Welcome to the 80th edition of Most Favoured Nation. This week’s edition is free for all to read. If you would like to receive top quality trade content in your inbox every week, please do consider becoming a paid subscriber.

Happy new year! As is traditional, I thought I would kick off with an apology. Many of you who participated in the Most Favoured Nation Christmas quiz erroneously thought you did really well because when you clicked on an answer Substack put a tick next to submission. Unfortunately the tick just means you entered an answer, not that the answer was right … which is a bit awkward.

Anyway, one thing I learned from the 2022 Christmas quiz is that lots of you haven’t been paying attention. For shame.

Let’s run through the questions/answers.

Question one

The question:

In June 2022, Boris Johnson’s ethics adviser resigned, in part because of an intra-government dispute over the legality of UK steel safeguard tariffs.

What was/is the name of the adviser?

The answer is of course Lord Geidt, which pretty much all of you got right. Well done!

Question two

The question:

The US’s Inflation Reduction Act includes many provisions designed to tackle climate change/onshore jobs in key industries [delete as appropriate].

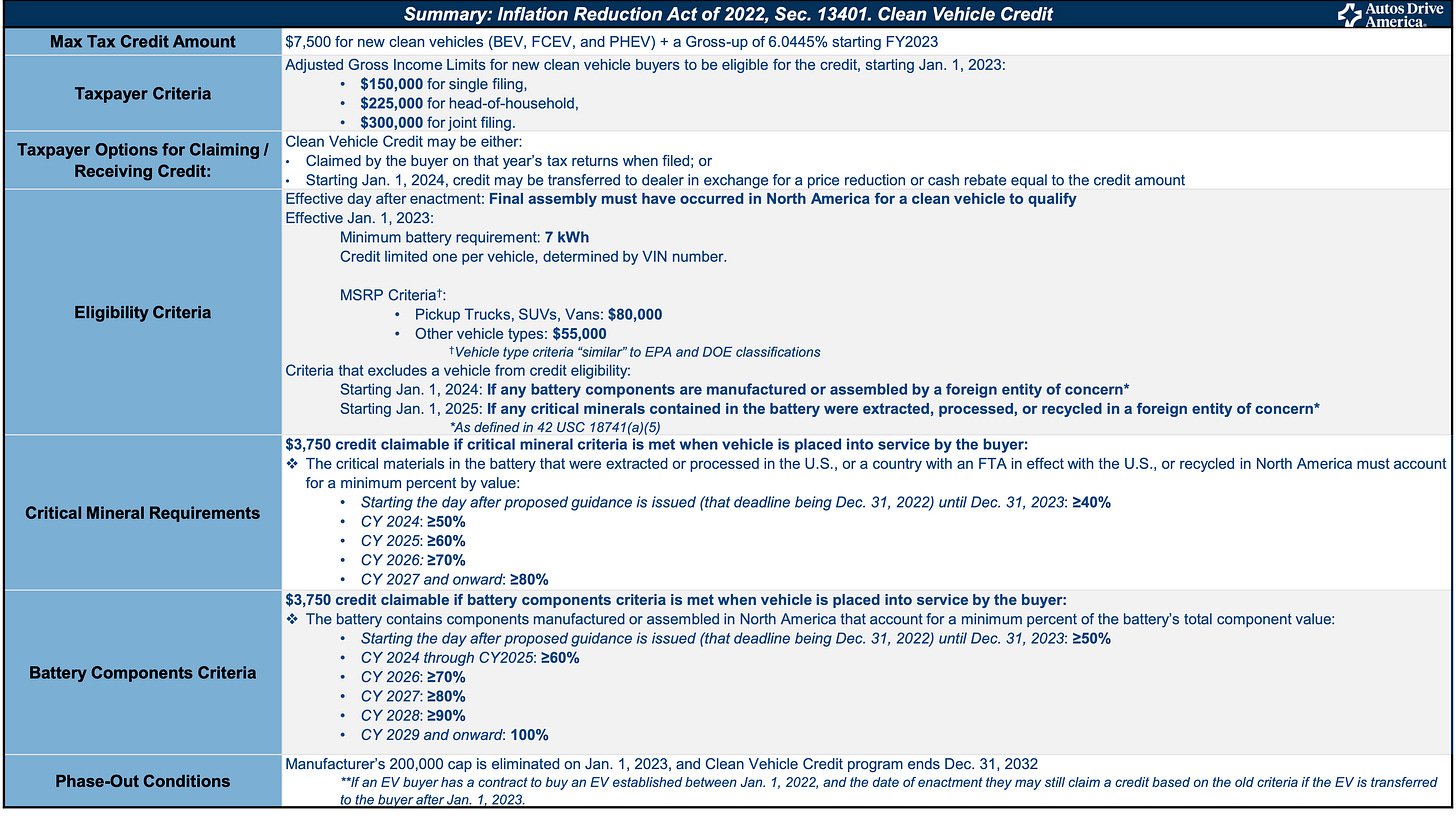

For an electric vehicle to qualify for a tax credit under the IRA, as of 2026, what percentage of the critical minerals used to make the EV battery must have been sourced from the US or a country which the US has a free trade agreement with?

So here, awkwardly, I need to apologise [again]. I gave you the options of 30%, 40%, 60% and 80% and, well, none of these are right. I made a mistake in the question — I meant to put the year as 2027 (answer: 80%) — so the answer for 2026 is actually 70%.

Credit, however, to Amy Porges who was the only person to point out this mistake. She also helpfully flagged this table by the Auto Drive America group which sets out all of the different conditions attached to the IRA’s Clean Vehicle Credit:

On the subject of the IRA, there was some movement over the break. The US Treasury released new guidance which seems to suggest that leased vehicles can qualify for the commercial tax credit, even if they were manufactured outside of the US. This goes a little way towards addressing the concerns of the EU, UK, South Korea and others, but still leaves open the question about the consumer tax credits for EVs, which is the main thing everyone is complaining about.

The guidance, has, however not pleased everyone. It also suggests we are about to have a really fun/tedious discussion about the exact definition of a free trade agreement [note: no capital letters]. See this blog post by Kathleen Claussen for more:

Question three

The question:

The CPTPP is all the rage. How many countries submitted formal applications to join in 2022? [And for a bonus point, name them.]

So this was a fun one! I gave you the option of 2, 1, 4 and 3, and this is the breakdown of your answers:

And, well, lots of you got this wrong! The answer is 2 — Costa Rica and Uruguay. The confusion here is understandable. Quite a lot of you said China and Taiwan, but they actually applied in 2021. The big spoiler was South Korea — which is what, I think, led lots of you to say 3. Despite threatening to apply lots of times — see here, for example — South Korea hasn’t actually formally applied yet. (I had to check this with a relevant official.)

So if you’re annoyed about getting this wrong, you know who to blame. (And if you got the answer right — well done!)

Question 4

The question:

In June 2022, WTO members reached agreement on a TRIPS waiver that would allow developing countries to authorise “the use of the subject matter of a patent required for the production and supply of COVID-19 vaccines without the consent of the right holder to the extent necessary to address the COVID-19 pandemic.”

An eligible member is able to apply the provisions of this waiver for how many years (from the date of the decision)?

The answer is 5 years, and lots of you got this one right. Well done!

Question 5

The question:

In 2022, the EU and New Zealand negotiated a free trade agreement. Under this FTA, the EU has agreed to phase in over 7 years a tariff-rate quota that will allow for 10,000 tonnes per annum of NZ beef to be imported at the preferential tariff-rate.

What is the preferential tariff rate?

Given the option of 10%, 0%, 20% and 7%, perhaps understandably, close to half of you said 0%, which is wrong. Spectacularly, the EU managed to get the New Zealanders to agree to very little in the way of market access here, and the answer is 7%.

(The UK, by comparison, will phase in a complete tariff removal over 10 years (subject to another 5 years of safeguards). The year-one tariff-rate quota allow 12,000 tonnes of NZ beef to be imported tariff-free.)

Question 6

The question:

At the end of 2022, the EU finalised the details on its carbon-border adjustment mechanism (CBAM). As part of the wider package, the EU has agreed to phase out free carbon allowances for its domestic heavy industry. These ETS free allowances will be fully phased out by which year?

Given the option of 2034, 2023, 2026 and 2030 a majority of you (53%) went for 2030, which is wrong.

The answer (which 20% of you got right) is 2034. The phaseout schedule will be staggered like this:

2026: 2.5%, 2027: 5%, 2028: 10%, 2029: 22.5%, 2030: 48.5%, 2031: 61%, 2032: 73.5%, 2033: 86%, 2034: 100%.

Despite reaching agreement on the free allowance phaseout, there will be another discussion from 2025 about possible export rebates to guard against EU firms becoming less competitive when selling in foreign markets (something free allowances guard against, but the CBAM does not). So the CBAM discussion is not quite over yet …

Question 7

The question:

The EU’s new foreign subsidies rules place new obligations on foreign firms engaging in large transactions, or bidding for large government contracts, in the EU.

The text below sets out the filing obligations for M&A deals. Fill in the blanks

Filing obligation for M&A deals

Turnover threshold: At least one of the merging companies (in case of a full merger), the target (in case of acquisition) or the JV is established in the EU and generates an aggregate EU-wide turnover of at least €___ million in the previous financial year; and

Foreign financial contributions: The parties to the transaction have received combined foreign financial contributions exceeding €__ million in the three years prior to the conclusion of the agreement, announcement of the bid, or the acquisition.

Here the answer is €500 million and €50 million, which the majority (51%) of you got right — well done!

The Winner(s)

Thanks to everyone who emailed me/tweeted me/posted their answers. Unless I have completely missed something, no-one got full marks (please get in touch if you think you did!), but the closest person was the aforementioned Amy Porges — who even managed to get the right answer to question 2 despite the question being wrong! Congratulations!

Babies for Free Trade

I have fairly strong views on lots of things that I don’t share on here/twitter because I assume that no one is particularly interested. But sometimes they overlap with things I assume at least some of you are interested in (trade policy). One of these opinions is on baby formula — which I think is a really good invention!

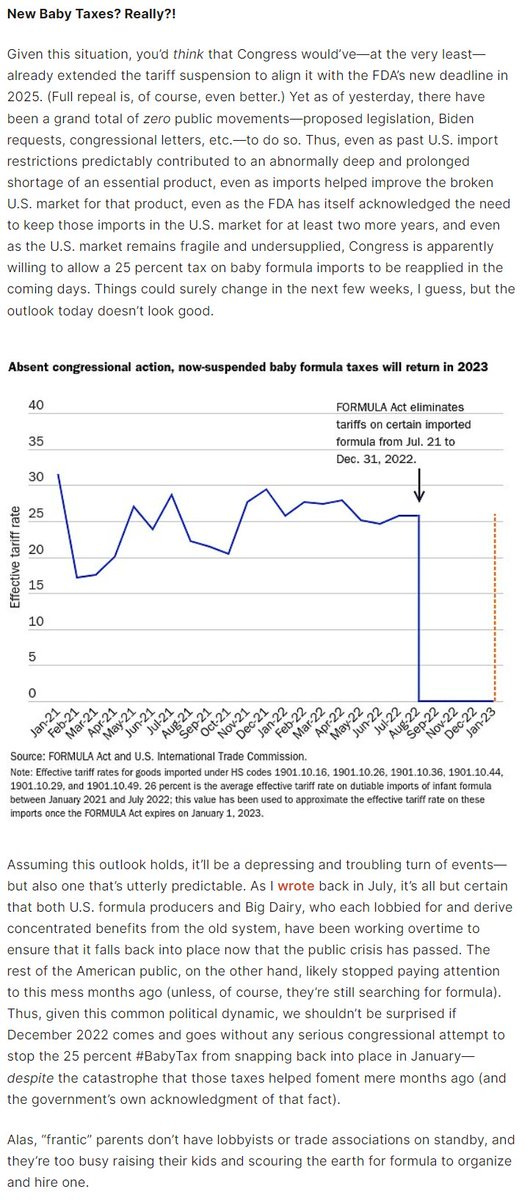

Unfortunately for babies and parents in the US, as of 1 January 2023 the US decided to reapply a 25 per cent tariff to imported baby formula despite there being recent shortages.

Mind boggling behaviour.

Efficiency gains?

On the recent Bloomberg Odd Lots podcast, Flexport CEO Ryan Petersen was asked whether the supply-chain pressure of the last two years had led to more efficient container utilisation. The TL;DR answer is “no”, but I thought the “why” was pretty interesting [emphasis added]:

Tracy: Did the containers get more full?

Joe: Yeah, did they get better at packing them?

Ryan: Surprisingly no. And if anything might’ve gotten worse, which is a really interesting counterintuitive thing. But if you, but it sort of makes sense when you think about the psychology of it all, it’s like, okay, you’re not going to sit there and try to optimise the inside of the container. Just whatever you’ve got now, just throw it in there and let’s go, which, you know, it’s sort of counterintuitive because you think like, ‘oh, this thing’s really scarce, we’ve got to really optimise our capacity’, but you may not have that luxury because you’re just scrambling to get space on a ship. So no, we haven’t seen a lot of progress on that metric.

He’s also quite downbeat re: whether (American, for the most part) ports have learned from the surge in incapacity and are modernising/automating as a result. Answer: also no, because of union pressure. All of which suggests that if another Covid-like supply/demand shock … we’ll be just as (un)prepared as last time.

As ever, do let me know if you have any questions or comments.

Best,

Sam