Most Favoured Nation: A Labour Trade Policy

Bidenomics, trade dependency, plastics, contact lenses and goods trade

Welcome to the 119th edition of Most Favoured Nation. This week’s edition is free for all to read. If you enjoy reading Most Favoured Nation, please consider becoming a paid subscriber.

A couple of weeks ago, Jonny Reynolds, Labour’s shadow minister for Business and Trade1, gave a speech setting our Labour’s trade policy.

Reynolds said a future Labour government would focus less on securing FTAs and more on regulatory alignment with new markets, including on data and recognition of qualifications. He also compared their preferred approach, favourably, with Biden’s and said Labour would focus on resilient and localised supply chains.

He made three concrete commitments: the publication of a Trade White Paper, creation of an Export Taskforce, and reforming the Board of Trade to operate independently and advise government, including reporting on regional economic performance.

Cool cool.

I have written before about what I think a Labour approach would look like, and it pretty much overlaps with this speech.

But to recap, this is what I think replicating US trade policy in a UK context means in practice:

High tariffs on steel and aluminium. This is something the UK already does, via [slightly illegal] safeguards created as part of the legacy response to the Trump steel and aluminium tariffs, and other other anti-dumping and counterveiling tariffs. You could also see the UK/a future Labour government introducing further protection via a carbon-border adjustment type mechanism. [Ed: if the current government hasn’t done so already].

However, it can’t go quite as far as the US and introduce tariffs with no legal basis whatsoever. Or rather, it could do, but would fear retaliation from the countries impacted. India, has already questioned the UK’s [illegal] steel tariffs, and threatening to impose “rebalancing” tariffs on UK exports such as whisky.

Large fiscal subsidies in green and advanced manufacturing. The US is pouring billions into green subsidies and the creation of, for example, domestic high-end semiconductors. Is this something Labour could replicate? I’d guess a little. The challenge is that the US subsidies, in the first instance, are damaging to the UK, in that they risk pulling existing investment out of the UK, and attracting future investment into the US that would have otherwise happened in the UK.

The UK is also fiscally unable to compete with the US [and EU] in terms of the quantity of subsidy it can offer. In such an environment, companies are also incentivised to play governments off against each other, in order to drive the amount of subsidy up — which will lead to a lot of waste *and* make intervention more expensive. One area where a UK government could probably make positive investments is in sectors where the UK has structural or geographic advantages. For example, floating offshore wind and tidal, where the UK has a lot of wind and big tides. Here you could see the UK investing heavily in the hope of benefiting from both the deployment and associated supply chains and industry.

Local content provisions. And this brings us to local content provisions. The US is [famously] conditioning the receipt of its taxpayer subsidies on much of the manufacturing being done within the US or, in some instances, allies. You could absolutely see Labour wanting to do the same. For example, “we’ll give you a load of money to make xxxx, so long as you only use locally-sourced steel”.

The problem is this sort of approach is very very in breach of not only the UK’s WTO obligations but also pretty much every free trade agreement it has ever signed (of which there are many), including the deal with the EU. The US can get away with this because everyone is scared of the US … the UK, less so. The EU already raised a complaint at the WTO over perceived UK local content bias in a recent business department consultation [this was quickly resolved]. So, what to do?

I suppose the question is, could Labour get away with designing a subsidy scheme that is not technically contingent on local content but also primarily benefits local providers? Maybe? You could see this being achieved via some arguably environmental justifications. The sweet spot is being just illegal enough to benefit local providers but not illegal enough for any other country to bother retaliating. [Ed: In addition, could also make some national security justifications, I suppose.]

Export controls on key technologies. Here, the UK will just probably end up going along, half-heartedly, with what the US does but implement it in a slightly chaotic way that ends up annoying UK companies. So a continuation of the status quo.

I’d now add a couple of extra things to the points above:

I fully expect a Labour government to embrace more stringent supply chain due diligence rules. These are already emerging in the US and EU, and it is rather inevitable the UK will eventually follow suit. Interestingly, whereas in years past you would have quite a lot of business opposition to such measures, now I am not so sure. Most multinational firms will be required to comply with US or EU measures anyway, so in a sense, the argument on principle has already been lost. The question will be **how** a UK government chose to enact, say, its own forced labour rules. From a business perspective, the ideal answer is “in exactly the same way as the EU”, but there will always be pressure to do things slightly differently or make the rules slightly more stringent.

On new FTAs, while I think it is unlikely that negotiating new deals will be top of Labour’s agenda — perhaps with the exception of an unexpected deal with the US, he kinda jokes – it is important not to forget CPTPP. Just by being a member of CPTPP, a Labour government may be forced to engage in negotiations with accession members. The current list of countries that have applied to join include China (!), Taiwan (!), Ecuador, Costa Rica, Uruguay and Ukraine (!). This could lengthen in future to include other countries such as South Korea and Thailand. So there could well be *some* new negotiations even if no one is that fussed either way.

Infographic of the week

The JDL institute has written a new report about EU-China de-risking and also created this useful infographic:

Contact lens classification

LinkedIn is generally a horrible place. However, there is one exception: customs folk on LinkedIn! Customs folk on LinkedIn often do great posts about really nerdy things that provide execellent content for this newsletter.

Take, for example, the question of contact lenses (the things you put in your eyes to help you see) customs classification.

A Mr Taichi Kawazoe has written a post pointing out that no one really knows how to classify contact lenses that are a bit more jazzy than usual, with the US and EU, for example, taking different approaches. Read his post, and the comments below, here.

The War on [Chinese] Plastic

Denis Reddonet and his trade defence team at DG Trade have taken a brief break from their anti-subsidy investigation into Chinese EVs to announce new provisional anti-dumping duties on imports of “of certain polyethylene terephthalate (‘PET’) plastic products from China”:

PET plastic products from China will now be subject to duties ranging from 6.6% to 24.2%, depending on the exporting producer. These duties will be in place for a maximum period of six months, during which all interested parties can provide feedback, before the Commission, after consulting EU Member States, takes the final decision on the imposition of definitive (i.e. permanent) measures.

The duties are the result of an EU investigation which provisionally found that the dumping of Chinese imports presented a threat of a clearly foreseeable and imminent injury to EU industry. It showed that the influx of dumped Chinese imports at artificially low prices was undercutting EU industry’s prices, forcing the EU industry to lower its prices to such a low level that they were selling their products at a loss.

As with EVs, I expect the UK Trade Remedies Authority to also take a look at this in due course. (In reality, there should probably be some sort of mechanism that means that if the EU triggers a trade defence investigation into something, someone in the UK trade department does a quick review to assess whether similar dynamics exist in the UK. Would probably streamline things somewhat.)

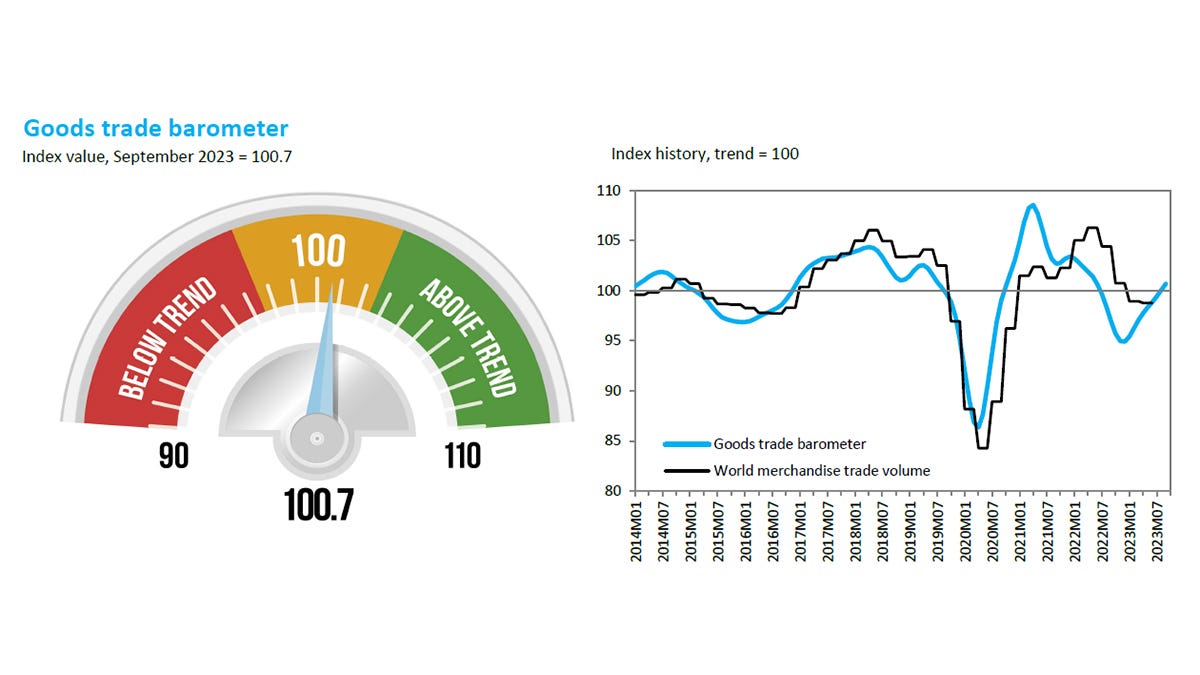

Chart of the week

According to the WTO Good Trade Barometer, trade in goods is returning to trend. Which I guess is … good?

Best wishes,

Sam

Note: for the non-Brits among you, ‘shadow minister’ just means he has the person in opposition with the same brief as the minister for Business and Trade, Kemi Badenoch. It doesn’t mean that he … I dunno … operates in the shadows or is even a minister for shadows or the like. The UK is weird.]

As ever, masterful! Another reason not to forget CPTPP, whoever is in power in the UK, is the regulatory co-operation side, not least given the review of the agreement in 2024. For example, Annex 8A on wines and spirits is useful on good regulatory practice in the sector, but at the very least needs updated to take into account subsequent advances in USMCA, and elsewhere.

Again for whoever is in charge, there will come a point quite soon where the UK needs to clarify its position on how it handles offensive disputes in the WTO and its FTAs. It's not obvious, from the outside, that it has done that yet.

That supply chain due diligence tightening is a good shout. Wonder how they will do it. Worked in a similar report for an MP with BEIS Cttee back in the day and govt was not keen at all.