Welcome to the 76th edition of Most Favoured Nation. The full post is for paid subscribers only, but you can sign up for a free trial below.

As discussed in past MFNs, the US’s Inflation Reduction Act (IRA) has led to quite the backlash from the EU (and others).

If you’re just catching up, in essence the US is in the process of implementing legislation that would throw a load of money at companies developing green tech, electric vehicles and batteries, so long as companies [generally speaking] make the green tech in North America/countries the US has a free trade agreement with.

France’s President Macron has been over in the US this week trying to convince them to buy the EU off/tweak the discriminatory requirements. This has led to some amusing comments from Biden saying the IRA “was never intended” to exclude Europe and US allies. To which I say, “Lol … yes it was.”

So anyway, perhaps the US and EU will be able to work something out. I’m not so sure there’s much that can be done – although this week the Financial Times reported that lawyers are trying to work out if there is a legal difference between a Free Trade Agreement and a free trade agreement (because given the IRA refers to a free trade agreement not a Free Trade Agreement you could maybe argue that EU-originating production can be looped in via … I dunno … the WTO’s Government Procurement Agreement to which both the US and EU are party), which is the sort of nonsense MFN supports and wants to see more of – but who knows.

If the US does go ahead with what’s roughly on the table, the EU will need to decide how much it really cares. And how much it really cares will be determined by whether the IRA succeeds in onshoring a load of industry.

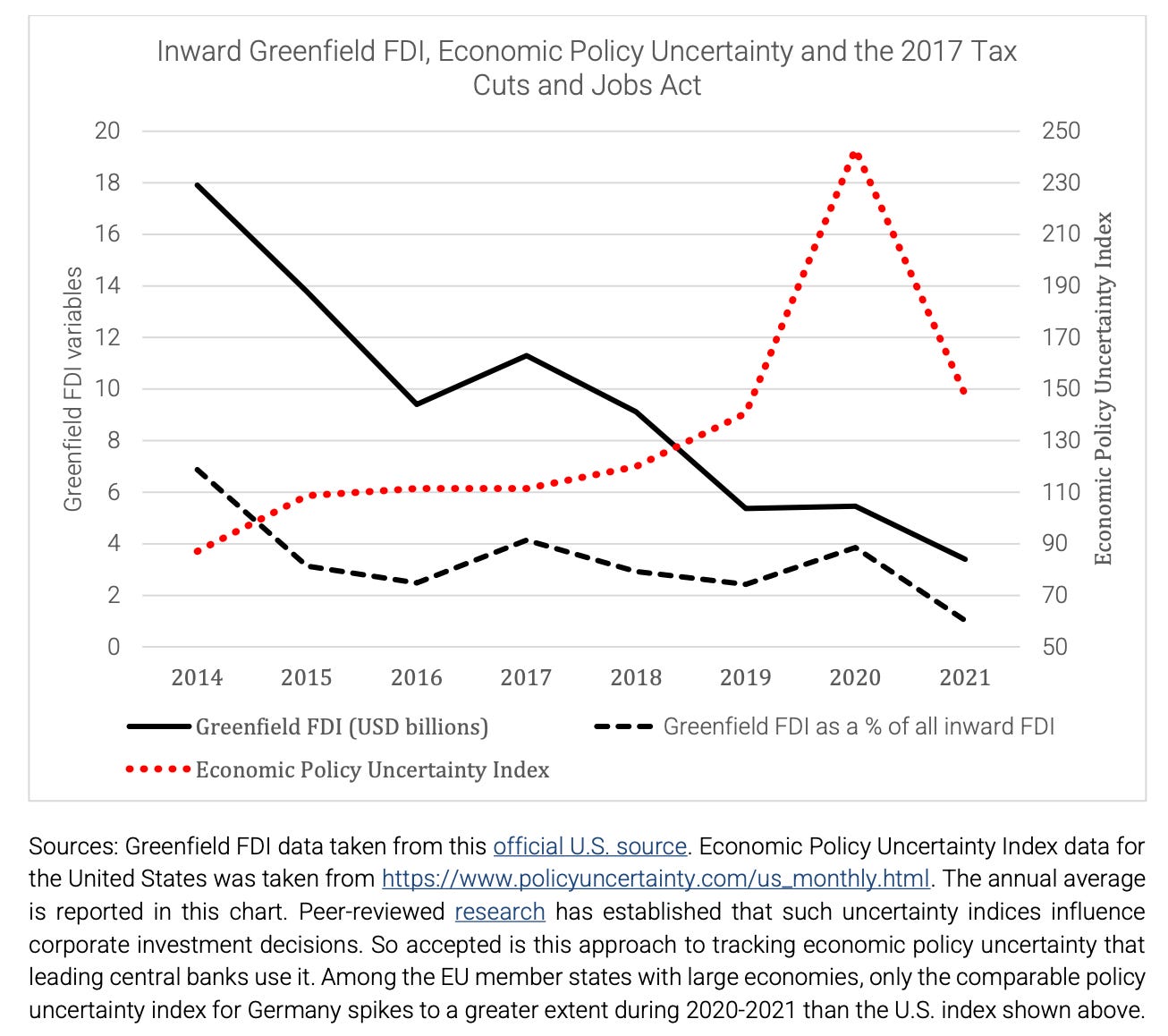

Simon Evennet has published a new report – Will the U.S. Inflation Reduction Act “Hoover Up” European Investment – looking at whether a past US corporate giveaway, the 2017 cut in corporation tax from 35% to 21%, resulted in an uptick in Greenfield foreign direct investment.

Answer: no. [see chart below]

“Why should the IRA incentives be any different?”, he asks.

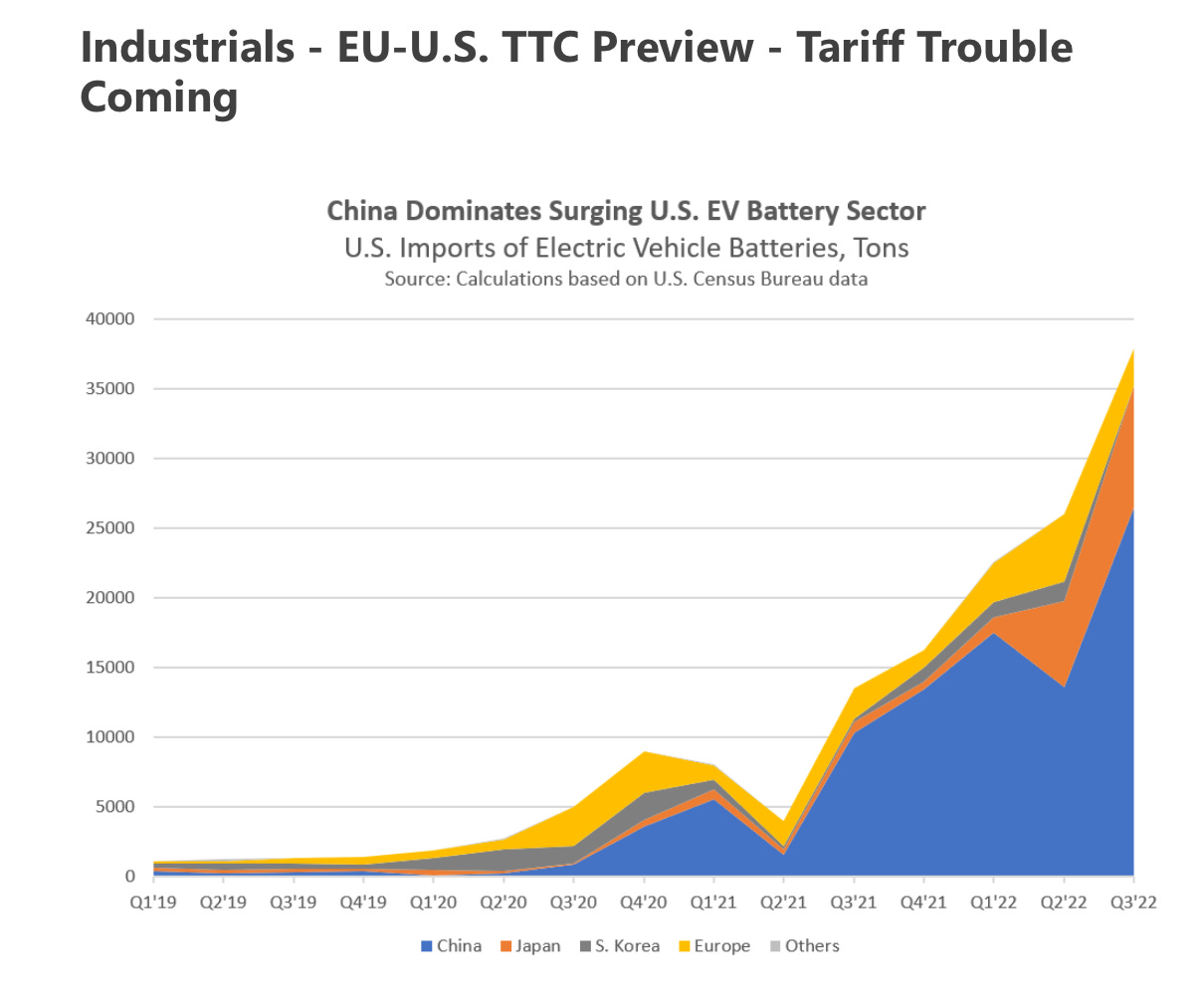

Another point worth exploring is whether the EU is even that exposed to the IRA from an export perspective. Chris Rogers at the Pauncefote and Hay Substack’s post ‘Tis Normally The Season [Note: I’d recommend subscribing — has consistently good charts] pulls out the data on existing EU exports of EV batteries to the US. Answer: not very much at all. But a whole lot of Chinese.

Keep reading with a 7-day free trial

Subscribe to Most Favoured Nation to keep reading this post and get 7 days of free access to the full post archives.