Most Favoured Nation: The Treaty of Waitangi, Revisited

New Zealand, Ukraine, Mirror Clauses and Digitalisation

You might think that the UK’s free trade agreement with New Zealand is to all extents and purposes much the same as the UK’s free trade agreement with Australia. And, for the most part, you would be right.

But there are some differences. For one, New Zealand convinced the UK to remove all import tariffs, while Australian exports of poultry, pork, eggs and long-grained milled rice will still face restrictions. [1-0 to New Zealand]. Alternatively, New Zealand’s transitional tariff-rate quotas are denominated in carcass weight equivalent (so 1 tonne of boneless lamb would be treated as 1.67 tonnes for the purpose of the initial 35,000 tonne quota) while Australia’s tariff-rate quota is denominated in product weight (so 1 tonne of boneless lamb would be treated as … 1 tonne of lamb). [1-1.]

Anyway, one of the less obvious differences is in the digital provisions. While Australia has committed not to require firms to hand over their source code as a condition of market entry (Article 14.18). New Zealand, on the other hand, has not.

In practice, this probably doesn’t matter that much – New Zealand doesn’t seem to make firms do this anyway – but it is slightly odd.

Why doesn’t New Zealand, a county that is generally very pro-free trade, and at the forefront of digital trade discussions, make commitments on source code? I asked around and, to my great delight, it comes down to our old friend the Treaty of Waitangi.

As long-term readers of MFN will know, New Zealand includes something called The Treaty of Waitangi exception in all its trade deals. Along with other provisions, this exception allows New Zealand to discriminate in favour of the Maori and ensure that trade deal obligations can’t get in the way of any settlement or redress afforded to Maori under the Waitangi Tribunal.

And it turns out New Zealand has already had an issue when it comes to making commitments on source code and other data issues. In response to New Zealand’s membership of CPTPP, and concerns around Maori data sovereignty, a Waitangi Tribunal concluded that:

… the risk to Māori interests arising from the electronic commerce (e-commerce) provisions [ed: which include commitments on source code] are significant and that reliance on exceptions and exclusions in the CPTPP to mitigate that risk falls short of the Crown’s duty of active protection. As a result, the Tribunal found that the Crown has failed to meet the Tiriti/Treaty standard of active protection and that this failure constitutes a breach of the Tiriti/Treaty principles of partnership and active protection.

So there we are.

If you appreciate the MFN content, and would like to receive MFN in your inbox every week, please consider signing up to be a paid subscriber.

There are a number of options:

1. The free subscription: £0 – which gives you a newsletter (pretty much) every fortnight

2. The monthly subscription: £4 monthly - which gives you a newsletter (pretty much) every week and a bit more flexibility.

3. The annual subscription: £40 annually – which gives you a newsletter (pretty much) every week at a bit of a discount

4. If you are an organisation looking for a group subscription, let me know and we can work something out

Ukraine

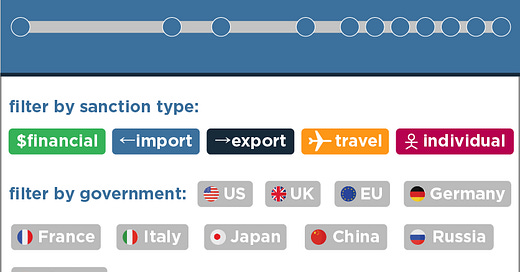

For those of you struggling to keep track of the different sanctions being placed on Russia as a result of its invasion of Ukraine, cult hero Chad Bown and his team at PIIE have pulled together an incredibly useful tracker:

As previously discussed in this newsletter, I’m of the view that we’ve reached the point of diminishing marginal returns when it comes to new trade sanctions on Russia – at this stage the only Western companies/countries still doing business with Russian entities have little other choice. (For those interested in a quantitive assessment of the impact of new tariffs and an energy ban, do read this excellent new paper by @SimonEvenett & Marc-Andreas Muendle.) What does interest me, however, is the possibility for Russian trade diversion, and subsequent secondary sanctions.

On that note, ECIPE’s Oscar Guinea and co. have taken a preliminary look at the extent to which China could step into the gap left by Western firms exiting the Russian market.

They conclude that in the long-term, maybe China could. But in the short-term, no … and it’s not entirely clear it is in China national interest to do so:

China’s deeper integration with Russia offers opportunities: a market to sell Chinese manufacturing goods and from which to buy energy, but this choice is not risk-free. Chinese exports to Russia increased by 18 percent between 2017 and 2020 but Russia remains just the 14th most important market for Chinese goods, representing just 2 percent of Chinese total exports, far from the importance the EU (15%) or the US (17%) hold as a foreign market for Chinese businesses. The bottom line: it is not in China’s interest to overthrow the world economic order because it benefits enormously from it.

digitaliSATION

Often when you hear people talking about digital trade it quickly becomes apparent they are actually talking about the digitalisation of trade which can be irritating because while both are important they are not actually the same thing. Digital trade encapsulates issues around restrictions on cross-border data flows and the like, the digitalisation of trade encapsulates issues around turning existing paper-based trade processes digital. Both are cool. But they are different things.

Anyway. The UK is making some positive steps forward on the digitalisation of trade and the recognition of electronic trade documents. Yesterday, the Law Commission published its recommendations and draft legislation:

Of course, it is not enough for one country to move on this. It requires others to do so too (borders have more than one side). But there are positive moves in that space – the new UK-Singapore digital economy agreement is accompanied by a shared commitment to work together to digitise trade, and ensure customs interoperability.

Nice.

Chart of the week

New research by the Swedish board of trade, looking at the utilisation of the EU-South Korea free trade agreement by Swedish firms, finds that it took 3-5 years for importers to get to grips with the FTA, but once they did utilisation rates shot right up. It’s all about the implementation.

Other things:

ECIPE/Trade Strategies’ Emily Rees has a new piece out looking at the concept of ‘mirror clauses’. Anyone interested in issues around trade conditionality, and when it is appropriate, and when it is not, should read.

Fans of the hit trade podcast, Trade__Talks, will be devastated to hear that this week’s episode was Soumaya Keynes’ last. Although I’m reliably informed that Chad will carry on without her, it will not be the same. Listen in here.

The EU has concluded its internal negotiations on an International Procurement Instrument. The Commission will now be able to apply restrictions to the EU's own procurement markets in the form of adjustments in the way tenders are assessed, or by excluding certain tenders, from firms operating out of countries that don’t also open up their procurement market to EU bidders.

The US, EU, South Africa and India have agreed a compromise on vaccine IP issues that would allow most developing countries (excluding China) to waive vaccine IP rules for a few years. It still has to be signed off by the rest of the WTO membership (and EU member-states), and it’s not clear it will actually achieve very much in practice. Some people will be happy; some will be sad.

As ever, if you enjoy reading MFN, do consider becoming a paid subscriber.

Best wishes,

Sam