Last Thursday, the UK published its long-awaited Trade Strategy.

For whatever it’s worth, I don’t think the UK government should have ever committed to publishing a trade strategy [note: this is different from me saying the UK shouldn’t *have* a trade strategy].

This is because no government can publicly say what it really thinks about the state of the world and what it intends to do about it. Or at least not as honestly as folk such as me would like.

Let’s assume *cough* for example that we are in a world in which the US market is becoming more closed due to tariffs, the EU market is more closed due to regulatory barriers, and the Chinese market is becoming more closed due to export controls, domestic preference, and increased domestic competition.

Let’s assume that as of right now the UK is a broadly open economy, with a globally integrated services sector that benefits hugely from its timezone and English language, a manufacturing sector that still does some cool things but is struggling and a relatively okay relationship with all three major blocs (albeit on worse terms with the EU than it was 10 years ago).

Let’s assume the objective is to keep the US and China-related damage to a minimum while deepening trade ties elsewhere, including with the EU. Let’s assume it won’t be possible to keep both the US and China happy in the long run, but you absolutely can’t say that publicly. If there is going to be China decoupling, you would rather keep it contained to specific areas of concern and drag it out for as long as possible.

So, what’s the strategy? And if you know what it is, does it work if you tell everyone?

… hard, right?

Given all the above, the UK’s Trade Strategy is … pretty good, I think. Although I fear it is one of those documents that requires you to know what is going on to actually KNOW what is going on.

Anyway, here are two points I found particularly interesting:

The UK government will “seek views on the potential for new powers to respond to deliberate economic pressure against the UK”. For those ITK (in the know), this is a precursor to conversations about a UK version of the EU’s anti-coercion instrument, or ACI. We’ll need to see what gets proposed, but in theory this would create the legal framework for the UK to place restrictions across a number of sectors (so not just tariffs) in the event another country is unfairly bossing the UK around. As an aside, it would have been fun if both the EU and the UK had an anti-coercion instrument during the Brexit negotiations, and the EU had triggered its ACI because the UK threatened to cut off Ireland’s food supply unless the EU caved and the UK triggered its ACI because the EU (well, France) threatened to cut off Jersey’s energy supply unless the UK gave its fishermen more fish. Would have been top quality newsletter content.

“We will now engage business and PEM members to consider the benefits of joining PEM.” For those of you who don’t know PEM, or The Regional Convention on Pan-Euro-Mediterranean preferential rules of origin is very much NOT A CUSTOMS UNION. This is not a slam dunk — the EU’s early enthusiasm for the UK joining has waned somewhat in recent months — but if timed correctly and incorporated into the EU-UK Trade and Cooperation Agreement, UK membership could make it easier for some exports to qualify for tariff-free trade. My suspicion is that any decision on PEM will only really come to a head when the EU and UK get nearer to 1 January 2027, when trading electric vehicles tariff-free between the EU and UK will become much more difficult due to the imposition of stricter rules of origin. Choice could be PEM [which could help a bit] or extension of the relaxed rules which are in place now. Maybe.

Chart of the week

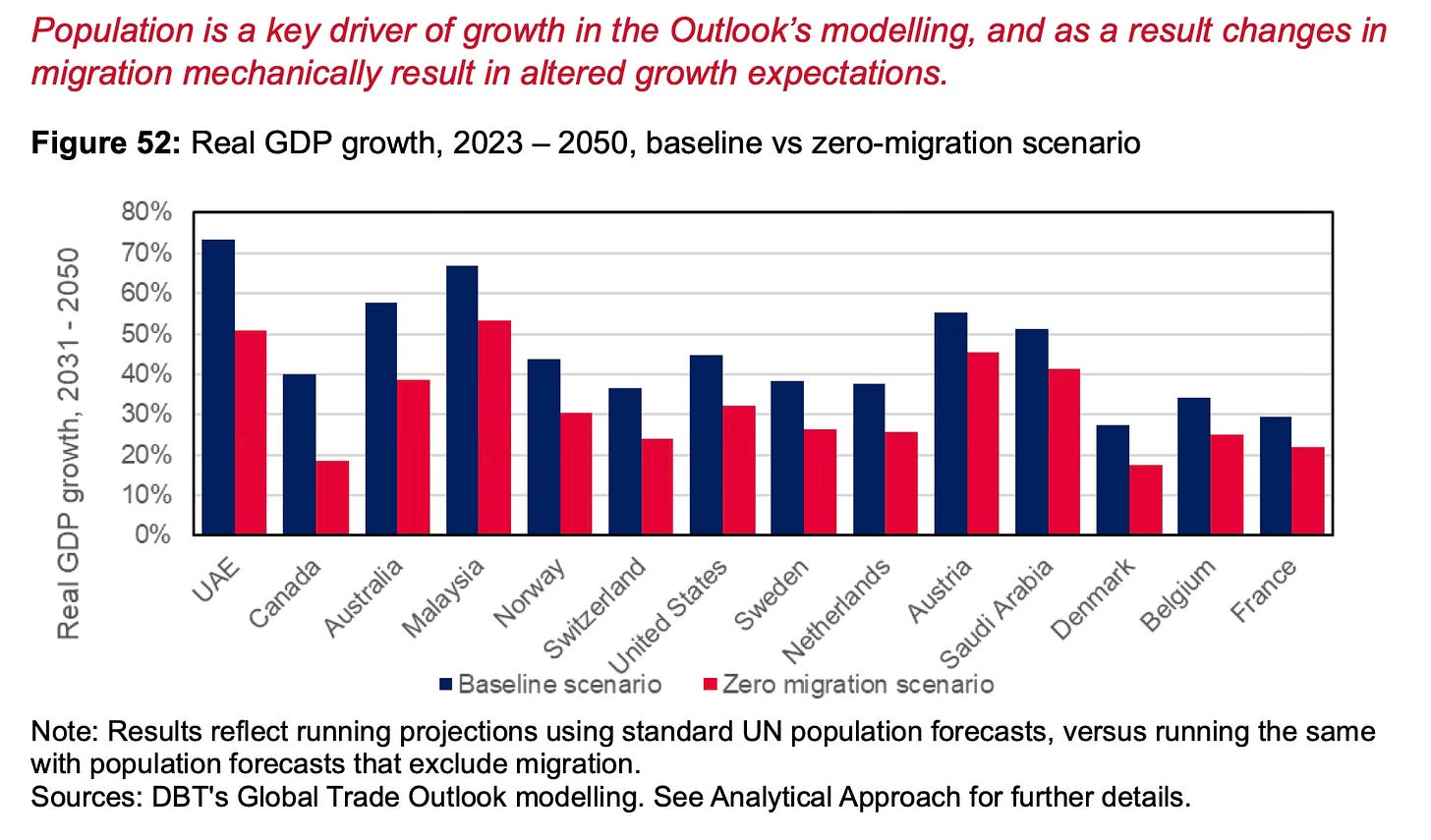

Alongside the Trade Strategy, the UK published a Global Trade Outlook, which includes lots of charts. And I like charts.

Here’s one I particularly liked:

Nothing personal

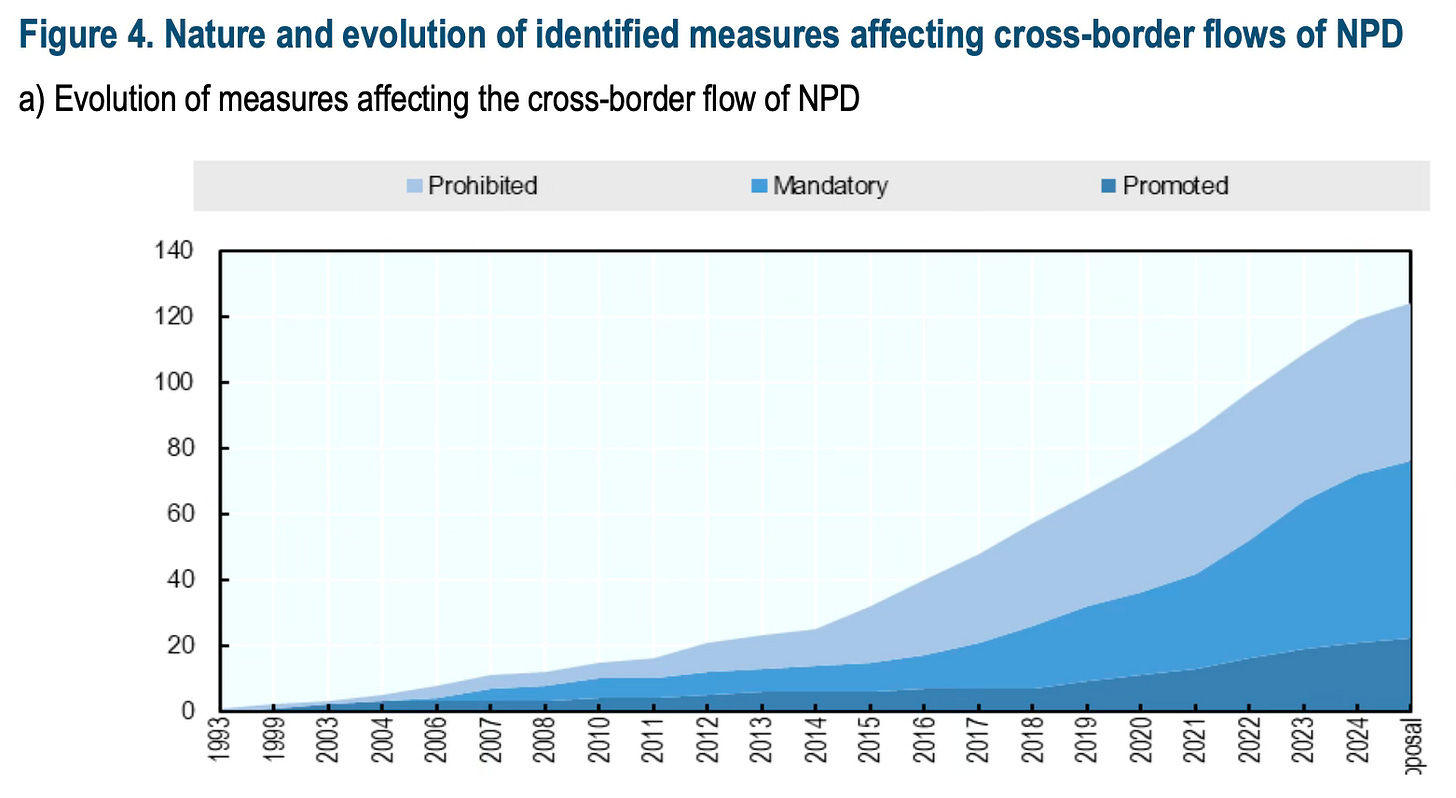

Javier López González and co at the OECD have produced some provisional mapping of measures affecting the international transfer of non-personal data.

Read the report HERE.

Such measures include strict data localisation measures such as …

• India’s RBI Directive Storage of Payment System Data (2018) which requires that the ‘entire data relating to payment systems’ to be stored in India only.

• Nigeria’s Guidelines for Nigerian Content Development in Information and Communication Technology (2019), which are legally binding, require public authorities and data information and management companies, to host all sovereign data in Nigeria

And yes, these measures — both positive and negative — are on the rise.

Another chart

Collecting tariffs, ain’t easy. Apparently.

(H/T Bob Elliott on Bluesky)

Tariff escalation

One of the reasons I think we are about to see tariffs ramp up between the EU and the US, is that there is a fairly high chance the US whacks the EU with higher tariffs on liberation day 2.0 (and new sections 232 tariffs on pharmaceuticals, copper etc) and that the EU retaliates.

For those of you who have missed it, the mood in the Brussels/EU think tank ecosystem has become much more fighty of late. I wrote a couple of weeks ago about one of these pieces. And here’s another one by Etienne Höra of the Bertelsmann Stiftung and Arthur Leichthammer of the Jacques Delors Centre. And I get the sense they are very much not alone …

Best,

Sam

Agree that those were the most exciting bits, with PEM also in regards to what could become possible under future updates to the convention