Most Favoured Nation: Chinese Retaliation?

More EV stuff, data transfers, using AI for customs classifications, import shocks and the US doing US stuff.

Welcome to the 111th edition of Most Favoured Nation. The full post is for paid subscribers only, but you can sign up for a free trial below.

A couple of editions ago, I wrote about the EU’s new anti-subsidy investigation into imported Chinese electric vehicles, which will probably be formally launched next week.

This investigation has got some companies/people worried about Chinese retaliation. China is [obviously] not happy about the investigation and could choose to retaliate, both in legal, WTO-approved, ways and less legal, non-WTO-approved ways, such as initiating random health inspections of German-owned car factories in China and closing them down for a couple of weeks because they found an old sock placed in the wrong bin.

But, interestingly, the European Commission is hoping that actually it will all be okay and that any Chinese reaction will be proportionate and constrained.

Why is this?

Well, because, relatively speaking, the EU approach and probable tariffs will be minor compared to the actions taken by other countries.

To provide some context, this investigation is the passion of the French government. Ursula von der Leyen wants another term as Commission President, and to achieve this, she will need the support of said French government – hence the investigation.

However, other bits of the EU, including Germany and DG Trade are less thrilled.

An anti-subsidy investigation is, therefore, the compromise position. Anti-subsidy investigations tend to result in the application of lower tariff rates than, say, anti-dumping tariffs. For example, recent anti-subsidy tariffs on Indian steel were set at 7.5%, while anti-dumping tariffs on the same steel range from 13.9% to 35.3%.

The level being briefed for anti-subsidy tariffs on Chinese EVs is around 10%, although this is, of course, subject to the findings of the official investigation that definitely haven’t already been pretty much pre-written.

When added to the existing EU 10% MFN tariff, this would mean imported Chinese EVs would face a tariff of around 20%.

This is pretty high! However, it would still be lower than, for example:

The US, which applies a 27.5% tariff to cars made in China (and exempts them from IRA benefits);

India, which applies a tariff of 70% to cars valued at under $40,000;

Turkey, which applies a 50% tariff (10% MFN plus 40% probably illegal tariff exclusively to Chinese EVs); and

Japan … which actually has a 0% tariff but suffers from a consumer base that, well, just doesn’t really want to buy Chinese (or any non-Japanese) EVs.

So, in that context, the EU market would still be relatively open. Chinese EVs would still be exported … they would just be a little more expensive and a little less price-competitive. So maybe, just maybe, no trade war.

How boring.

Chart of the week

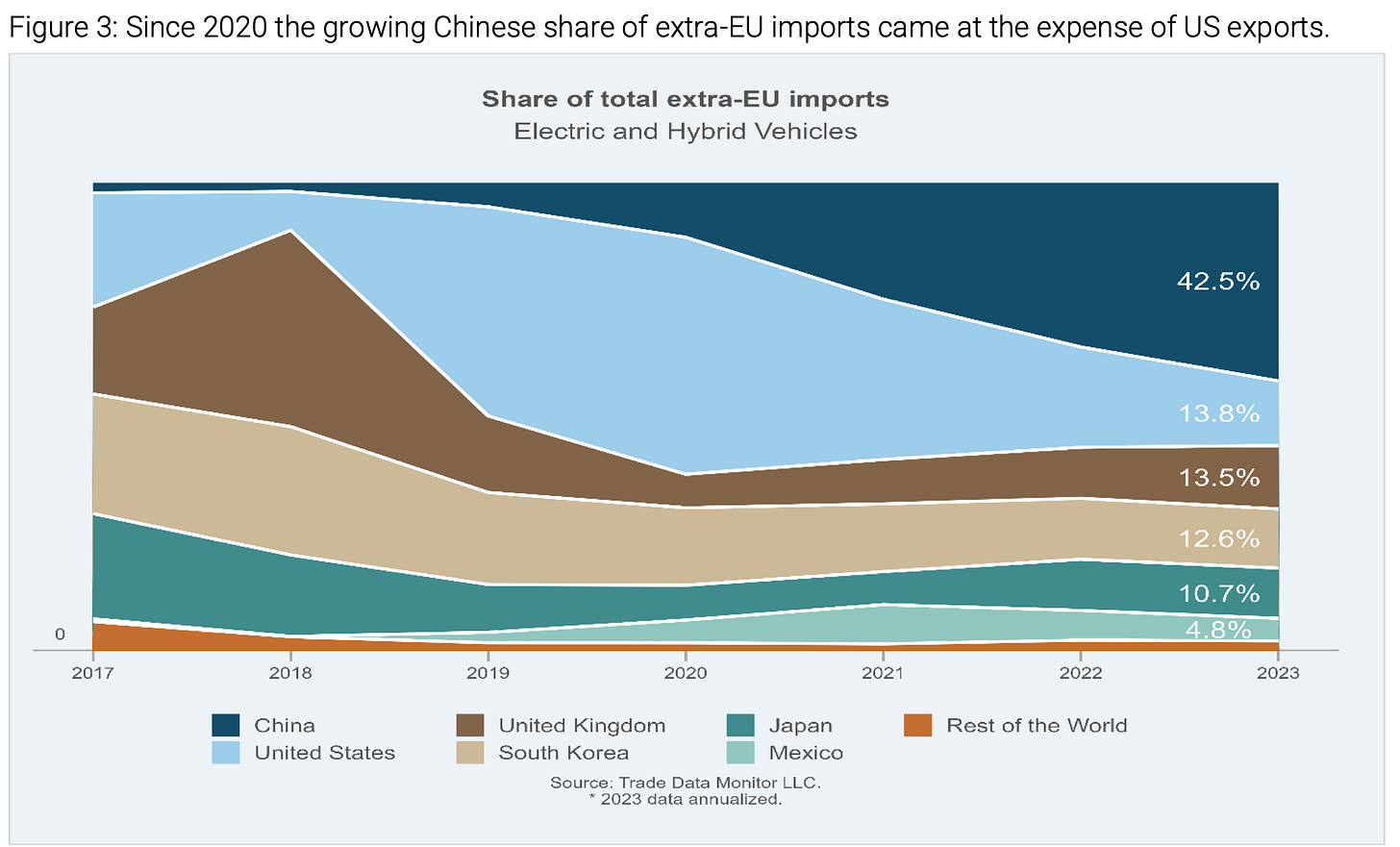

In their new paper, ‘Where do EU citizens source foreign EVs from? Putting fast growing Chinese EV sales in the EU in perspective’ Simon J. Evenett and Fernando Martín produce this chart, which shows that Chinese EV imports into the EU appear to be eating into the US market share.

One snarky EU trade wonk may have said something along the lines of “I guess this explains why US Biden supporters are so keen on pointing out the surge in Chinese EV exports to the EU.” To which I say, “lol”.

New Guest Columnist

As you will probably have seen earlier this week, MFN has added Karthik Sankaran to its roster of occasional guest posters.

Karthik has at various times been a modern historian, emerging markets journalist, and global macro portfolio manager and strategist. He is also an incorrigible and prolific source of terrible puns. My hope is that this provides an informative reprieve from all of my usual badgering on about niche technical issues and puts all that we discuss here in a more global context.

I highlight this section from his first contribution, ‘Post Neoliberalism, The Baby, And The Bathwater’, mainly for the pun at the end.

This last transformation is rooted in political, technological and logistical changes that allowed outbound investment by multinational companies targeting exports back into advanced economy, a process described by Richard Baldwin in his book the Great Convergence. It has been a far more potent mechanism for broad technological diffusion than anything else seen over the last 70 years. These changes have led to the distinguishing character of the second great age of globalisation identified by Branko Milanovic — the simultaneous fall in intercountry inequality alongside a rise in intracountry inequality, the obverse of what was observed in the first age of globalisation before 1914. One might say that GATT resurrected what Gatling destroyed. [Ed: **sigh**]

Below the paywall there is extra content on data transfers out of China, the use of AI in customs classification, a comparison of the UK/euro area import shock, and some commentry on USTR Katherine Tai’s recent comments. If you enjoy MFN, please do consider becoming a paid supporter.

Keep reading with a 7-day free trial

Subscribe to Most Favoured Nation to keep reading this post and get 7 days of free access to the full post archives.