Most Favoured Nation: Read Between The [Tariff] Lines

Why the UK's bioethanol tariffs are important to critical national infrastructure

Last week I briefly touched on the political economy of tariffs, and how the existence (or lack) of tariffs can tell you quite a lot about the priorities of a government. Most of the time the underlying politics and producer interests are pretty obvious. For example, the EU has high tariffs on imported clothes because Portugal and Italy have a fairly vocal domestic textiles industry.

But sometimes the rationale for a tariff is more mysterious.

One example of a mysterious tariff emerged when the UK tweaked its first no-deal tariff regime.

(ICYMI: in early 2019 the UK government published a draft tariff schedule that would have temporarily scrapped tariffs on 88 per cent of imported goods in the event of a no-deal Brexit. This no-deal tariff regime never came into force, and was eventually superseded by the less generous UK Global Tariff.)

Despite tariffs being scrapped on near everything else, the UK decided to apply high tariffs to imports of bioethanol, on the justification that the domestic supply of bioethanol is “important to critical national infrastructure”. The industry reaction was as expected, with the UK renewable energy association welcoming the move because the removal of import tariffs would probably have led to the then last remaining UK producer of bioethanol [a British Sugar plant in Norfolk] closing down. The Brazilian sugar cane industry association on the other hand were annoyed, unsurprisingly.

But the decision was still a bit odd. Why did the UK prioritise retaining tariff protection for one producer of bioethanol, when (at the time) it was happy to expose most other industries to increased foreign competition? And what does bioethanol have to do with critical national infrastructure anyway?

The answer: it has nothing to do with the actual bioethanol and everything to do with a by-product of bioethanol production: industrial carbon dioxide. As well as producing bioethanol, the British Sugar plant in Norfolk captures the carbon dioxide from the sugar fermentation process and sells it to the food and drink sector. Making it (I think!) one of the only UK producer of high quality industrial carbon dioxide.

This, it turns out, makes the British Sugar bioethanol plant quite important. Not because it helps carbonate our fizzy drinks (although that’s not unimportant) but because industrial carbon dioxide is … used in UK nuclear reactors. (According to the internet, this is how the process works … apparently.) And seeing as nuclear reactors are very much critical national infrastructure, famously, you can understand why the UK wants to have at least one domestic producer of industrial carbon dioxide, in the event that something goes horribly wrong and the UK can’t import the stuff from anywhere else. Hence, in a very roundabout way, import tariffs on bioethanol are important to critical national security infrastructure.

Who ever said trade policy was dull?

---

I enjoy putting Most Favoured Nation together, but assembling all of the content usually takes up one of my evenings each week, when I could otherwise be watching Netflix, wasting time on Twitter, or something. So if you appreciate the MFN content, and would like to receive MFN in your inbox every week, please consider signing up to be a paid subscriber.

There are three options:

The free subscription: £0 – which gives you a newsletter (pretty much) every fortnight

The monthly subscription: £4 monthly - which gives you a newsletter (pretty much) every week and a bit more flexibility.

The annual subscription: £40 annually – which gives you a newsletter (pretty much) every week at a bit of a discount

---

Everyone wants a trophy

Liz Truss has been racking up political trophies, what with the rollover trade deals, the [near] completion of a trade deal with Australia, and the soon-to-be-announced agreement in principle with New Zealand. Unsurprisingly, other UK cabinet ministers are looking to get in the trade trophy action. Hence, I would not be surprised if the UK-Switzerland mutual recognition agreement on financial services negotiations – which are being negotiated by the UK Treasury, not the Department for International Trade – conclude this year. Which is potentially exciting.

Another trophy, but this time for Rishi.

Data localisation goes global

MFN fan favourite, Nigel Cory (aka the guy who knows everything about digital trade and also restrictions on trade in video games), has a new report out documenting the recent rise in global data localisation policies.

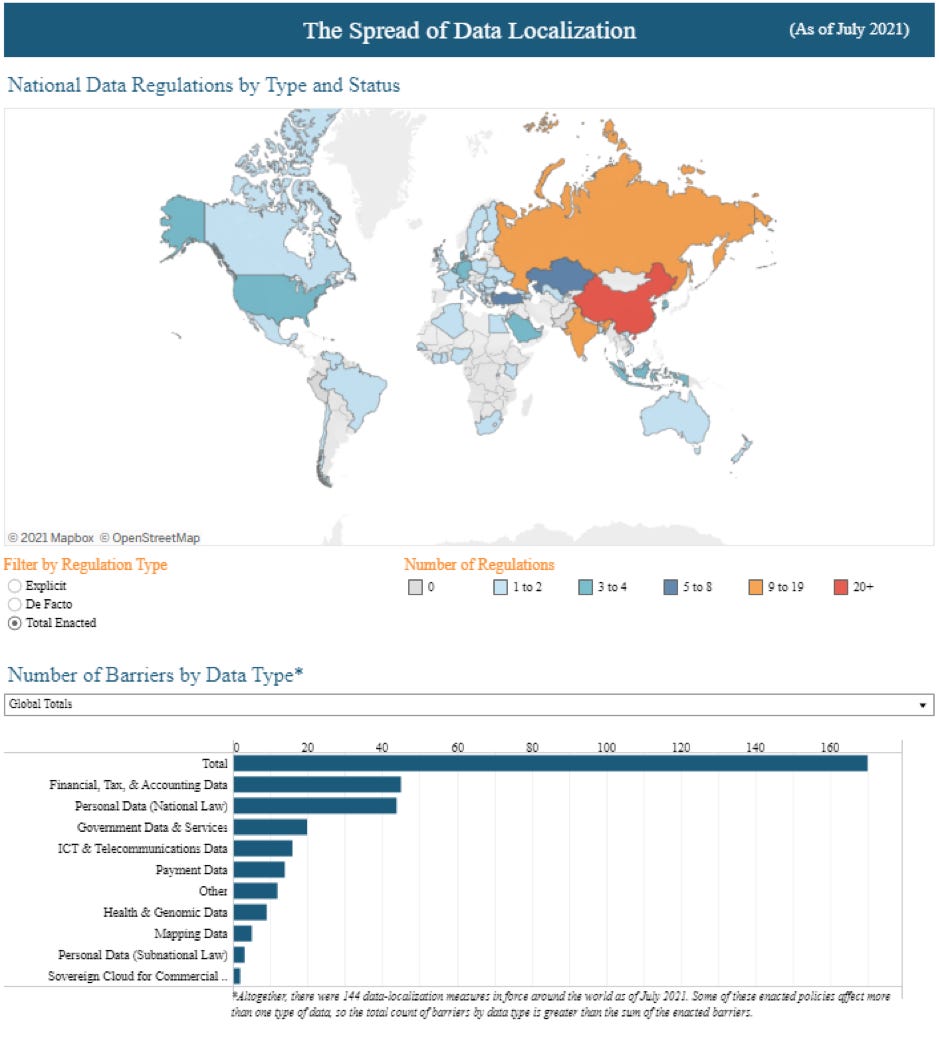

You should obviously read the full thing, but the key stat is that in 2017 35 countries had implemented 67 measures restricting cross-border data flows, but as of July 2021 that number has increased to 62 countries imposing a total of 144 restrictions. Which isn’t great.

The biggest culprits are, unsurprisingly, China, Indonesia, Russia and South Africa.

See this map and chart for more:

---

As ever, do let me know if you have any questions or comments.

Best,

Sam