Back in 1993, the EU imposed a load of anti-dumping tariffs on Chinese bikes.

In response, to dodge the tariffs, EU importers …

a) imported lots of bike parts from China and assembled the bikes in the EU, or

b) imported bikes that looked very similar, someone would say identical, from countries such as Indonesia, Malaysia, Sri Lanka, Tunisia, Cambodia, Pakistan and the Philippines;

As you can imagine the European Commission wasn’t too thrilled about this. So it decided to conduct various anticircumvention investigations and reviews (which continue to this day) and extended the anti-dumping tariffs to …

a) some of the bike parts imported from China (1997); and

b) some bikes imported from countries such as Indonesia, Malaysia, Sri Lanka, Tunisia, Cambodia, Pakistan and the Philippines (2019).

Loopholes closed.

Why am I talking about this?

Well, today EU member states signed off (or at least not oppose) the imposition of anti-subsidy tariffs on imported Chinese electric vehicles.

As a result, we are probably going to see more investment in EV production capabilities in nearby countries such as Turkey, but also within the EU.

See this table from a recent Rhodium Group report:

Buuuuut, what are these companies actually going to do in these plants?

If it is solely assembly of so-called complete knock-down kits (CKDs) or semi-knockdown kits (SKDs) which involve simply putting together imported pre-prepared parts, then you arguably have tariff circumvention similar to the bike example mentioned above.

But will anyone care?

Even if the new plants just have a load of people assembling pre-made packs, the member states hosting them – such as Hungary and Spain – will benefit from some additional jobs and investment.

My best guess would be that even if the Commission does start to get bothered by circumvention, extending the anti-subsidy tariffs to the imported parts could be difficult to get past the beneficiary member-states. However, it might find it easier to make the case for e.g. imports of China-brand vehicles from Turkey.

Regardless, today’s tariffs are probably just the start of a big game of tariff whack-a-mole.

Drop the GATT

Long-term readers will know that I am a big fan of trade-related songs — this one being my favourite of all time.

So with thanks to LSE’s Mona Paulsen for digging it out of the British Library’s archives (and giving me permission to share), here is Drop the GATT rap:

The first person to put this to music and send in a video rendition wins a prize.

Chart of the week

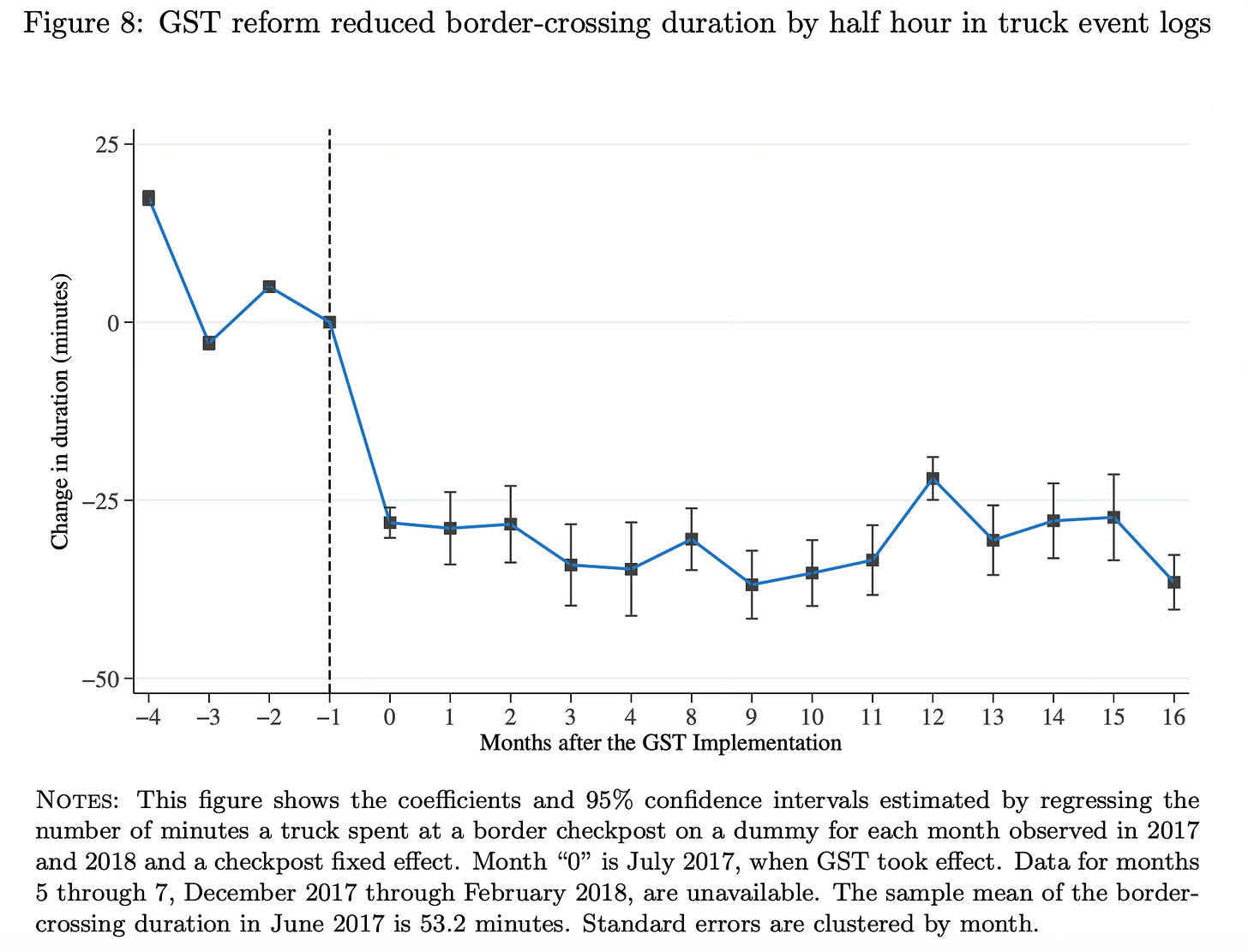

A new paper by Jonathan I. Dingel and others looks at the impact India’s Goods and Services Tax (GST) has had on removing internal trade barriers. Lots of interesting stuff in there, but this chart is a particular highlight:

Best,

Sam