Most Favoured Nation: Let's See How It Goes

Northern Ireland protocol, steel, TRQs, CE marking, vaccines and the cost of Brexit throughout the multiverse. What more could a person want?

Hello! Welcome to the first edition of my newsletter, Most Favoured Nation. I’ll discuss whatever trade issues, gossip, research, or analysis has piqued my interest at the time of writing. Hopefully you will find it useful. If not, please tell me what I should do to make it better.

I’ll be publishing every fortnight or so. Full disclosure: if this goes well, I might add a paid subscription option in future … but let’s not get ahead of ourselves.

Steel yourself for TRQs

The Withdrawal Agreement’s Northern Ireland Protocol is wild. And the way it interacts with the UK trade policy is really, really wild. Did you know that imports into Northern Ireland only benefit from lower UK tariffs (rather than being subject to the EU tariff) if the importer is registered under the Protocol’s “not at risk” scheme (to ensure the import doesn’t end up south of the border) *and* the difference between the applied UK tariff and the applied EU tariff is less than 3% of the value of the good [Article 3, 1, (b), (ii)].

Not ideal.

On the other hand, because the UK’s rolled over trade deals contain rules of origin provisions that are much more accommodating than the EU’s (at least until the useful bits expire … more on that another time), it might make more sense to export certain products *cough* dairy things *cough* from Northern Ireland than Ireland.

Swings and roundabouts.

For now let’s talk about steel and tariff-rate quotas (TRQs).

It hasn’t received too much attention, I presume because it’s all slightly convoluted, but due to an unfortunate combination of Trump’s trade war, new EU regulation on TRQs and the Northern Ireland protocol there is a lingering question mark over whether steel made in Great Britain can enter Northern Ireland tariff-free.

The story goes as follows

Trump started a trade war, and slapped (tariffs are always “slapped” …) a 25% tariff on steel imports because of a pretend threat to the US’s national security. The EU responded by putting its own ‘safeguard’ 25% tariff on steel imports, but opened up zero tariff TRQs for a load of countries to ensure their steel exports to the EU didn’t get caught. The UK, now no longer a member of the EU, has access its own EU steel TRQ.

Late last year the EU updated its approach to managing its TRQs. Which is fine. But in doing so decided that Northern Ireland would not be covered by any of the EU TRQs because something about fear of legal challenge (I don’t really understand the argument but this was how it was explained to me).

On January 1st 2021 the Northern Ireland Protocol came into force. This means that goods entering Northern Ireland from Great Britain are subject to EU tariffs unless

a. The EU doesn’t apply a tariff anyway

b. The importer can demonstrate the product will stay in Northern Ireland, subject to terms and conditions

c. The product qualifies for zero tariffs under the EU-UK trade and co-operation agreement

Unfortunately none of this helps British steel entering Northern Ireland from Great Britain because any product subject to a trade defence measure (in this case the 25% safeguard tariff) is automatically considered to be at risk of onward transport into the EU, and the trade deal doesn’t preclude trade defence measures either. And because Northern Ireland isn’t covered by the EU’s TRQs it wasn’t clear if importers could make use of the TRQ the EU created for UK steel.

All a bit of a mess.

Anyhow, the EU and UK have managed to sort this out, for now (see page 4 of Maroš Šefčovič’s letter to Michael Gove). Steel from Great Britain entering Northern Ireland can make use of the EU’s UK steel TRQs … until they are maxed out. Which will happen in the next few months, probably, because the EU didn’t create the UK TRQ with intra-UK GB to NI trade flows in mind. [Aside: I don’t think this work around is properly implemented yet, but regardless, no one has actually paid any tariffs on steel entering Northern Ireland from Great Britain because in practice the UK is behaving as if it has been implemented.]

Long-term it would be better if the EU’s steel safeguard tariffs disappeared … but that depends on the US removing its trade war tariffs. So let’s see.

Of further interest, at least to me, is what happens to steel imported into Northern Ireland from the rest of the world. There is a lingering question over how TRQs actually work in respect of the protocol – as in, when determining if an import into Northern Ireland is at risk of onward transport into the EU is the UK’s TRQ in-quota tariff rate assessed against an equivalent EU TRQ in-quota tariff rate (assuming it exists), or against the EU’s MFN tariff rate? Because if it’s the MFN rate then there’s likely to be a tariff differential of over 3% … which means the EU tariff will apply, and imports into Northern Ireland won’t benefit from either the UK’s TRQs or the EU’s (which as discussed, don’t apply to Northern Ireland).

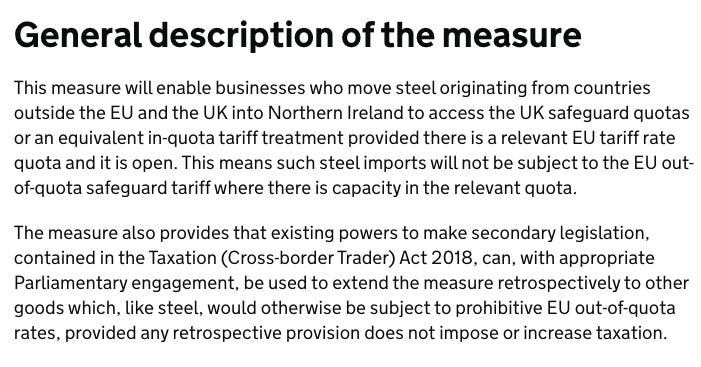

A recent UK policy paper makes clear how it thinks this should work. For steel (note: the UK also currently applies its own safeguard tariff of 25%, along with the relevant TRQ exemptions) entering Northern Ireland, the UK’s TRQs will apply, so long as there is still excess capacity in the equivalent EU TRQ:

Simple. Hopefully the EU shares the UK’s understanding.

Did you know …

That the UK (by which I mean GB, because Northern Ireland is different) will recognise EU CE marking on medical devices placed on its market until June 30th, 2023? For everything else, CE marking will be recognised until the end of 2021, after which companies will need to apply the UKCA label. (I reckon this deadline will get extended, though.)

Vaccine nationalism

Amidst threats of export bans and generally unsavoury behaviour, the trade world’s nicest man, Chad Bown, has co-published a proposal to replicate the success of the US’s Operation Warp Speed and quickly get billions of doses of vaccine to the global population. Read about his proposed new COVID-19 Vaccine Investment and Trade Agreement (CVITA) here.

In summary:

1. CVITA should be aligned with COVAX and existing networks of regulators so to “create a more transparent pathway to the licensing of vaccines, instilling global confidence, reducing development costs, and expediting access in poorer markets.”

2. CVITA should “create an investment framework designed to subsidise the full vaccine manufacturing supply chain and especially coordinate expansion of input production capacity … Governments would pay into the investment fund on a subscription basis. Participation of the poorest countries should be heavily subsidized or free.”

3. CVITA should include enforceable commitments not to place export restrictions on vaccines or vaccine inputs. “Countries should agree that imposing export restrictions on vaccine output will be swiftly met with trading partners jointly restricting their supply of inputs to the exporting restricting country.”

4. CVITA should create a transparency system similar to the Agricultural Market Information System to monitor vaccines and inputs.

5. Finally, “CVITA needs an effective and transparent administrator who is one part general contractor and one part ombudsperson.”

All sounds very sensible to me.

Calculating the cost of Brexit throughout the multiverse

It’s pretty difficult to discuss the impact of increasing/decreasing barriers on trade flows.

Whether total trade goes up or down following the introduction/removal of trade barriers doesn’t necessarily tell us much about the impact of the new trading regime, or at least doesn’t give us the full picture.

What actually matters is whether total trade increased/decreased relative to total trade in an alternate universe in which a different trading arrangement was in place. Total trade could increase, but still be bad if it didn’t increase as much as would have in the alternate scenario. Equally, total trade could decrease, and still prove the new trading relationship is better than the old if it decreased less than it would have otherwise.

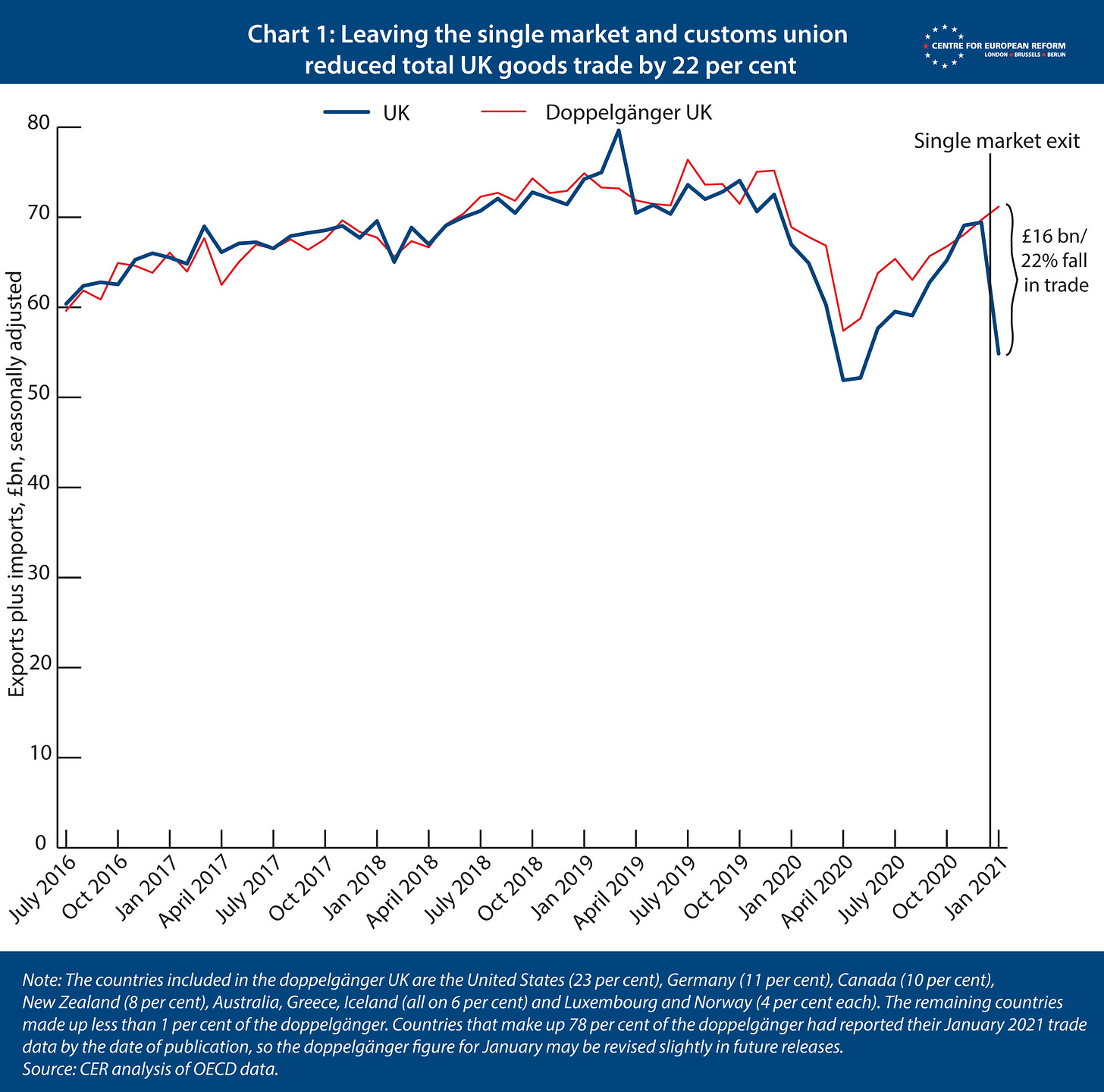

So when measuring the costs of the new post-Brexit trading arrangements for the UK, what matters is whether total trade increased or decreased relative to a world in which the UK chose to do something different, for example stay in the single market and customs union.

The problem for researchers is that it isn’t particularly easy to compare what is happening in the real world with what is happening in a world that doesn’t exist.

But not impossible. My CER colleague John Springford has created a model that compares the real world UK trade data with that of a synthetic “doppelganger” UK that remained in the EU’s customs union and single market (the methodology is all explained in the piece). As he acknowledges, the data is a bit noisy at the moment – but he’ll be returning to the model regularly and publishing updates.

For now, the TL;DR is that putting up significant barriers to trade decreases trade.

The rumour mill

It is pretty much an open secret that the UK intends to join the Agreement on Climate Change Trade and Sustainability. To which I say: go for it!

---

If you’ve made it this far, great. Do let me know if you have any questions or comments, and I’ll try to address them in the next issue. And if you enjoyed reading, please do subscribe.

Best,

Sam

Agree with Pete, the EU vaccine shambles & accompanying behavior has switched off many that previously had a more favorable opinion of the EU. Yes, trade may take a hit,but that's one of many factors. The inability to get rid of VDL & the hopeless Health commissioner again exposes the lack of democratic accountability and further exacerbates the situation.

Hopefully any future EU reform will see the President of the commission democratically elected & have the free hand to appoint commissioners based on merit, experience & competence & not based on the current situation where country x must have a commissioner.

I believe the Uk will now move rapidly further away from the EU, there is now anger at the bullying and arrogance involved since January. Majority if UK now see why leaving the EU was popular and not because of drops in trade, it was to get the failed monkey off our backs. Suspect the EU will see capital flight and a gradual move away from investments. AZ have this week said they would no longer get involved in vaccine production on an at cost basis. French and German vaccine manufacturers have failed to get a vaccine even though 500m was promised. Expect to see AZ relocate some plants or downscale.

Every failed politician from EU countries manages to get on the EU gravy train, but failed politicians cannot organise a ....... as is evident.