Welcome to the 101st edition of Most Favoured Nation. The post is for paid subscribers only, but you can sign up for a free trial below.

In 2016 David Autor, David Dorn and Gordon H. Hanson published their seminal paper ‘The China Shock: Learning from Labor Market Adjustment to Large Changes in Trade’.

As per the blurb, their overarching finding was that China’s entry into the global market displaced US workers and, importantly, had a long-term negative impact on local US labour markets, with wages and participation remaining low for up to a decade after the shock. The job losses have also not yet been offset by new job creation in other industries:

China’s emergence as a great economic power has induced an epochal shift in patterns of world trade. Simultaneously, it has challenged much of the received empirical wisdom about how labor markets adjust to trade shocks. Alongside the heralded consumer benefits of expanded trade are substantial adjustment costs and distributional consequences. These impacts are most visible in the local labor markets in which the industries exposed to foreign competition are concentrated. Adjustment in local labor markets is remarkably slow, with wages and labor-force participation rates remaining depressed and unemployment rates remaining elevated for at least a full decade after the China trade shock commences. Exposed workers experience greater job churning and reduced lifetime income. At the national level, employment has fallen in U.S. industries more exposed to import competition, as expected, but offsetting employment gains in other industries have yet to materialize. Better understanding when and where trade is costly, and how and why it may be beneficial, are key items on the research agenda for trade and labor economists.

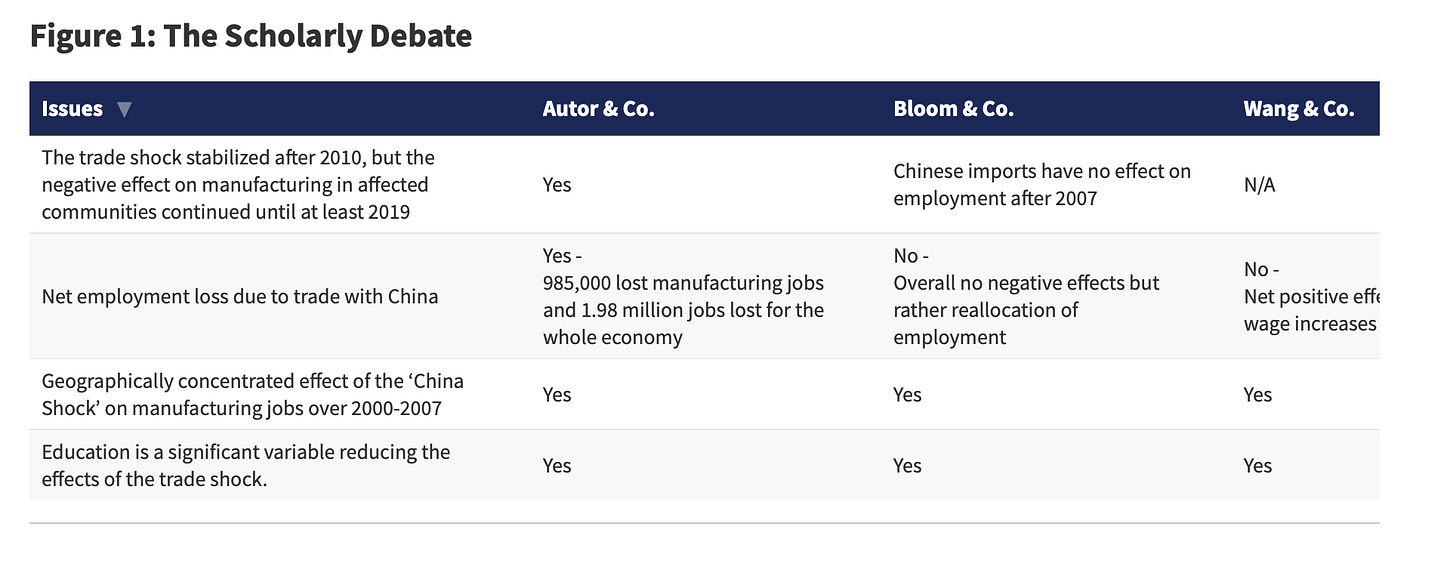

This paper contrasts with other research that found evidence of an initial shock, but not of long-term negative impacts. See here:

Anyhow, the Autor et al. paper has provided an intellectual underpinning for much of the recent US action on trade, and the imposition of new trade restrictions on imports from China, in particular.

But what if Autor et al. were wrong?

Keep reading with a 7-day free trial

Subscribe to Most Favoured Nation to keep reading this post and get 7 days of free access to the full post archives.