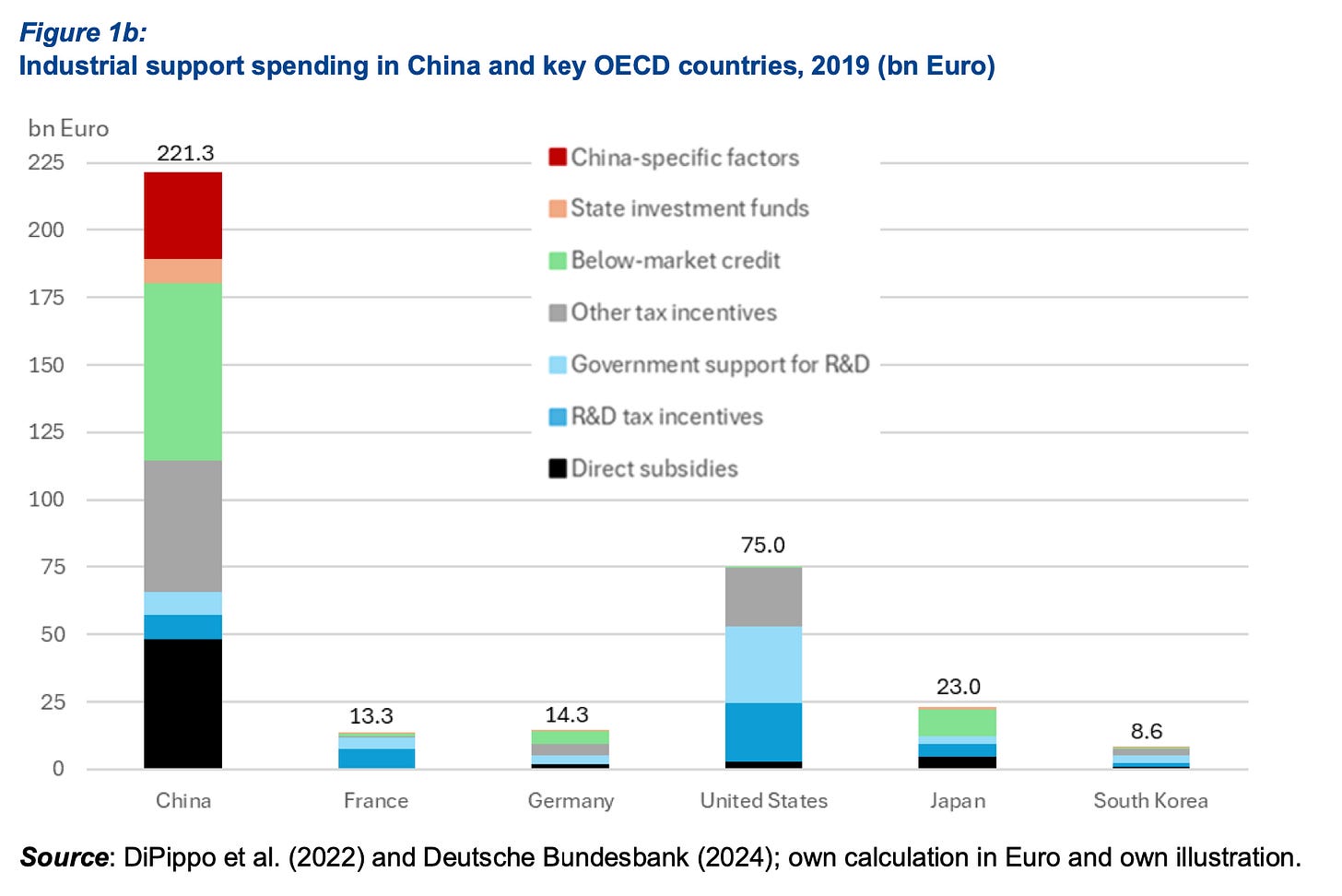

You’ve probably all seen the Kiel Institute for the World Economy’s new attempt to quantify the scope and scale of industrial subsidies in China. If not, here is the report and here is the key chart:

Bonus content: a tired man

Best wishes,

Sam

I suspect that the relative sizes of "subsidy" spend in the KIWE chart is due in no small part to the exclusion of the $trillion dollars the US spends each year on supporting their domestic arms industry.