Made In America

Flags, parcels, foreign subsidies, steel, retaliation and digital services taxes

G’day.

This week, my colleague, Rhys Davies, had the enviable task of reading through the responses to USTR’s request for “Comments to Assist in Reviewing and Identifying Unfair Trade Practices and Initiating All Necessary Actions to Investigate Harm From Non-Reciprocal Trade Arrangements.”

And it turns out that quite a lot of people are annoyed about imported China-made American flags.

For example:

We are a small Veteran owned business that sells American and Military Flags. The flag business is very competitive and none of us have a large profit margin on the products we sell. When someone tells me they found the same “American Made” flag for less, I ask them to show me what they purchased or are looking to purchase. So many people are duped into buying a foreign/Chinese made flag, THINKING they are supporting America and American Business. When I explain to them how to research items and find out where they are actually made, the response is “There should be a law against deceitful advertising”. I agree and that is why we are asking you to put an end to incorrectly labeled products. I would like to see it taken one step further and outlaw ANY and ALL foreign made USA Flags. American Flags should be made in the USA!

And, you know what? Good point, well made.

A Postal Union

A lesser-discussed component of the Trump 2.0 trade war is the war on tariff de minimis.

As predicted by someone [*cough*], the rapid growth of Chinese e-commerce providers has led policymakers worldwide to become increasingly opposed to measures that allow foreign businesses to avoid paying tariffs when selling low-value consignments directly to consumers.

In the EU, this has resulted in the European Commission moving to remove its €150 tariff de minimis threshold as part of a broader customs reform package.

In the US, following on from the Biden administration’s removal of its $800 de minimis treatment on Chinese imports subject to section 201, 232, and 301 tariffs, Trump proceeded to remove the de minimis treatment of imports from Canada, Mexico and China, at the same time as hitting them with new tariffs.

Here’s the text from the Canada Executive Order:

(h) For avoidance of doubt, duty-free de minimis treatment under 19 U.S.C. 1321 shall not be available for the articles described in subsection (a) and subsection (b) of this section.

Well, I say the de minimis treatment was removed.

After a few days of chaos at the border [note: there’s a reason that most countries have avoided placing tariffs and applying other checks to small parcels], the de minimis treatment has been temporarily re-instated while US customs works out how to perform its duties in a way that does not create a new border wall … out of parcels.

Anyhow, all of this got me thinking.

Given that a) the main concern here is really just Chinese e-commerce, and b) everyone seems more willing than ever to ignore [the US] or flexibly interpret [most others] their WTO obligations, I wonder if we might see some sort of attempt to create a de minimis club. Or, rather, a postal union.

The basic premise would be that all members of the club agree to continue to waive tariffs on low-value consignments traded between themselves but remove the treatment for countries outside. You would probably need to agree to a consistent de minimis threshold between the members (e.g. the US’s $800) and also agree to some other conditions possibly relating to supply chain practices and efforts to combat illicit trade in e.g. fentanyl (note: *sigh*).

Something like this:

… maybe?

Foreign Subsidies

Following last year’s EU decision to slap new tariffs on imported Chinese electric vehicles, I wrote this [‘EU EV Tariffs ... What Next?’]:

One way to dodge tariffs is to make electric vehicles in-market, in this case, the EU. Some European policymakers are publicly advocating for this to happen — France’s economy minister, Bruno Le Maire, said “France welcomes all industrial projects. BYD and the Chinese auto industry are very welcome in France.” But this option isn’t necessarily straightforward, given the new EU foreign subsidies regulation [more below], and the possibility that the EU will investigate and penalise any EU-based Chinese auto-investment on the basis it is benefiting from … Chinese state subsidies.

And, lo and behold, this week the FT’s Andy Bounds and friends reported that the European Commission is investigating BYD’s investment in Hungary:

Brussels is investigating whether China provided unfair subsidies for a BYD electric car plant in Hungary, in a highly sensitive move to target the deepening economic ties between Beijing and Viktor Orbán.

The European Commission is in the preliminary stages of a foreign subsidy probe into the BYD plant, two people familiar with the matter told the Financial Times, in a step that will further raise trade tensions with Beijing.

If Brussels finds that the Chinese company has benefited from unfair state aid, it could force it to sell some assets, reduce capacity, repay the subsidy and potentially pay a fine for non-compliance.

And that right there is why you should tell all your friends to subscribe to Most Favoured Nation.

Learn from thy enemy

In a sign that the EU is taking some pointers from the US [scroll down to ‘Melt and Pour Reporting Requirements’], as per its European Steel and Metals Action Plan, the Commission is considering applying trade defence tariffs to metals on the basis of where the product was “melted and poured” to guard against firms fiddling their origin declarations on the basis of minor transformations in order to dodge tariffs.

See:

The Commission has observed a growing trend whereby exporting producers attempt to circumvent the trade defence measures. This behaviour risks undermining the effectiveness of our TDI measures. This means that while the specific anti-dumping or anti-subsidy measure adequately addresses the direct imports, the latter can be replaced by indirect imports whereby the ultimate stage of the production process takes place in a third country not subject to the measures, before shipment to the EU, avoiding payment of duties. To ensure the effectiveness of its trade defence measures, as one of the priority actions, the Commission will assess whether it should adapt its practice by introducing a “melted and poured rule”, which would allow the Commission to act against the country where the metal was originally melted, regardless of the place of subsequent transformation and the origin of the good as determined by the traditional non-preferential rules of origin. Applying this rule would eliminate the possibility to change the origin of the metal product by performing minimal transformation and give more certainty in tracing the origin of the product.

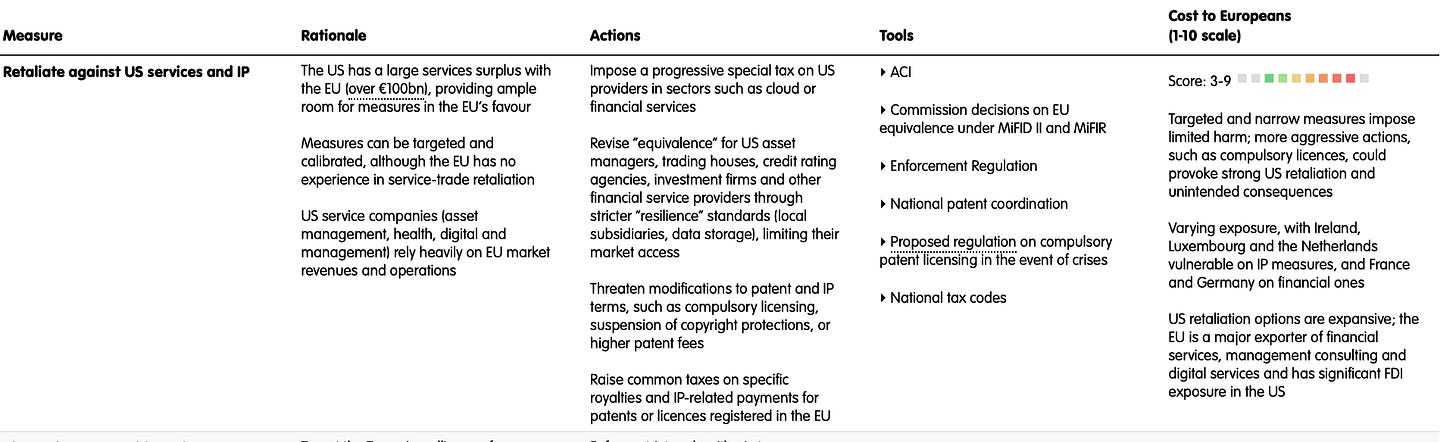

Whack thy enemy

ECFR’s Tobias Gehrke has written a new paper setting out the different ways the EU could retaliate against the US, if it so chooses.

Whatever your views on the merits, this paper is well worth reading as insight into what EU officials are inevitably discussing right at this moment.

A taster:

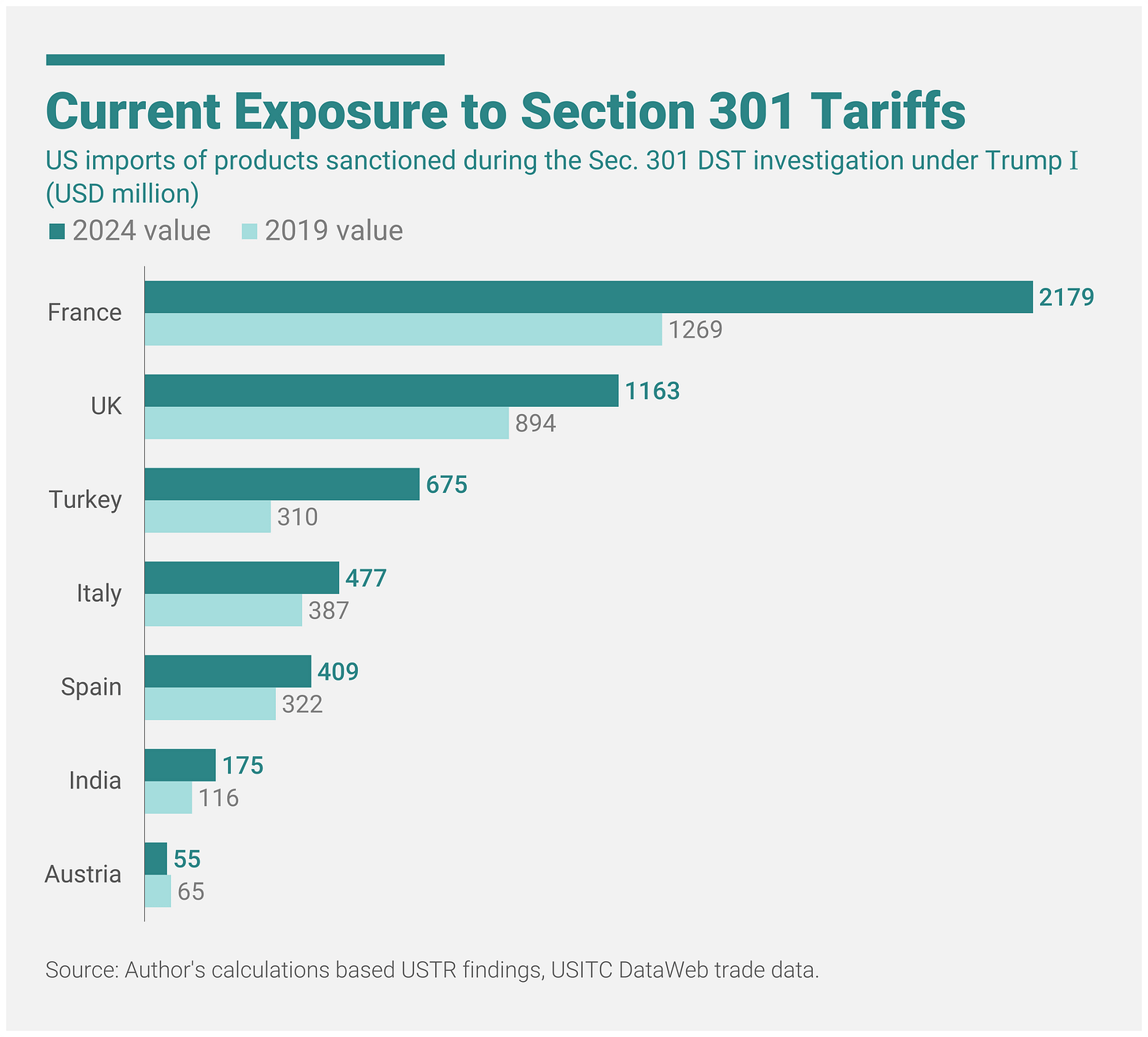

Chart of the week

From Digital Policy Alert’s Johannes Fritz:

Best,

Sam

The first rule of De Minimis Club is you don't talk about De Minimis Club. Great post.

Didn't we used to have a sort of De Minimis club called "Mark as gift for customs purposes" :-) At least that's how sellers used to roll on ebay in the 00's.

thanks for the shout, Sam!