Most Favoured Nation: Who Did It Better?

EU-New Zealand versus UK-New Zealand, foreign subsidies, and other things

Welcome to the 57th edition of Most Favoured Nation. This week’s edition is free for all to read. If you would like to receive top quality trade content in your inbox every week, please do consider becoming a paid subscriber.

New Zealand

The EU and New Zealand have signed an FTA. This is pretty good new for both the EU and New Zealand. The EU because it proves it can in fact still sign new free trade agreements, and New Zealand because it gets preferential access to one of the biggest markets on the planet (and managed to do so before the Aussies).

Now, given how twitter is, one of the first things the good people (Brits) of twitter wanted to know is whether the EU deal with New Zealand is better or worse than the UK’s.

And the answer is … it kinda depends what you mean by better. From a trade liberalisation perspective, the UK-New Zealand deal goes further: in particular it provides for, eventually, much greater liberalisation of food tariffs.

For example, under the EU-New Zealand free trade agreement, the EU will phase in over 7 years a tariff-rate quota that will allow for 10,000 tonnes per annum of NZ beef to be imported at the preferential tariff-rate of 7%. 10,000 tonnes is really not very much, particularly when you consider it applies to the entire EU.

The UK, by comparison, will phase in a complete tariff removal over 10 years (subject to another 5 years of safeguards). The year-one tariff-rate quota allow 12,000 tonnes of NZ beef to be imported tariff-free.

This means that, if you are a British consumer, you will (dependent on what NZ exporters actually decide to do) probably have relatively better access to NZ beef than your EU counterpart.

However, if you are a British farmer, you might view things a little differently. You might, for example, be jealous of EU farmers who remain largely shielded from NZ competition.

It will also be interesting to see how the agreements interact. Because even though, for example, Irish farmers are relatively well insulated from any increased NZ competition in their domestic market, they will now have to compete with NZ producers when selling into the UK.

—

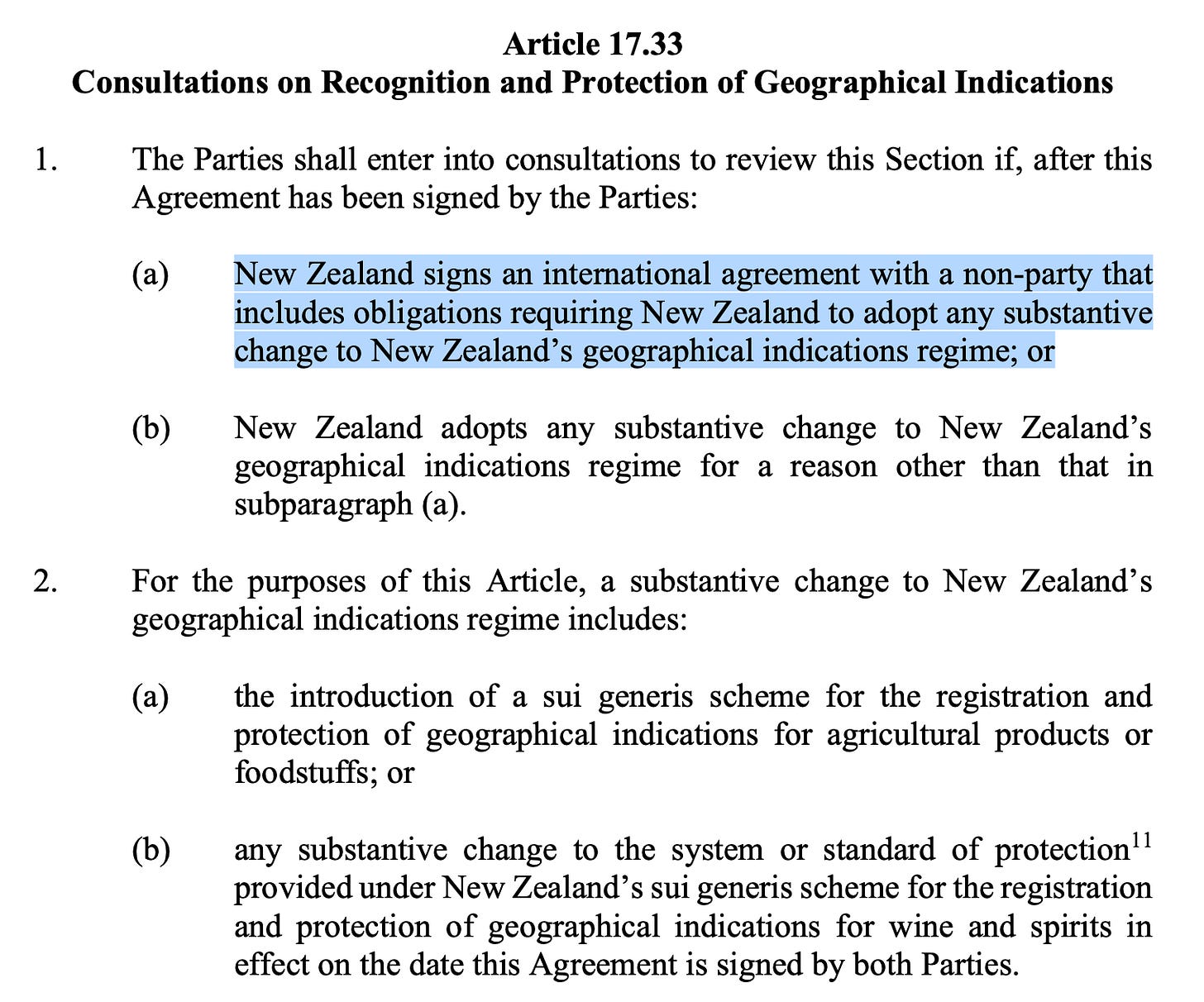

On a related note, the EU-NZ agreement does mean some potential change to the UK-NZ deal. Due to its desire to get the deal done quickly, the UK outsourced some of the negotiation to the EU. Specifically, on Geographical Indications, it included this clause:

And now that the EU has indeed negotiated a deal with New Zealand that includes provisions on Geographical Indications (at least according to the fact sheets, the text isn’t available yet), I guess it’s time for the UK to open consultations about including some of its own.

Foreign Subsidies

For the last few years I have, largely unsuccessfully, tried to get people to pay attention to the litany of new EU unilateral trade instruments. As well as the carbon-border adjustment mechanism (CBAM), you have have efforts such as the international procurement instrument (IPI), the anti-coercion tool and new supply chain due diligence rules.

One of the biggest and baddest are the new foreign subsidies rules, that were agreed by the European member states and parliament last week. The final stage will be a vote in the Council and Parliament in the coming months.

The tool gives the Commission new powers to investigate financial contributions granted by non-EU countries to companies involved in mergers, procurement bids and other activity within the EU’s single market:

As I wrote in a piece for CER in 2020, the basic rationale for the foreign subsidies rules is to allow the EU to guard against unfair Chinese industrial policy:

The Commission has re-evaluated its trade and investment defences as concern has grown in Europe about the World Trade Organisation’s (WTO) inability to prevent China subsidising its companies. While the WTO Agreement on Subsidies and Countervailing Measures (known as the SCM Agreement) allows for additional tariffs to be placed on imported goods that benefit from trade distorting subsidies, the WTO regime only covers direct government subsidies, and not off-government-balance-sheet interventions such as state-directed Chinese banks funnelling money into Chinese companies. Additionally, the WTO anti-subsidy regime does not extend to services, procurement or companies operating within the EU. To address this gap in its armoury, the Commission has proposed introducing new measures that would allow European enforcement agencies to intervene in the event that a company operating within the internal market is found to be in receipt of market-distorting foreign subsidies.

But the thing is … while China may be the target, China is nowhere near being the dominant country-of-origin for most investment into the EU.

That would be the US and UK.

Source: https://trade.ec.europa.eu/doclib/docs/2021/november/tradoc_159935.pdf

And all investors and firms looking to engage in large transactions within the EU, or bid on substantial procurement contracts, will be required to go through the new notification process. They will also be required to keep track of money they’ve received from foreign governments, including [unless something has changed] monies received for the purchase of goods and services, going back 5 years prior to entry into force. Which … y’know, given COVID and governments worldwide turning the fiscal taps on, could be slightly annoying.

Making Friends is Easy

Some of you might remember that the EU brought a WTO dispute against the UK, claiming the UK was making its offshore wind subsidies contingent on firms doing a lot of the associated manufacturing locally.

I always thought this was a bit of an odd case, given I’m pretty confident it would not take long to find examples of EU member-states doing similar. But anyway, it’s no longer a problem because the EU and UK got together, had a little chat, and found a mutually-acceptable solution. Which is surprisingly … grown up.

Listed

One of the ways to get loads of people to share your content on the internet is to write a list of Top People Doing A THING. That way, all of the Top People Doing A THING will probably share and promote your list, due to being chuffed to be listed as one of the Top People Doing a THING.

On that note, I was pretty pleased to be listed by Flexport’s list of the top 55 people to follow for logistics, supply chain and global trade content:

Other Stuff

Most of you will be aware that the EU-UK Trade and Co-operation Agreement includes provisions that will force EV manufacturers to source their batteries either within the EU or UK. This is something that really really annoys the Norwegians, whose battery producers are effectively going to be shut out of EU-UK EV supply chains. Anyhow, Norway’s (loud) moaning has delivered some results. Maroš Šefčovič has agreed to “discuss the application of the rules of origin laid down in the EU-UK Trade and Cooperation Agreement for battery packs and battery cells of Norwegian origin installed in electric vehicles produced in and traded between the EU and the UK.” (h/t Jon Regnart).

The OECD has a new paper out mapping data localisation measures. Would you be surprised to learn they are on the rise? And on the subject of data localisation … US lawmakers are attempting to make it more difficult for US data to be transfered to hostile jurisdictions. A not unexpected development …

As ever, do let me know if you have any questions or comments.

Best,

Sam