Most Favoured Nation: Chemical Brothers

EV rules of origin, Digital Trade, A really hard quiz, The Brussels Effect and CPTPP

Welcome to the 120th edition of Most Favoured Nation. This week’s edition is free for all to read. If you enjoy reading Most Favoured Nation, please consider becoming a paid subscriber.

[Programming note: Sorry this/last week’s edition is slightly late … I was just really quite busy last week.]

The big trade news for MFN readers is that the European Commission has [finally] decided to recommend that the existing EU-UK Trade and Cooperation Agreement battery rules of origin continue until 2027, thus avoiding an end-of-year cliff edge that would have seen a 10% tariff slapped on most electric vehicles traded across the Channel.

[If this issue is new to you, read this piece.]

This is something MFN flagged as a problem before it was cool, and I am obviously pleased that common sense has prevailed (subject to the member-states signing it off once they have stopped squabbling about how to spend an associated €3bn in battery subsidies).

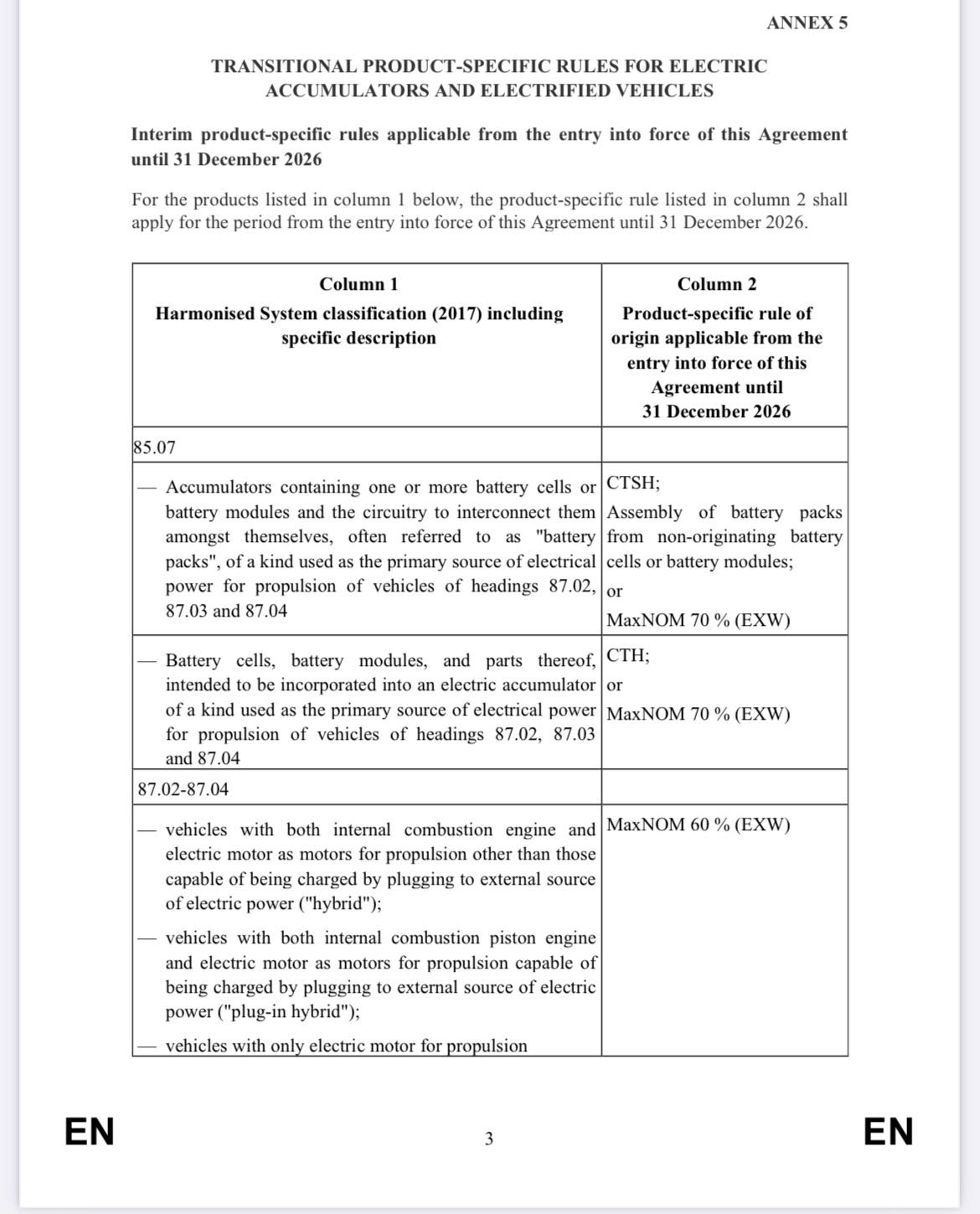

You can read the Commission’s proposal and reasoning here, and the rule change would be as follows:

In English, this means that EU/UK EV makers will be able to continue using batteries with a large proportion of foreign content and still qualify for tariff-free trade until the end of 2026.

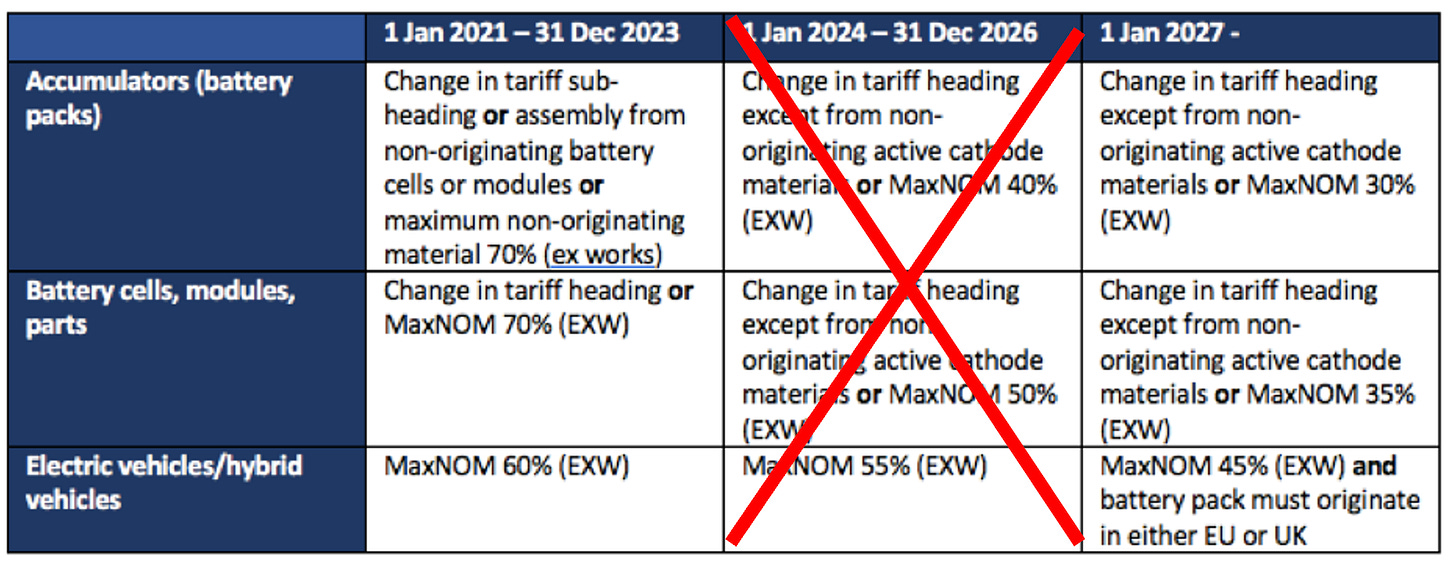

After that, the rule change that was already built into the TCA will kick in, and the provisions in column 4 will apply:

This means that for an EV to qualify for tariff-free trade, its battery MUST originate in either the EU or UK.

Fine. However, for a battery to be considered originating, every single component from the active cathode material up will need to have also been sourced from within the EU/UK.

And that’s the point of this story I think most of the reporting has missed. This isn’t actually a battery-supply problem: it’s a chemicals-supply problem.

Lots of carmakers could have actually complied with an end-of-year rule change that allowed them to treat batteries as local if all that meant was packaging up some imported cells or the like. The reason none of them could comply — hence the rule change — is that there is simply just not enough active cathode material being made in the EU/UK right now to meet the demand for EVs.

The chart and table below, taken from a September report by the UK’s Advanced Propulsion Centre, set out the problem quite clearly. Active cathode material accounts for a significant proportion of the value of an EV battery (46%), and the capacity/demand balance for both 2027 and 2023 is well in the red.

I suppose the question now is whether this situation can change in time for the new deadline, 2027?

My view is that it will probably change enough, or at least to the point that a decent number of European automakers will be able to comply. This will mean, at the very least, that there will be fewer companies asking for another extension in 2027, with some, perhaps even opposing, given the competitive advantage compliance could bring vis-a-vis non-compliant competitors.

The European Commision has also suggested inserting a new clause into the TCA that would prevent a further extension in 2027:

(4) The aim of the product-specific rules for electric accumulators and electrified vehicles set out in the Trade and Cooperation Agreement is to incentivise the investment in a manufacturing capacity in the European Union and in the United Kingdom. No further postponement of the incoming rules should be considered. Therefore, the envisaged amendment should furthermore remove the possibility for further changes to the product- specific rules of origin for electric accumulators and electrified vehicles until 1 January 2032.

So any push for a further 2027 delay would be an uphill battle.

Digital Trade Stuff

A few weeks ago, I wrote about the US’s decision to withdraw its support for provisions prohibiting data localisation measures and the forced transfer of source code in the context of the WTO’s e-commerce negotiations. Since then, other people have written about this, and there has been some more positive news coming out of the EU:

In a new piece for his Substack,

(do sign up!), trade lawyer Devon Whittle helpfully flags some comments by USTR Katherine Tai setting out the rationale for the US’s change of heart on digital trade rules:This is my opportunity to explain … that what we did this fall at the WTO was not to reverse a position, was not to change a position, but to withdraw our attributions. …withdraw our indicated support for three or four proposals in the ongoing WTO negotiations on an e-commerce agreement…

What we did was to take a look look at what our positions were and to assess whether or not they still align with the domestic debate … domestic regulatory environment for these issues. … And on a couple of those proposals - ones that deal really specifically with data (data flows, data localization and also on source code) - in these three areas what I saw was that the debate that we are having here at home… has shifted significantly since we put those proposals forward in 2019. As a result we needed to withdraw our attributions to create the space for us to come up with new positions and a new orientation for engaging with the other 90 countries that are negotiating this.

He also pulls in some of her other comments that suggest, as highlighted in MFN, that this change of heart was triggered by recent developments in AI:

I'll give you one very specific example that I think may resonate with a lot of people because it's a large part of the conversation in so many ways. The unveiling of ChatGPT4 in the spring I think was a wakeup moment for all of us that wow there is a lot of innovation that's going on in our economy. … What is AI built on? It's built on massive amounts of data… You have to have access not just to those massive amounts of data you have to have access to incredibly powerful computing processes… Who has access to that kind of data and that kind of computing power? A very small number of extremely powerful and dominant companies that are almost all if not all American.

That's why our posture on the rules that apply to data flows, data localization and source code is so important.

At the core of each of these proposals in these negotiations is the question that we have to answer around the balance of authority between the private sector and the companies and the government and our regulatory authorities. Who gets to decide or control how freely the data can flow and when it can be restricted? Where it needs to be stored and when access is required to disclose source code? I think that those issues are very much consequential not just for trade and economics but for our entire society. The crosscutting nature of these issues means that if we're going to lead using trade rules at a time when there is no consensus but massive amounts of debate and questioning then I, as USTR, am committing massive malpractice and probably committing policy suicide by getting out ahead of all of the other conversations and decisions that we need to make as a country.

In contrast to how Tai views her own decisions, MFN fan favourite Nigel Cory has published a piece arguing that the US’s actions have handed a victory to China on digital sovereignty. He also points out that digital provisions don’t actually prevent the introduction of legitimate laws and regulations::

It’s important to emphasize that digital trade rules that foster data flows and nondiscrimination don’t stop fair and legitimate laws and regulations addressing digital issues. The U.S.-Mexico-Canada Agreement (USMCA) didn’t stop California’s Consumer Privacy Act. And it wouldn’t stop the proposed American Data Privacy and Protection Act, or any hypothetical new U.S. competition law, as long as these laws treat all firms the same. Likewise, Australia, New Zealand, and Singapore’s many digital trade agreements and partnerships haven’t stopped them from updating privacy, cybersecurity, and digital content laws. More specifically, the European Union-United Kingdom Trade and Cooperation Agreement’s source code provisions did not stop the EU from enacting related provisions in its AI Act.

And while all of this has been going on, the EU went and agreed new digital trade provisions with Japan, as an Annex/amendment to the existing EU-Japan FTA. Simon Lester has given it a nice write-up at his IELP blog.

The Hardest Trade Quiz of All Time (Unless You Are A Customs Broker)

Over on Bluesky, Lorcan Roche Kelly introduced me to one of the hardest trade quizzes of all time. I managed to get through it with just two errors, so let me know how you do by email or in the comments below.

Clue: one of the answers is not “Most Favoured Nation”.

Let me know how you get on by email, on BlueSky/X, or in the comments below.

[Note: if you are a customs broker/know what incoterms are, you will probably find it fairly easy.]

The Brussels Effect?

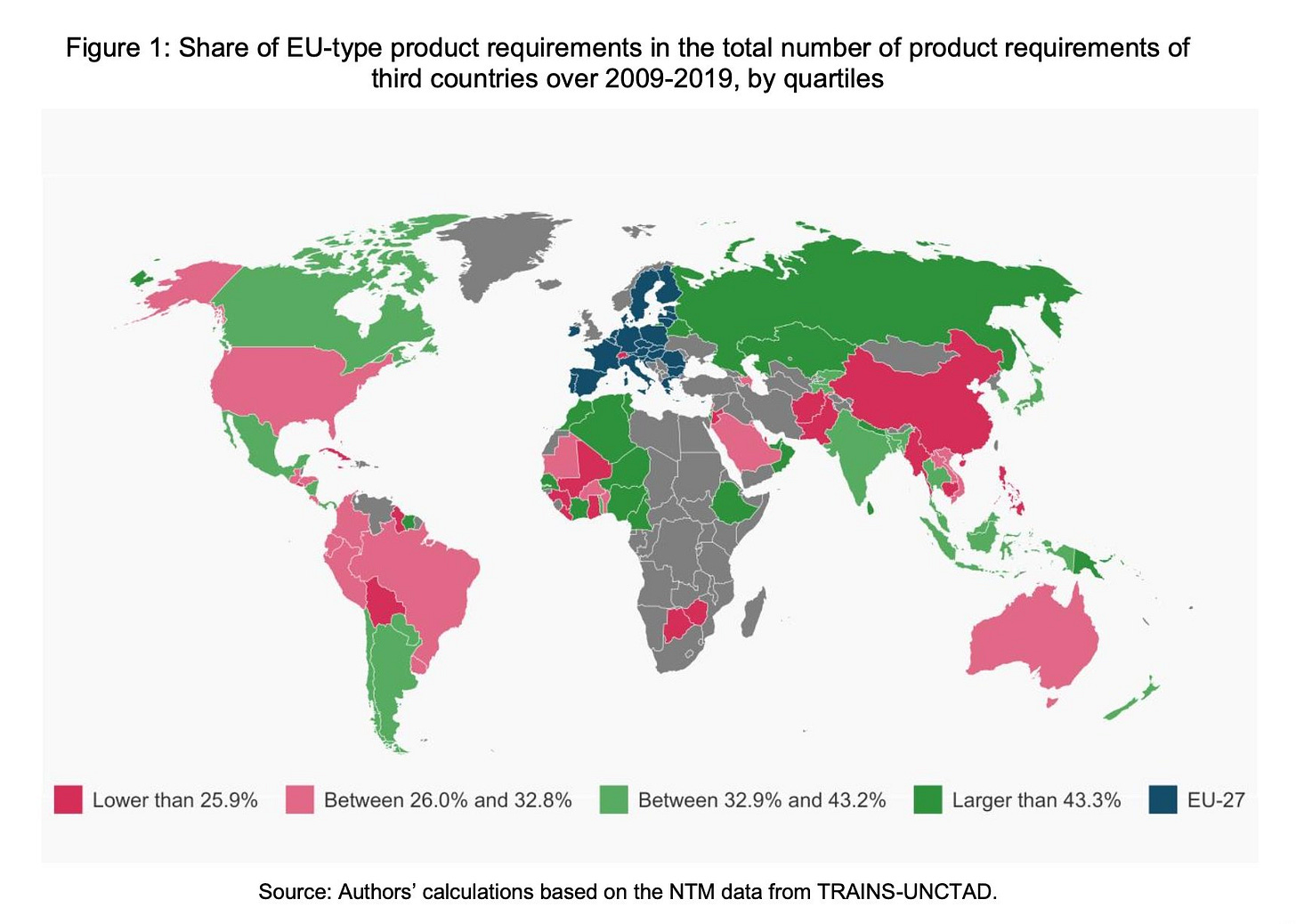

Last week, I read a newly-published paper which looks at whether the EU provides a regulatory model for other countries. Unsurprisingly, it finds it does.

Here’s the abstract [emphasis mine]:

We examine whether the European Union (EU) is providing a model for other countries for product requirements aimed at protecting health, safety, and the environment. The analysis draws upon information on detailed categories of sanitary and phytosanitary (SPS) measures and technical barriers to trade (TBTs) introduced on specific products by 86 countries across the world over the 2009-2019 period. First, we examine whether the existence of requirements within a given product- level SPS/TBT category in other countries is associated with the prior existence of requirements within the same product-level SPS/TBT category in the EU, and document a positive and significant correlation. Second, we delve into potential mechanisms likely to explain the subsequent adoption of requirements by other countries within the same product-level SPS/TBT categories as the EU. The results indicate the presence of both market-driven forces, such as the importance of the EU as an export market for other countries, and treaty-driven forces, such as the existence of trade agreements between the EU and other countries. Finally, we show that the EU’s role in providing a regulatory model for other countries for product requirements aimed at protecting health, safety, and the environment is (1) predominant when compared to the United States or China, and (2) reinforced in the area of environmental protection.

And here’s the map showing where there is the most convergence:

BUT, and I hate to be that guy, while the Brussels effect is definitely a real thing, I’m slightly confused by the paper’s methodology.

To assess the impact of EU regulatory hegemony, the authors looked at whether countries introduced regulatory measures on similar product categories soon after the EU did. They did not look at whether the regulatory measures are the same as the EU’s. So, for example, if New Zealand introduced a regulation to protect people from poisoned fish a year after the EU did, this analysis would assume it was following the EU even if it’s actually because loads of people got killed by poisoned fish at some point and the EU just-so-happened to do something about it slightly quicker.

The authors, of course, address this point and make some arguments defending the methodology. And I agree the paper probably tells us something, I just don’t think this approach tells us enough to claim convergence with the EU. I also think the fact Switzerland — one of the countries most convergent with EU TBT and SPS standards – is coloured red on the map above should raise some alarm bells.

Other stuff

The UK’s Trade and Agriculture Commission has published its analysis of whether CPTPP is consistent with the maintenance of UK levels of statutory protection in relation to animal or plant life or health, animal welfare and environmental protections. The TL;DR answer is “

NoYES” [EDIT: the original version of this piece had an error that changed the entire point. Sorry, Lorand Bartels] but it is worth reading the reasoning. I particularly enjoyed the section on palm oil.

Best wishes,

Sam

I appreciate the added frisson!

Big typo!!! CPTPP **is** consistent with UK food/health policy. Gah