Hi everyone,

This will probably be the last MFN of 2023. I would like to thank all of you who subscribe and, in particular, those paid subscribers who provide me with the motivation/financial incentive to write this (almost) every week.

If you’ve been on the fence about a paid subscription, I’m offering a Christmas-special discount of 20%. You know you want to.

This morning, the UK [finally] published its response to its spring consultation on whether the UK should do its own Carbon-Border Adjustment Mechanism or not.

The conclusion: Yes, but not yet [emphasis added].

After carefully considering all responses, the government will implement a CBAM by 2027, applying a charge on the carbon emissions embodied in imports from the following sectors: aluminium, cement, ceramics, fertiliser, glass, hydrogen, iron and steel. The delivery of the CBAM will be subject to further consultation in 2024.

The government also announced its intention to work with industry to establish voluntary product standards that businesses could choose to adopt to help promote their low carbon products to consumers; and to develop an embodied emissions reporting framework that could serve future carbon leakage and decarbonisation policies. These measures will also be subject to further technical consultation in 2024.

As we have discussed many times, this acceptance was kinda inevitable. The EU’s CBAM, which currently applies on an administrative basis but will kick in fully from 2026, means there is a heightened risk of carbon-intensive products being dropped onto the UK market. This drawing explains why:

But while expected, the UK announcement still throws up a few interesting points:

Timing #1. While the UK government has accepted it needs to do a CBAM, it does not want to do a CBAM soon. The “by 2027” deadline means that the CBAM’s ultimate design and delivery date will be decided after the next UK general election. Going off the current polling, this means it will probably end up being delivered by a Labour-led government. That being so, pretty much nothing that is currently being said about the UK CBAM design and scope can be taken as definitive. We should also assume that a Conservative Party in opposition will not have the same view of CBAM as a Conservative Party in government; the support that exists for it now will probably dissipate, and Labour will be attacked for introducing a measure that introduces trade friction, pushes up prices, hurts consumers, etc. Politics is fun.

Timing #2. As the UK Steel industry is already pointing out, the “by 2027” deadline means that the EU CBAM could have been running at full throttle for almost a year before the UK equivalent kicks in. This could mean, as per the infographic, nearly 12 months of carbon-intensive products being pushed onto the UK market (instead of the EU). I predict that, because of this, a UK CBAM will end up being introduced earlier. #timestamp

Coverage. As it stands, the UK CBAM will cover mostly the same goods as the EU’s and, as is the case with the EU’s, the coverage is limited to goods that have a domestic carbon price, as set by the UK’s Emissions Trading System. However, there are some differences. While both cover aluminium, cement, fertiliser, hydrogen, iron and steel, the UK’s will also apply to glass and ceramics while the EU’s also applies to electricity.

Northern Ireland. There is an outstanding question re: how the EU CBAM interacts with the Northern Ireland Protocol/Windsor Framework. The general issue is that, as it stands, if you wanted to dodge the EU CBAM, you might be able to do so by importing your carbon-intensive steel via Nothern Ireland (and hoping no one notices). The solution? Apply the EU CBAM to imports into Northern Ireland. But while the EU might want to do this, the UK is less keen, given the EU CBAM would then also apply to goods entering Northern Ireland from Great Britain. The argument also isn’t so clear-cut from an EU perspective, given that while the EU ETS applies to electricity generation in Northern Ireland, the UK ETS applies to the other carbon-intensive sectors. It’s all a bit of a mess. A UK CBAM could help with this, of course, so long as it covers the same sectors as the EU’s … and if you combined this with a formal linkage of the UK ETS to the EU ETS, you’re probably okay. But not uncontroversial with the pure sovereignty crowd.

Trade Team Status Quo

If you’ve ever wanted to get under the skin of recent US trade policy positions and its seeming decision to turn against a global trade system that has, on nearly every metric, benefited the US massively, you would do well to read this Hinrich Foundation interview with Lori Wallach.

Wallach is one of those people who most people working in trade have been aware of for a long while — in Europe mainly for her involvement in anti-TTIP activism — and now has a legitimate claim to have significantly influenced the trade policy of both Trump and Biden.

Some choice quotes:

Defenders of the old model think that they somehow did not do a good enough job in educating voters but the reality is when enough people have been directly harmed by a policy, even the most wealthy special interests cannot advertise, Astro-turf and otherwise bamboozle people to believe a sales pitch versus what they have personally experienced. That is why Big Pharma, Big Tech and other commercial lobbies associated with real harms to many people can spend fortunes in advertising, funding front groups and more and still have a terrible reputation with the public.

The old ploy of promising the moon with every new trade agreement stopped working a long time ago as peoples’ lived experience of these deals punctured the sales pitch.

I do not see crumbling support for multilateralism as a driving force but rather the current regime of corporate-rigged trade and investment rules have fallen into disrepute based on their damaging outcomes and thus could take down the institutions carrying them absent significant changes to the rules so they benefit more people. The stubborn adherence of what I sometimes call “Trade Team Status Quo” to a model that has failed and is tarnishing the very concept of trade is what does enormous damage to institutions like the WTO.

I imagine David Ricardo and Adam Smith are rolling in their graves to see the WTO and Free Trade Agreements mandating that governments provide classic rent-seeking tools for specific interests, such as lengthy monopoly licenses in the form of various intellectual property protections required in TRIPS and FTA IP chapters.

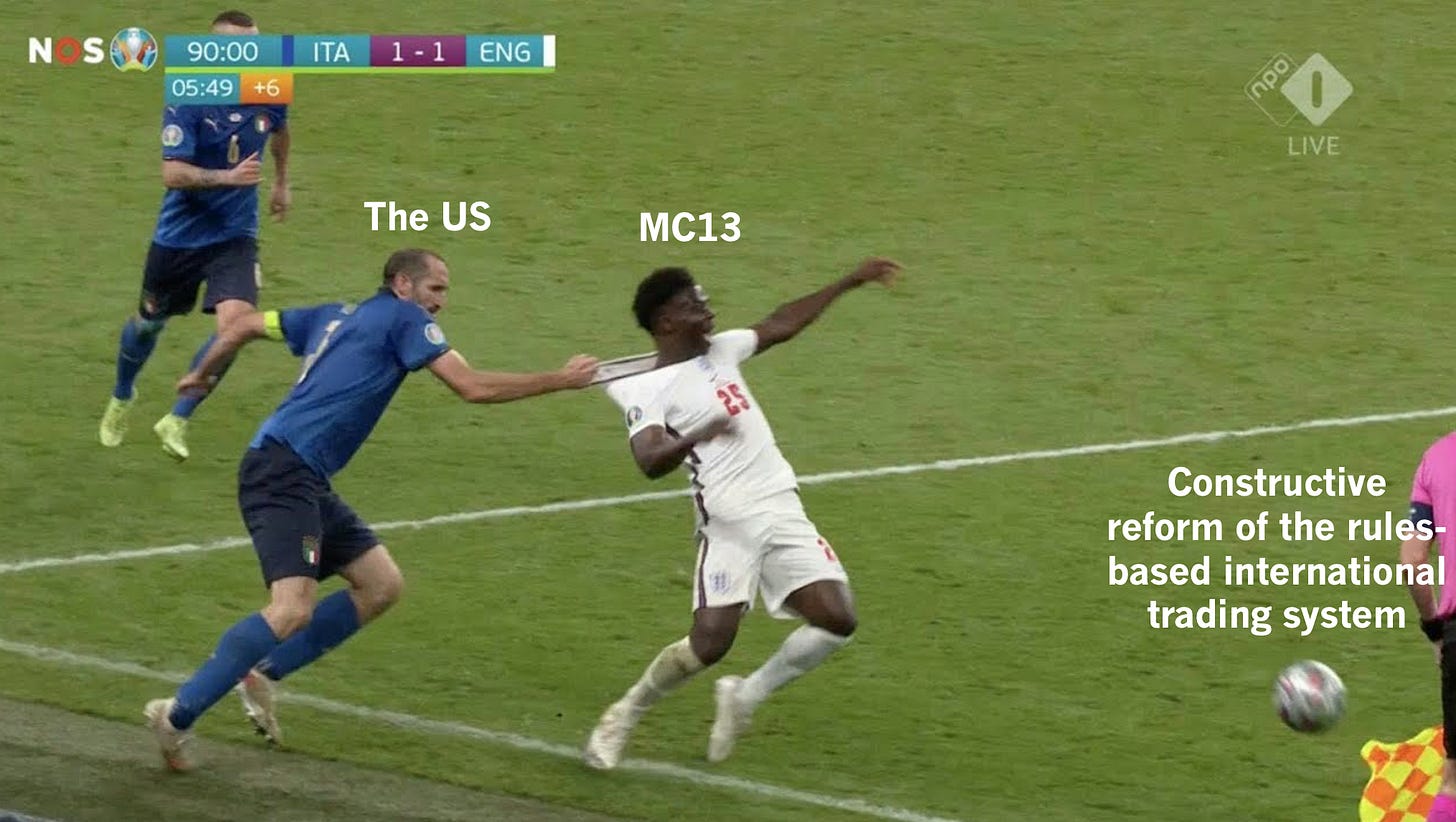

Anyhow, on that note, here is a slightly unfair prediction/meme to the end the year with:

Merry Christmas!

Sam