Most Favoured Nation: 100th Edition (!)

Vibes theory of trade, CPTPP, uninteded CBAM consequences, rules of origin, and other things.

Welcome to the 100th edition of Most Favoured Nation!

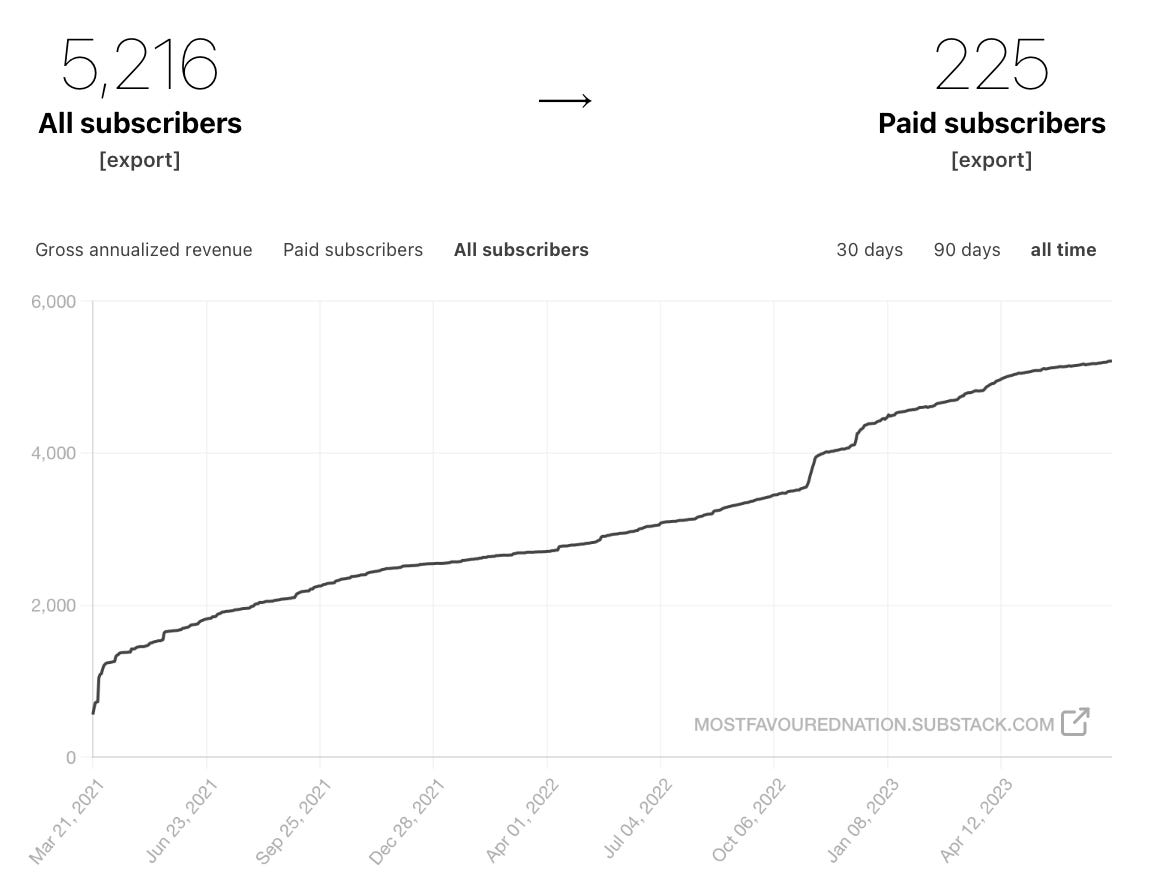

When I started writing this newsletter back in March 2021, I wasn't completely sure that anyone would read it. Thankfully my fears were unfounded, and now over 5000 of you from 108 countries (and 44 US states, apparently) are signed up.

I would also like to say a special thank you to the 200 or so of you who have signed up as paid subscribers. Your support is particularly welcome and ensures I produce a new edition of MFN even on the weeks I don’t really feel like it.

If you have been thinking about becoming a paid subscriber, now is as good a time as ever to do it. I’ll even throw in a little discount, which will be live until the end of the month.

Regardless, I would love to hear about what you have enjoyed, what you would like to read more of, and anything else that comes to mind, either by email or in the comments below.

The Vibes Theory of Trade

Most readers of MFN probably know that the economic benefits of free trade agreements never look pretty impressive when modelled. e.g. the estimated long-run gains of UK-Australia is a 0.01% lift in UK GDP, UK-US a 0.16% uplift … even EU-US (TTIP) back when it was being negotiated was only estimated to create a 0.5% uplift to EU GDP, despite some absurdly optimistic assumptions (100% tariff removal, 25-37.5% removal of non-tariff barriers).

But one of the justified complaints about these sorts of models is that they do not necessarily capture the intangible benefits of doing a trade agreement.

For example, simply talking about a trade relationship a lot can lead companies to engage commercially even if the trade agreement doesn’t actually do anything to improve the relevant terms of trade.

You see this happen sometimes with services firms, who decide to sell something they could have sold anyway and attribute it — at least in supportive quotes adorning government press releases — to a free trade agreement. At the more extreme, and tangible, end you could do a trade agreement with China that offers very little on paper but suddenly find that all of your companies start to receive much more favourable treatment by Chinese customs and regulatory authorities.

So the vibes matter. But how much?

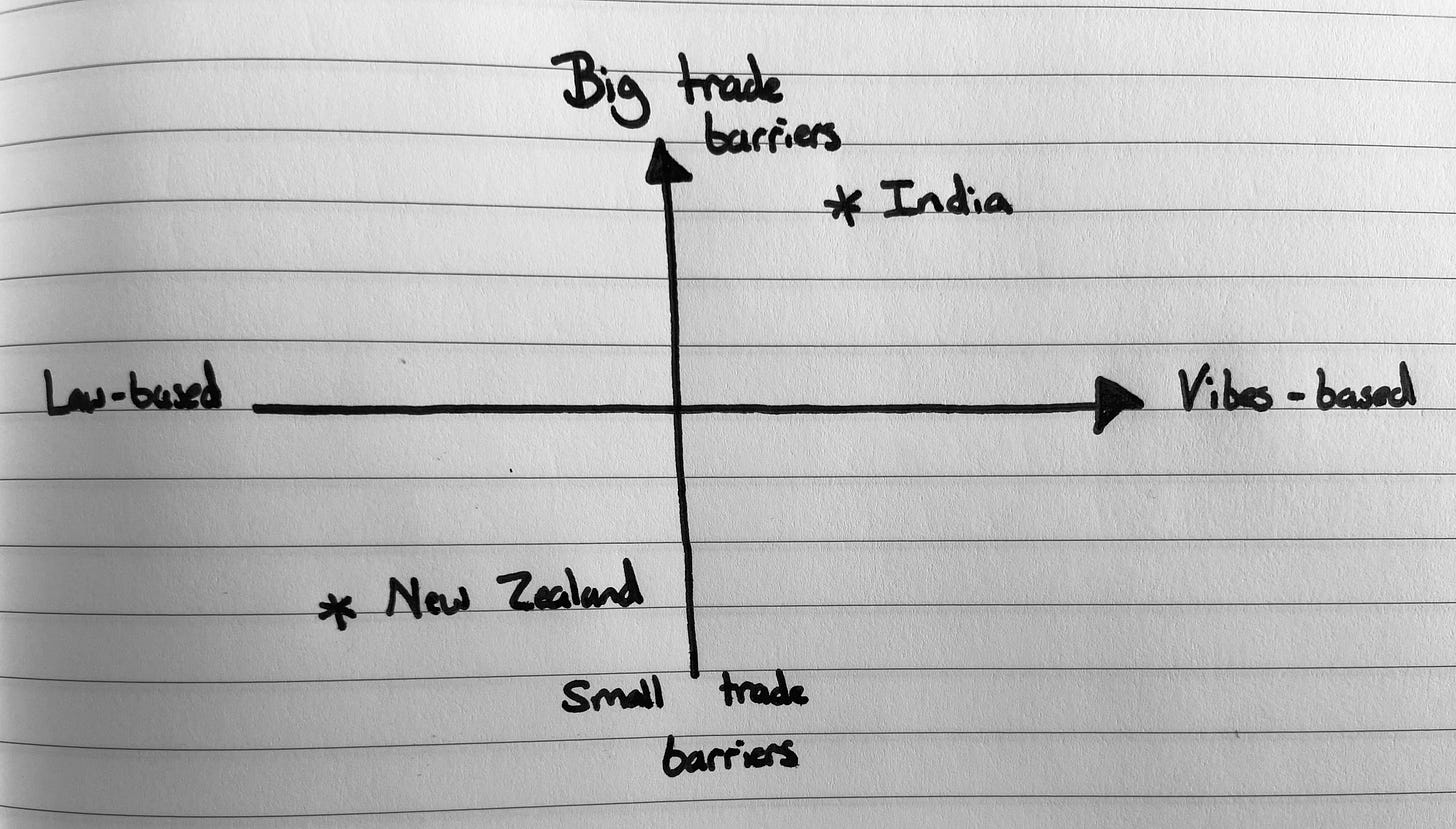

Obviously, I can’t put a precise number on it, but I have been thinking about a framework to help identify whether the intangible economic benefits will be big or small:

So from left-to-right you have a spectrum running from ‘law-based’ to ‘vibes-based’ approach to doing business, and then from top-to-bottom, you have ‘big trade barriers’ to ‘small trade barrier’. And basically, if the country ends up in the top-right quadrant, then you can assume that the intangible benefits of doing a free trade agreement with it will exceed those spat out of any economic model.

Not an exact science … but I think it kinda works?

CPTPP

This weekend, the CPTPP membership will formally sign off the UK’s accession. Woo! I can’t really be bothered to go back all over it again, but if you are interested in what the UK joining CPTPP actually does, I covered it all here.

The unintended consequences of CBAM

This week the Financial Times ran an interesting piece highlighting industry concerns that a CBAM “loophole” could lead to foreign producers dodging new levy by remelting scrap aluminium and rebadging it as a zero carbon product:

Under the EU’s proposed carbon border tax, a levy on the amount of CO₂ emissions produced during the manufacture of goods imported into the bloc, offcuts of aluminium which are remelted can be sold as a zero carbon product even if the virgin material was produced with coal or other fossil fuel power.

Aluminium companies including Norsk Hydro and Speira told the Financial Times that the so called carbon border adjustment mechanism (CBAM) incentivised producers outside the EU to generate as much scrap as possible which would be then be remelted and exported to Europe.

“This loophole enables the widespread greenwashing of imported aluminium products and undermines the effectiveness of CBAM in preventing carbon leakage,” said Hilde Merete Aasheim, chief executive of Norway’s Norsk Hydro.

I’m not fully au fait with the details of this specific issue, but it is true that CBAM will have some unintended consequences.

In some instances — due to its partial application to upstream products and not complex goods — it could actually lead to carbon leakage and production moving out of the EU.

For example, the CBAM could increase the cost of producing a car in the EU if it means the imported high-carbon aluminium is subject to an additional levy. However, if the same car were made outside of the EU, using the same high-carbon aluminium, then the finished car could be imported into the EU, and the aluminium used to make it would not be subject to the CBAM. In this example, producing the car outside of the EU would be relatively cheaper than producing it in the EU.

But while this might be the case, at least in theory, you’ve got to think these things through.

If the CBAM did lead to complex manufacturing jobs moving offshore, what would the EU probably do?

Scrap the CBAM?

Nah.

It would probably just extend its coverage to whatever product it is that was leaking out of the EU.

RoO corner

With thanks to MFN fan favourite Nigel Cory, who sends me interesting rules of origin news whenever he stumbles across it, here are a couple of RoO-related things that happened recently:

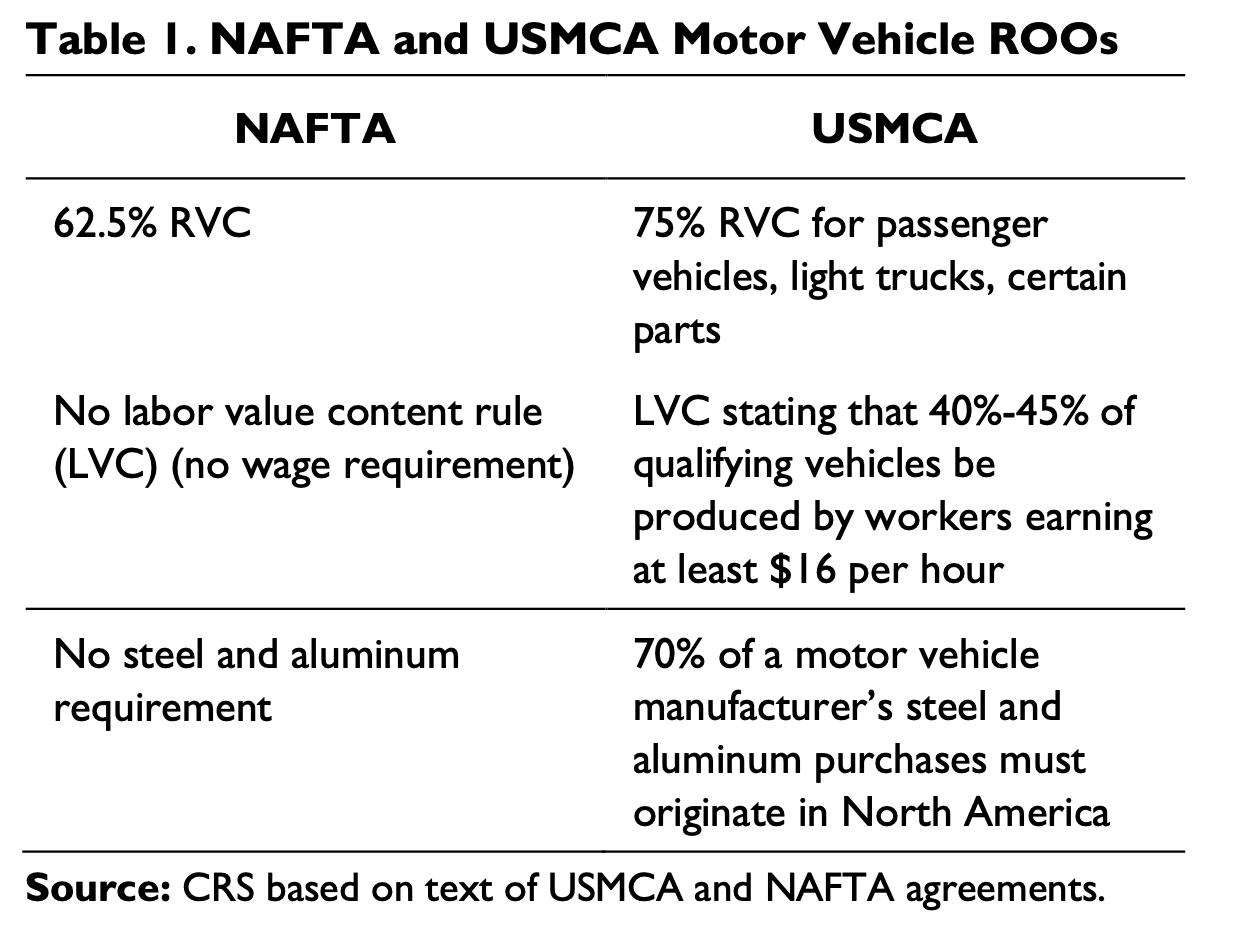

The US International Trade Committee has released a new report quantifying the impact of USMCA’s more restrictive [than its predecessor, NAFTA] rules of origin on the US automotive industry.

To re-cap, the USMCA made it much more difficult for cars to be traded tariff-free between the US, Mexico and Canada by increasing the regional value-added threshold, including new requirements to use locally-sourced steel and by inserting minimum wage requirements. More details here:

So, with the caveat that not all of the rules have been fully phased in yet, what has the impact been? [Emphasis added by me.]

For the period July 2020 through December 2022, the Commission’s economic modeling analysis indicated that the ROOs reduced U.S. imports of vehicle parts and increased U.S. revenues, employment, wage payments, and capital expenditures related to light vehicle and automotive parts production. The model also indicated that the ROOs increased the cost of producing light vehicles in the United States. The higher costs of U.S. vehicle production increased U.S. sales of imported light vehicle models from the rest of the world. Lower tariff preference utilization reduced U.S. imports of light vehicles from Canada and Mexico. These economic effects were concentrated in the automotive industry and had a negligible economy-wide impact.

So more US production, but everything got more expensive.

Mode 5 and rules of origin

I have written about the concept of Mode 5 services before (scroll down), but in summary: the value of many manufactured goods is derived from services inputs. For example, if you lease a jet engine from an aerospace firm, you are paying both for the physical engine but also the live monitoring, maintenance and repairs services that come with it.

But acknowledging that the line between goods and services is blurry leads to some questions about how we approach, for example, customs valuation. Tariffs are only meant to be levied on goods, not services, so when assessing the value of an imported good for tariff purposes, should you deduct the value attributable to services? Also, returning to our old friend rules of origin, when accounting for local value creation, should we explicitly account for the value created by, and the origin of, the services components (note: some calculation methods already do this implicitly by, for example, deducing the local value by deducting the cost of foreign inputs, which leaves the domestic services value added de-facto grouped in with the final local value-add figure).

Anyway, if you are interested in this kind of thing, the OECD has a very good paper discussing the ins and outs of more explicitly accounting for services inputs to trade in goods.

Other things

After we discussed the possibility of the EU leaving the Energy Charter Treaty a couple of weeks ago, the European Commission has now publically recommended it do just that. As noted last time, due to the 20-year sunset clause, this does create a potential situation where the EU leaves, but, say, the UK or Switzerland remain members, and companies just anchor themselves in UK/Switzerland to bring legacy disputes against the EU and its members. Which would cause a fair bit of drama.

On 10 July the EU finally published its implementing rules for its new foreign subsidies regulation. And … it’s going to be chaos! Mandatory notification requirements for firms engaging in large M&A and procurement activity within the EU will kick in from 12 October , but as of 12 July the Commission will have ex oficio powers to investigate any company operating in the single market it views as unfairly benefiting from foreign financial contributions. More information here. This is one of those funny situations where lawyers and consultants (guilty …) all pretend that they think the rules are really burdensome and commercially damaging while actually rubbing their hands with glee due to all of the extra work both the administrative requirements could create, but also the drama that can be created [e.g. if you don’t like your competitor much, you could dig out some evidence they have been benefiting from a US IRA subsidy or the like.]

As discussed last week, Indonesia has restricted the export of raw nickel in an attempt to force companies to invest in local processing capabilities. In response, the EU brought a WTO case against Indonesia, which it won. Indonesia then took advantage of the fact the WTO appeals function is broken and appealed the case into the void. This has led the EU to consult on whether to use one of its new trade defence tools: the enforcement regulation. If triggered, this would allow the EU to retaliate against Indonesia even though the WTO case has not, and will never, conclude. If interested, you have 11 August 2023 to feed in your thoughts.

Once again, thank you so much for all of your support. And if you’re able to upgrade to a paid subscription, it would be much appreciated!

Best wishes,

Sam

Congrats on the 100th edition!

Agree intangible benefits of FTAs can be very important / almost impossible to model estimate. In services in particular where networks and the trading of ideas is so important. Maybe we need more ex post than ex ante modelling! Complemented with deep quali to get into the people stuff!