Welcome to the 121st edition of Most Favoured Nation. This week’s edition is free for all to read. If you enjoy reading Most Favoured Nation, please consider becoming a paid subscriber.

Happy New Year! Let’s get to it …

Governments hate giving taxpayer money to foreign companies.

But there are often good reasons to do so. For example, if a government wants to build a state-of-the-art airport, domestic companies might not have the skills necessary to build it well. Alternatively, a local company might be technically able to build a state-of-the-art airport, but using them would be far too expensive.

Giving money to foreign companies, or at least allowing foreign companies to compete for government money on the same terms as domestic providers, can ensure taxpayer money is not wasted and that the government has access to the best products and services. You could also argue that allowing foreign companies to bid helps prevent cronyism and corruption, such as local politicians doling out money to their mates and people who might vote for them.

But there is a downside.

Whether it is direct subsidy or procurement contracts, it would make much more political sense to dole out money to your mates and people who might vote for you.

Global trade rules have generally — subject to lots of conditions such as sectoral specifications, subsidy/procurement thresholds, and the identity of the government entity granting the subsidy/contract – been created to prevent this sort of naughty behaviour.

Ergo, in most developed countries, most large subsidies and government contracts must be open to anyone to bid for it, no matter the nationality, and must not be accompanied by conditions stipulating, for example, that the winner of the subsidy/bid source all of the things they need to deliver the contract locally.

This obviously sucks, if you are a politician. But if you are a **clever** politician you can, maybe, get around such obligations.

Here’s how the US, EU (and member-states), and UK are doing it:

The US

This one is fairly short. The US has basically just decided it DGAF (and tbf, it had always carved out much of its system from procurement obligations anyhow) and decided to condition most recent subsidy grants on companies buying local stuff.

The obvious example of this is this is the new Inflation Reduction Act’s Clean Vehicle Tax Credits:

Beginning in 2023, EVs qualify only if the vehicle’s battery meets certain conditions. The maximum potential credit is the sum of two amounts: the critical mineral amount and the battery component amount.

Critical Minerals ($3,750): Starting in 2023 (and after the Treasury issues guidance on this requirement), to qualify for this portion of the credit, at least 40% of the value of the battery’s applicable critical minerals must have been extracted or processed in the United States or in a country with which the United States has a free trade agreement, or recycled in North America. The 40% amount increases to 50% in 2024, 60% in 2025, 70% in 2026, and 80% in 2027 and thereafter.

Battery Components ($3,750): Starting in 2023 (and after the Treasury issues guidance on this requirement), to qualify for this portion of the credit, at least 50% of the value of the battery’s components must have been manufactured or assembled in North America. The 50% amount increases to 60% in 2024 and 2025, 70% in 2026, 80% in 2027, 90% in 2028, and 100% in 2029 and thereafter.

Additional restrictions apply to vehicle batteries starting in 2024 and 2025. Specifically, starting in 2024 an EV cannot qualify for the clean vehicle tax credit if any of the vehicle’s battery components were manufactured or assembled by a foreign entity of concern. Starting in 2025, an EV cannot qualify for the clean vehicle credit if the vehicle’s battery contains critical minerals that were extracted, processed, or recycled by a foreign entity of concern.

The US can get away with this kind of thing because it is the US, and other countries are scared of starting a trade war with the US. This occasionally leads US supporters of creating local jobs for local people to claim that other countries who are annoyed with the US breaching its international obligations should just do the same as the US. But other countries generally can’t do exactly what the US does because other countries are not the US.

But they can try other things …

The EU

The EU is not the US. Because of this, the EU is slightly more concerned about blatantly breaching its international obligations. However, that doesn’t mean it doesn’t still want to create local jobs for local people.

For example, the European Commission’s proposal for an EU Net-Zero Industry Act [note: this is not final; the text is still being thrashed out] includes new, so-called, “sustainability and resilience criteria” for covered public procurement procedures.

See, Article 19, 2 & 3:

The tender’s sustainability and resilience contribution shall be based on the following cumulative criteria which shall be objective, transparent and non-discriminatory:

(a) environmental sustainability going beyond the minimum requirements in applicable legislation;

(b) where an innovative solution needs to be developed, the impact and the quality of the implementation plan, including risk management measures;

(c)where applicable, the tender’s contribution to the energy system integration;

(d)the tender’s contribution to resilience, taking into account the proportion of the products originating from a single source of supply, as determined in accordance with Regulation (EU) No 952/2013 of the European Parliament and of the Council 72 , from which more than 65% of the supply for that specific net-zero technology within the Union originates in the last year for which data is available for when the tender takes place.

Contracting authorities and contracting entities shall give the tender’s sustainability and resilience contribution a weight between 15% and 30% of the award criteria, without prejudice of the application of Article 41 (3) of Directive 2014/23/EU, Article 67 (5) of Directive 2014/24/EU or Article 82 (5) of Directive 2014/25/EU for giving a higher weighting to the criteria referred to in paragraph 2, points (a) and (b).

This is slightly convoluted, but in theory, would give member-states an excuse to grant contracts to local bidders on the basis they were more resilient than the cheaper foreign alternative.

France

Another way to ensure the benefits of government money largely fall to local providers is to condition the subsidy or contract on the recipient complying with a non-discriminatory obligation, preferably environmental, that technically any company in the world **could** comply with, but only your local companies can comply with easily.

On this note, France has played a blinder.

Its revamped EV subsidy scheme pays an additional “green bonus” of up to €7000 per car for consumers buying EVs that meet certain environmental criteria, including a total manufacturing emissions threshold. Cars made in France, where the electricity grid is powered by lots of non-CO2-emitting nuclear power plants, qualify easily. Cars made using energy from dirty coal plants in China or *cough* Germany … more of a challenge.

The UK

The UK government would also like to create local jobs for local people. A future Labour government would really really want to create local jobs for local people.

The problem the UK has is that as well as having signed up to all of the different things saying it shouldn’t do this, it also has an observant neighbour that actually pays attention when it decides to dip its toe in the local water.

Since Brexit, the only actual trade dispute (or at least a WTO request for consultations) the EU has brought against the UK was in relation to UK attempts to, allegedly, write local content requirements into its contract for difference auctions for offshore wind.

This means that if the UK wants to create local jobs for local people without starting a trade dispute with the EU (ignoring that the EU is also trying to create local jobs for local people) it has to be very very careful.

In a live consultation (closes on 11 January 2024), the UK Department for Energy Security and Net Zero is asking for views on a new Sustainability Industry Reward for future Offshore wind auctions.

This includes a proposal to introduce a new SIR criterion that would reward a project’s investments in areas near deployment zones where there are greater levels of socio-economic deprivation.

Clever.

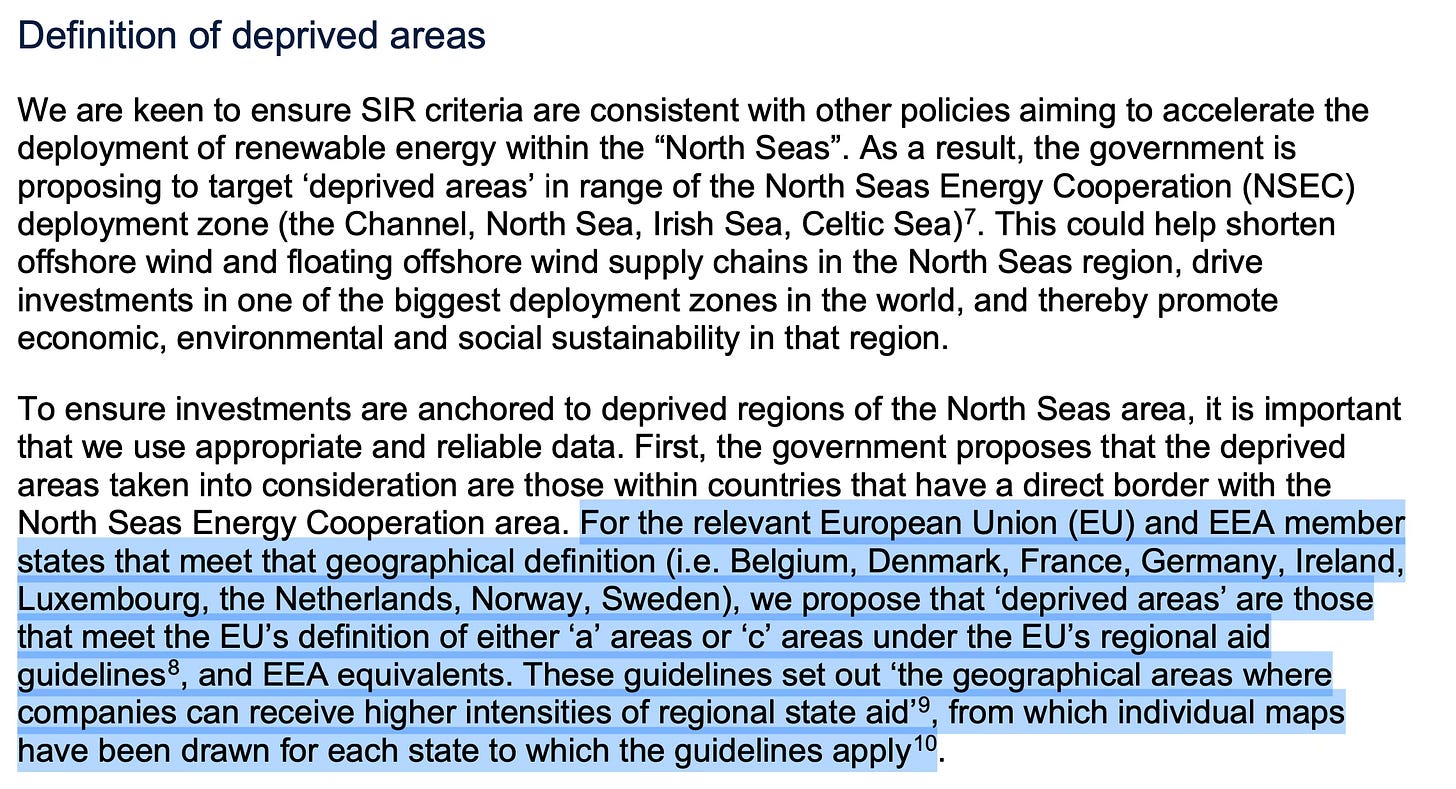

Even more clever is the definition of “deprived area”, which deliberately includes, theoretically, adjacent deprived areas in EU member-states:

To find out whether any regions in any of the EU/EEA member states would actually qualify would take a lot of time, and I’m busy. But if anyone else would like to do it, I would be interested in the results!

Chad Charts

MFN fan favourite, Chad Bown, has written a new paper on Modern Industrial Policy and the WTO, which you should read.

It also includes this incredible chart:

Here the thing that really stands out to me is just how relativel recent the upsurge in anti-subsidy (countervailing) tariffs is, wheras anti-dumping tariffs have been a mainstay.

Simon Charts

While we are on the topic of charts (and industrial policy), Simon Evenett and the gang at Global Trade Alert have compiled a new data set quantifying recent industiral policy interventions.

And there have been quite a lot.

The justification? Mainly “Strategic Competitiveness”. Which I like to think is actually shorthand for Creating Local Jobs for Local People.

Mutual Recognition

I wanted to do a deep dive on the new UK-Switzerland mutual regocnition agreement for financial services. But because they decided to publish the details on December 21st, no one has bothered to write a decent analysis of it for me to plagiarise reference, which means I would actually have to sit down and read it all. Which I will do. But for a future edition of MFN. For now it is enough to know it exists and is probably meaningful.

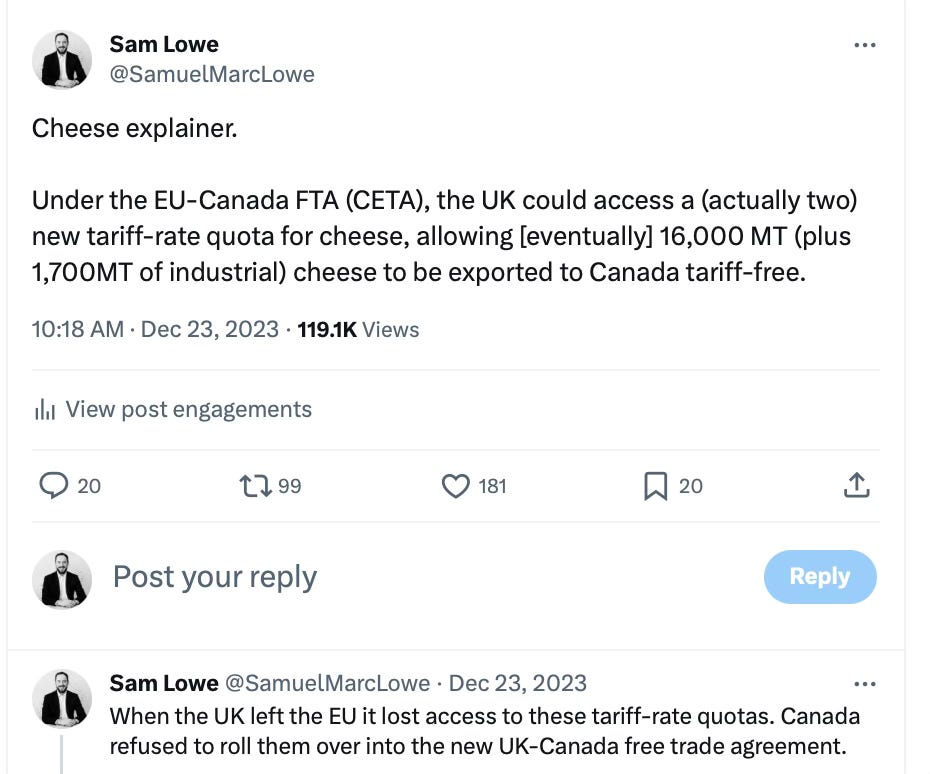

Cheese

If you were wondering why lots of Brits suddenly started tweeting about Cheese and Canada in the run up to Christmas, read my thread.

Best,

Sam

Hmm, the comment seems wrong that the US "had always carved out much of its system from procurement obligations anyhow." Here's a quote from a US Government Accountability Study:

"Under the World Trade Organization (WTO) Agreement on Government Procurement (GPA), the United States has reported opening more procurement covered by the agreement to foreign firms than have other parties to the agreement. For example, U.S. data for 2010—the most recent available—show that the United States reported $837 billion in GPA-covered procurement. This amount is about twice as large as the approximately $381 billion reported by the next five largest GPA parties—the European Union, Japan, South Korea, Norway, and Canada—combined, even though total U.S. procurement is less than that of the other five parties combined."

The report, and other experts, often point to the terrible lack of good data, but still...

https://www.gao.gov/assets/gao-17-168.pdf