Brexit is back and we all must suffer. I’m sorry.

Due to not understanding what it signed up to / the dastardly EU’s interpretation of how the Northern Ireland Protocol should be implemented / new completely definitely unexpected consequences / always intending to renege on its commitments [delete as appropriate], the UK has decided enough is enough and the Northern Ireland Protocol needs to be overhauled. And if the EU is not willing to make the necessary changes as part of a negotiation, the UK will implement them unilaterally.

But no one [to my knowledge; sorry to the inevitable academic/IfG intern that has been meticulously documenting this for years] has compiled a list of what it is the UK actually wants.

So I thought I would do a public service and pull one together here.

With the caveat that this list is mainly based on conversations and me piecing together disparate bits of information that has been briefed to friendly journalists/leaked to unfriendly journalists, these are the changes I think the UK wants to see made:

Reverse the burden of proof. As it stand, the default for goods entering Northern Ireland is that they are treated as if they are entering the EU’s customs and regulatory territory unless (in the case of customs duties) the importer can prove they will remain in Northern Ireland. The UK wants to flip this, so that all goods entering Northern Ireland are treated as if they will remain in the UK, unless there is a clear and obvious risk of onward movement to the EU. But how to achieve this in practice?

Expand the remit of the “not at risk” regime. At the moment, goods entering Northern Ireland can, subject to terms and conditions, avoid EU tariffs if they can demonstrate they will remain in Northern Ireland. Given this is acceptable for fiscal purposes, there is no reason, the UK argues, the same approach could not be used for the purpose of avoiding regulatory controls too. Food products entering Northern Ireland from Great Britain could avoid checks so long as they are sold to Northern Irish consumers. Of course the UK wants the remit of the scheme to be as wide as possible, and drastically simplified too. At its most permissive, the UK would also like the EU to actively identify the product types – for example citrus fruit – it is most concerned about from a bio-security point of view, and target checks accordingly.

And you know what, I’m kinda with the UK on this. In practice, the extension of the not-at-risk process has already happened: the grace period allowing for chilled meat preparations to enter Northern Ireland from Great Britain (yes, sausages) is only available to supermarkets in Northern Ireland, on the basis you have a clear, local, point of sale and heavily monitored supply chains. If you can prove it will stay in Northern Ireland, and it is not something that poses a major threat to EU biosecurity, then what’s the problem?

General expansion of trusted trader. Trusted firms should face minimal [see: zero] checks and bureaucracy; compliance would be policed via audit.

Use existing commercial data to identify product movements instead of customs declarations. At the moment, traders moving goods into Northern Ireland from Great Britain have to make customs declarations via the Trader Support Service. The UK wants to drastically simplify this process by reducing the amount of information asked for. It also wants to remove and the requirement for firms to work out the product codes (HS codes) of goods (something that is actually quite time consuming and difficult) by allowing them to rely on existing commercial information, which the UK argues already contains the required details (or at least the details can be deduced from what is there). Removing the need for HS codes has symbolic importance from a UK perspective, in that it removes one of the visible representations of the internal border.

I think this is all theoretically possible. And the EU has engaged with the UK on reducing the amount of information asked for. But I’m not sure the UK and the firms operating across the internal border are quite ready to implement such a scheme. For one it would require linking the disparate internal systems of various companies with, presumably, the TSS. Not at all impossible, but it would require investment, testing, and refining (and for the UK to share live data with the EU). Also a lot of EU-UK trust. But definitely possible in time. [Note: one of the reasons these sorts of innovative approaches are more feasible in this context than other trade borders is because the internal UK border is unique: while some rules might be different on each side, the UK remains the legal authority, allowing it to more effectively police compliance on both sides.]

Grace periods/easements. The first thing to say is that the protocol as applied in practice is nothing like the protocol as first envisioned. It has already evolved quite dramatically (most notably on medicines). There include a grace period that allow, for example, chilled meat preparations to continue entering Northern Ireland from Great Britain (under set circumstances) despite EU rules not allowing the import of chilled meant preparations and unilateral UK breaches of commitments that exempt small parcels being sold by businesses in Great Britain to consumers in Northern Ireland from customs formalities.

The UK wants these grace periods and derogations to be made permanent, arguing that, in comparison, some of the EU proposals to improve the protocol would in fact increase the burden on traders. And I’ll let you in on a secret: everyone, including on the EU side, knows that these grace periods and derogation are not going anywhere. The UK is never going to stop [mainly hypothetical] Great British sausages from entering Northern Ireland from Great Britain. This is all kinda a phoney war.

Fix VAT. Look, this is one of those things I don’t really understand. Export/import VAT is ridiculously complicated, and the Northern Ireland Protocol approach all the more so. If you want detail, go speak to Richard Asquith or someone like that. But the UK wants the UK VAT regime to apply in Northern Ireland.

UK standards. Northern Ireland is de facto within the EU single market for goods. This means goods placed on the Northern Irish market have to conform with EU regulations and standards. The UK wants businesses in Northern Ireland to have a choice, to either conform with UK regulations and standards (if placing the product solely on the UK market) or EU regulations and standards (if selling into the EU). Brexit hipsters might recognise this as Liechtenstein-style parallel marketability.

In the UK’s favour, at least for product standards, it is correct to say that such an approach is manageble without needing checks on the land border. Within the EU, compliance with European standards is rarely (not never) enforced at the border, rather legal liability for ensuring conformity is placed on the importer and policed in-market. However, knowing that the UK is 90 per cent of the time going to have the same underlying standards as the EU, given we have retained our membership of the European Standards Organisations and y’know gravity, there is a more obvious solution to ensuring the uniformity of the UK market: the UK could just, as a whole, continue accepting that products produced to EU standards and certified for the EU market are fit to be placed on the whole UK market … as the UK is currently doing anyway. Problem solved.

TRQ reform. I might be the only person who cares about it, but I’ll mention anyway. Importers of food in Northern Ireland currently cannot use UK tariff-rate quotas (either in free trade agreements or autonomous) because the UK tariff regime can only be used if the difference between the applied UK tariff and EU tariff is less than 3 percentage points. Because the in-quota UK rate (usually zero percent) is compared to the EU out-of-quota rate (usually a bazillion percent) the difference is always greater than 3. I wrote about just how this came to be so complicated last year.

I’m not quite sure what the new UK proposed fix for this is, but I assume it is along the lines of if you can prove it stays in Northern Ireland then you should be covered by the UK tariff regime (essentially scrapping the 3 percentage points criteria).

Standstill. The UK does not want any new EU rules coming into force in Northern Ireland. It is already the case, per the Northern Ireland Protocol, that brand new EU rules do not automatically come into force in Northern Ireland and have to be discussed in the joint committee, but updates to the existing rulebook do … and the existing rulebook is quite large. Divergence would then be managed on a case-by-case basis over time.

I think the UK is pushing its luck a little here. There are clear benefits to the Northern Ireland being in the EU’s single market for goods and I’m not sure why gradually eroding this over time would be helpful or put NI in a strong position to attract investment.

Replace subsidy rules with TCA rules. Pretty much what it says: the UK wants the EU subsidy rules in the protocol to be replaced with the provisions included in the trade and co-operation agreement.

Get rid of ECJ. The UK wants to get rid of the ECJ because it doesn’t feel good and it is a bit embarassing (no Northern Irish business group has raised this as an actual issue). Something I think is overlooked in this discussion is that the presence of the ECJ in the protocol actually serves as a safeguard against discrimination for Northern Irish businesses selling into the EU.

A complete rewrite. And of course all of the above requires the Protocol to be rewritten.

I’ve probably missed something, but the above is – to my understanding – what the UK is asking for. I’m broadly in favour of anything that improves the life of businesses and a lot more sceptical of the asks that are basically the UK having a retrospective temper tantrum. But the big question is, even if the EU agreed to 75% of the above … would it be enough for the DUP?

Answers on a postcard/in the comments section below.

If you appreciate the MFN content, and would like to receive MFN in your inbox every week, please consider signing up to be a paid subscriber.

There are a number of options:

The free subscription: £0 – which gives you a newsletter (pretty much) every fortnight

The monthly subscription: £4 monthly - which gives you a newsletter (pretty much) every week and a bit more flexibility.

The annual subscription: £40 annually – which gives you a newsletter (pretty much) every week at a bit of a discount

If you are an organisation looking for a group subscription, let me know and we can work something out

Blame Canada

On the topic of countries signing up to international treaties and then not abiding by their commitments [I’M JOKING], New Zealand has brought a case against Canada under the CPTPP because despite Canada agreeing to liberalise its dairy markets via new TRQs, it in practice makes it very hard for anyone to actually use them. (A classic.)

Janyce has the lowdown here:

Defensive Manouveres

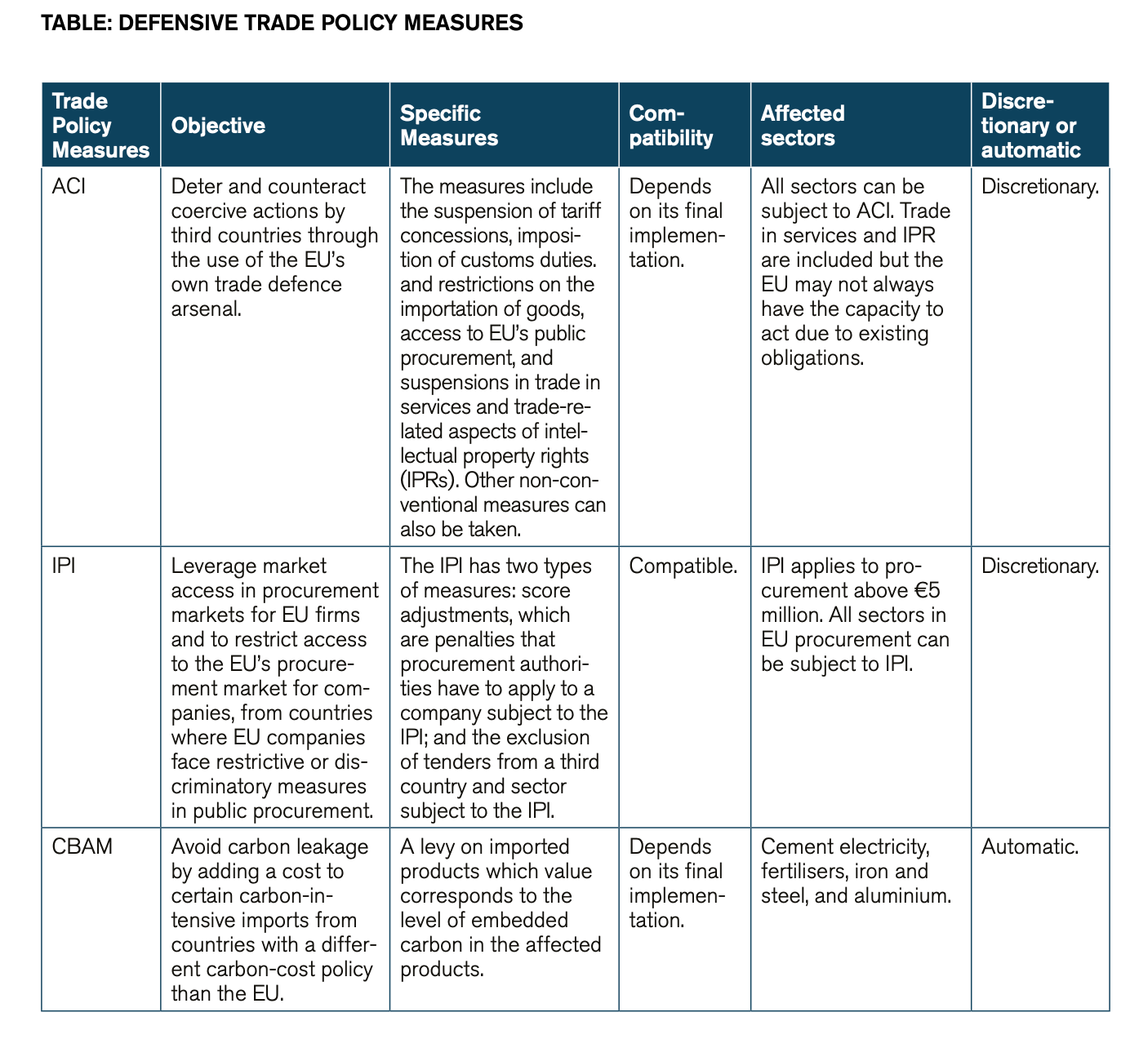

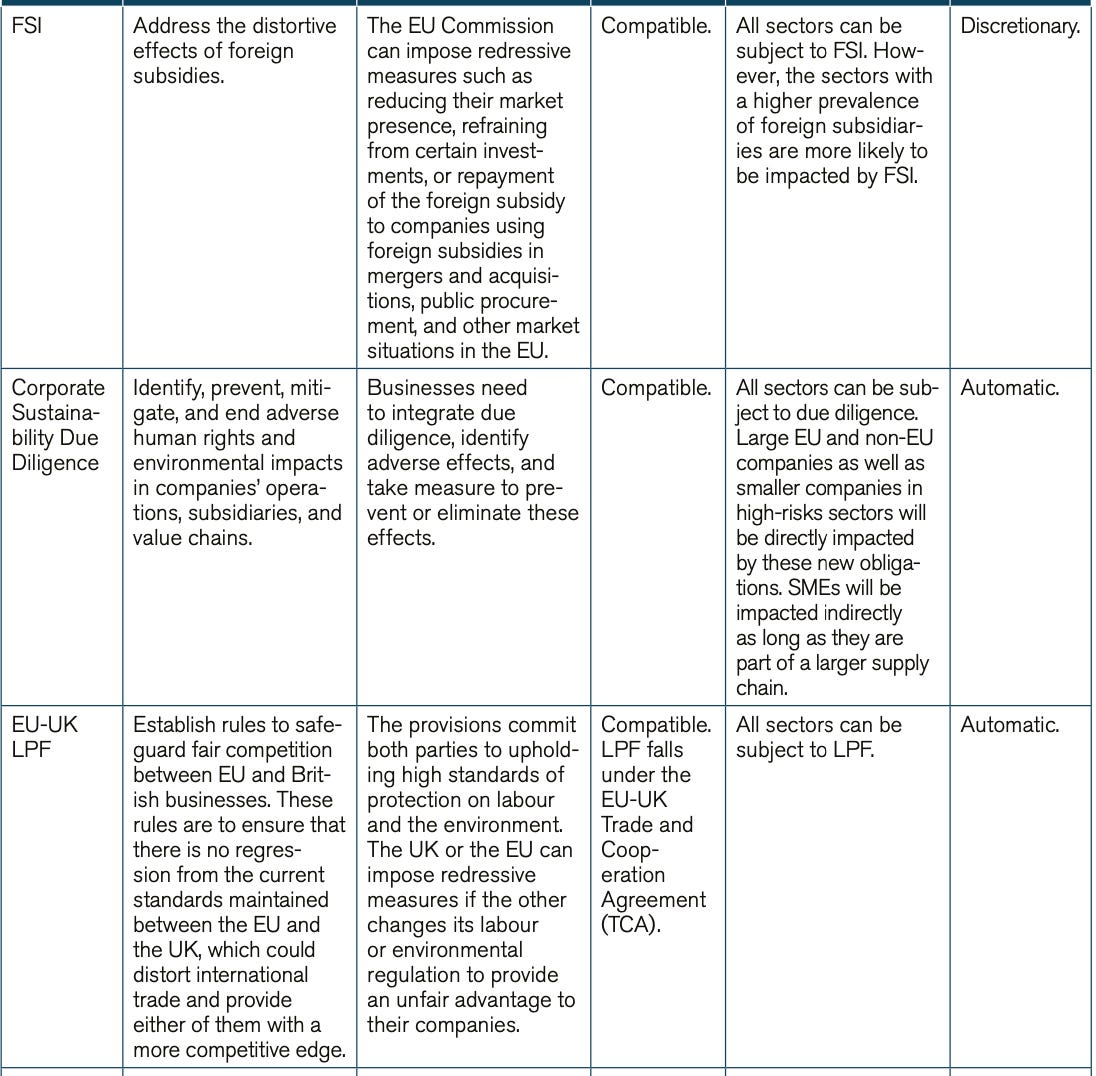

The useful folk at ECIPE have pulled together an overview of the EU’s new trade defence measures, including a judgement as to whether they are compatible with the EU’s international obligations:

Best wishes,

Sam