Most Favoured Nation: The "British Mittelstand"

Why I am the most significant British services export, 15th century customs data, and more

Welcome to the 123rd edition of Most Favoured Nation. This week’s edition is free for all to read. If you enjoy reading Most Favoured Nation, please consider becoming a paid subscriber.

In my day job as a consultant – p.s. please hire me — I advise companies on issues relating to international trade (surprise). You might, for example, be concerned about an EU trade defence investigation, want to know more about the UK approach to rules of origin, or be worried that your planned investment is susceptible to changes in trade rules, etc., and decide to pay me (well, my employer) to help you out.

If you happen to be based outside of the UK and pay me for my time, then my advice would technically be classified as a services export, which makes me a services exporter.

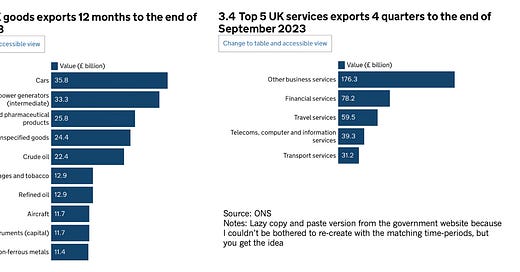

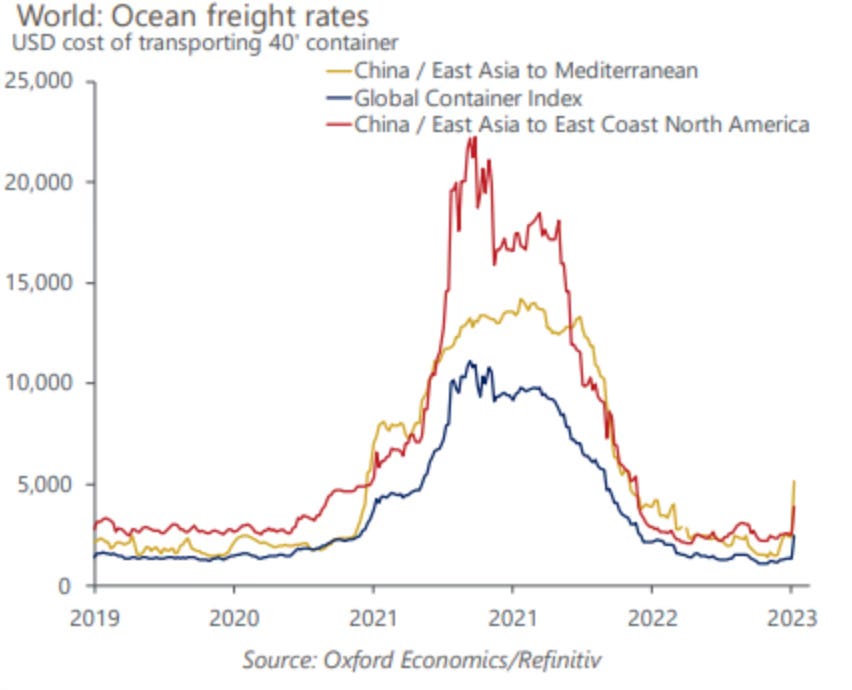

I would, in fact, be a services exporter in the UK’s most successful services exporting sector: “other business and professional services”. [Source: the charts at the top.]

This is all to say you should read this recent Substack post by

where he successfully teases my entire profession AND makes the point that us “other business and professional services” bods are indeed the beating heart of the UK economy — the “British Mittelstand” — and therefore everyone should be nice to us/mainly me:This is the British Mittelstand, and I think any industrial strategy for the UK has to take into account the things that we’re actually good at, rather than what seems whizzy and cool. Germany has a massive hinterland of small manufacturing companies that, to use the slogan “make the thing that makes the thing inside the thing”. The UK has an equally significant hinterland of businesses based out of the Old Rectory somewhere, all based around someone who “knows the person who knows the answer to the question”. Looking at the noticeboard in my co-working space, I can see about a dozen faces of people who go to a lot of networking events and whose children only really understand they’re a “businessperson”.

MPIA

Prof David Collins, of the City Law School and an Independent Member of the UK Trade Remedies Authority's Audit and Risk Assurance Committee, has written a paper for the Adam Smith Institute arguing that the UK should join the Multi-Party Interim Appeal (MPIA) arbitration mechanism.

For those who haven’t been following this, the MPIA is an attempt by 53 WTO members (so far) to create an alternative to the WTO’s appellate body, which currently isn’t working because the US doesn’t want it to work. MPIA members include the EU, Canada, Australia, China and Japan, but not, for some reason, the UK.

As he notes, there are currently 8 disputes before the MPIA, and so far its panellists have issued one judgement in the case against Colombia relating to Anti-Dumping Duties on Frozen Fries from Belgium, Germany and the Netherlands (DS591) [Ed: seriously].1

And David is right! It is indeed really weird that the UK hasn’t joined the MPIA given it seems like a pretty sensible alternative to the appellate body, and at least provides an appeals function for trade disputes that don’t involve the US.

I’ve been scratching my head as to reasons why, and these are the possibilities I’ve come up with:

The UK doesn’t want to annoy the US.

The UK doesn’t want to join an EU-led thing. [Note: the EU would really like the UK to join.]

Someone/some people in the UK government really doesn’t/don’t like the MPIA for some reason, perhaps because they would rather focus on fixing the WTO system.

The UK doesn’t want to sign up to the MPIA because it is worried a member might bring a dispute against it over one of its many, arguably, WTO non-compliant measures, such as its steel and aluminium safeguards or ban on hormone grown beef.

The UK just hasn’t got around to it yet.

Anyhow, if I had to guess, I would assume that if the WTO stasis drags on, which it will, then the UK will probably end up joining at some point … probably when and if it decides to launch a dispute against another member and decides it would be useful.

Living in the past

With thanks to Huw Sayer on Bluesky, I have been made aware of a project that will delight both history nerds and trade nerds. (Yes, I know the Venn Diagram is a perfect circle.)

Seemingly just for the fun of it, a Dr Stephen Gadd has been “upcycling” London customs data from the … wait for it … 15th century! Read more about his endeavour here.

Textbook

I’ve been meaning to flag this for a while, but it kept slipping my mind. The Geneva Trade Platform has roped in a load of top trade scholars to produce a free-to-access international trade law e-casebook. Given you usually need to sell a kidney to buy a second-hand academic textbook, this is quite the act of generosity.

Access it here:

Charts of the week

Chart #1

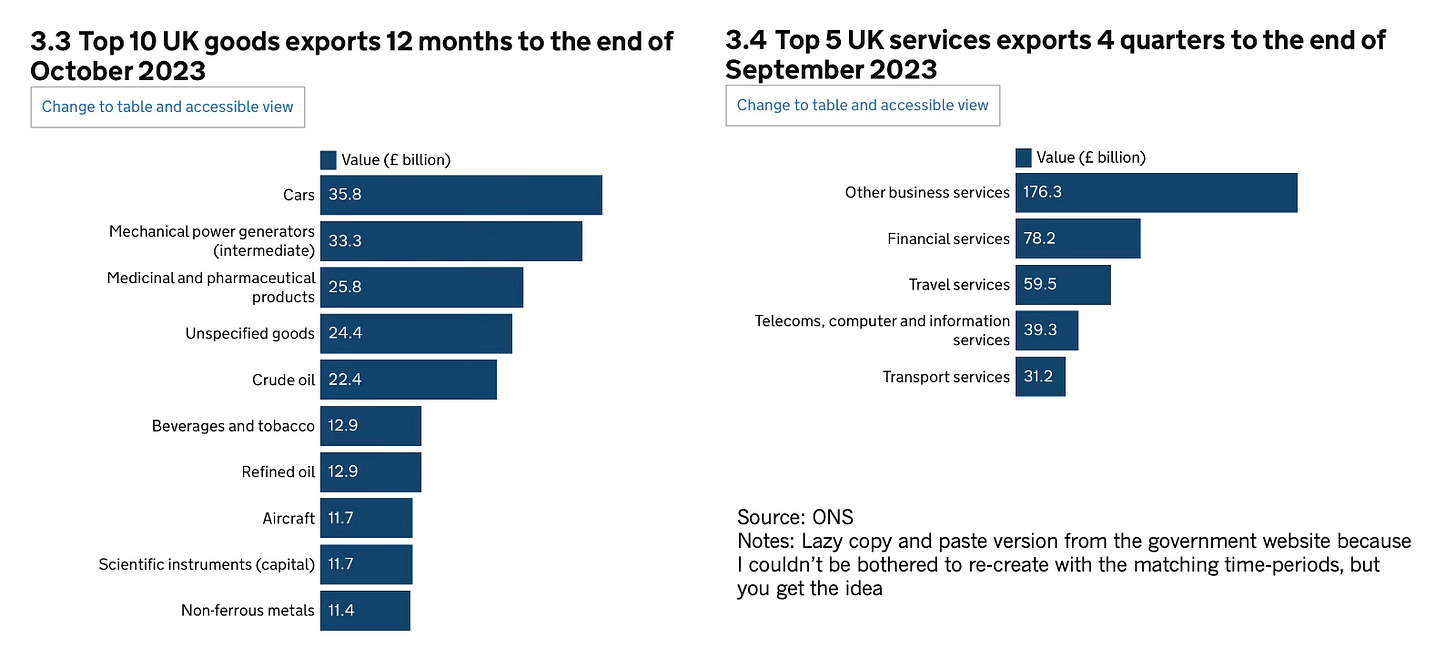

Over on LinkedIn, Prof Richard Baldwin has written about the G7’s asymmetric reliance on Chinese supply chains, and whether this can be reversed. As per the chart above and quoted text below, it will be difficult.

There is a simple economic mechanism behind this reality. Agglomeration economies of scale are inherent to manufacturing. Industry clusters geographically to save costs and enhance quality, and this, in turn, provides a competitive edge that fosters further clustering. Once China established its lead, the natural forces of agglomeration and the resulting productivity gains solidified its advantage. With over a third of all the world’s manufacturing, one can wonder whether other economies could ever turn back the clock. While it may be possible to challenge China's lead in certain sectors like semiconductors, medical products, and electric vehicles, reversing this dominance across a broad range of sectors is likely to be infeasible.

Chart #2

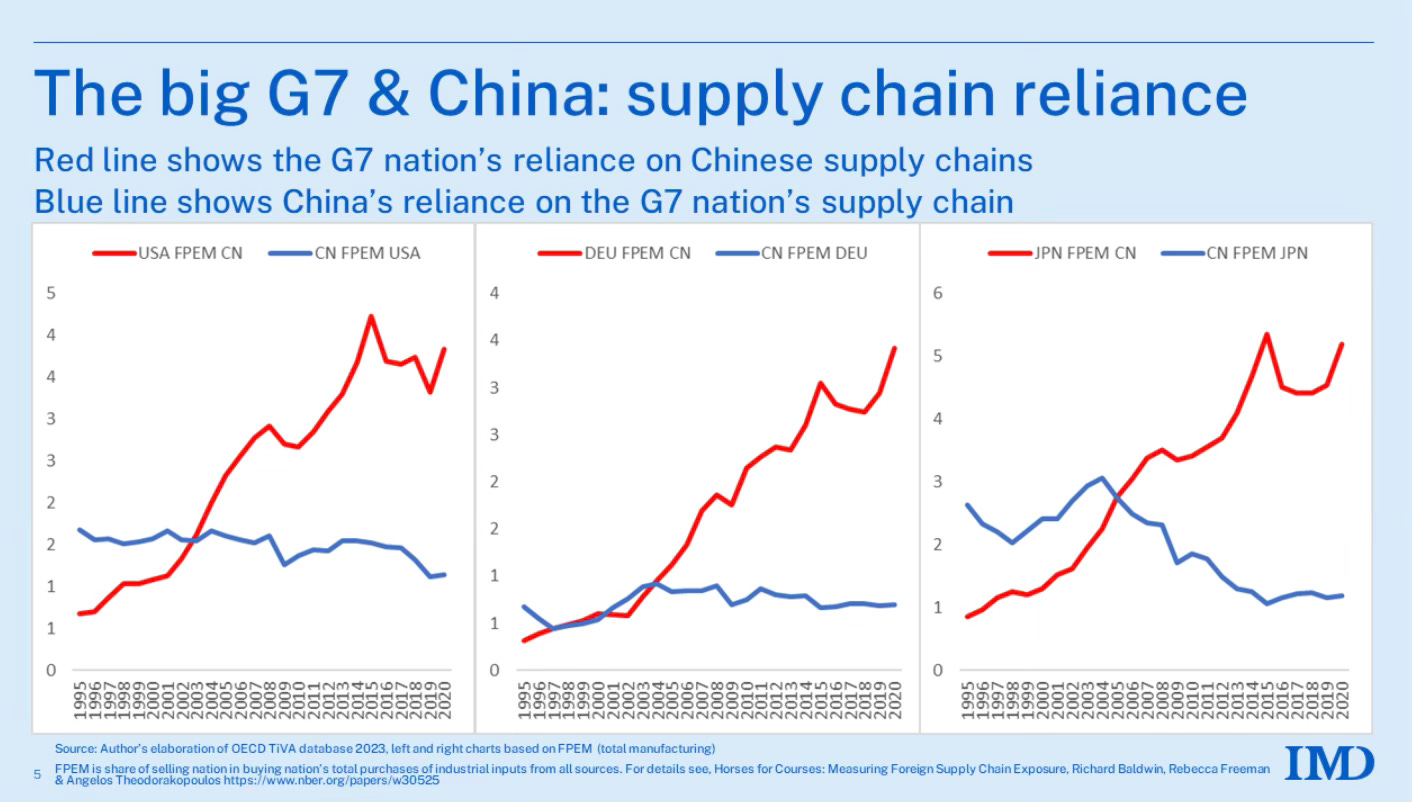

As per Oxford Economics:

If the Red Sea were to remain closed to shipping for several months … this could add 0.7ppts to annual CPI inflation rates by the end of 2024 … Still, the inflation push from this scenario wouldn’t be enough to stop world inflation from slowing over the course of this year

Best,

Sam

p.s. Subscribe

If I recall correctly, Colombia hasn’t actually complied with this ruling. But I’m sure the trade lawyers in the replies will correct me if I’m wrong.

Re the EU-Colombia MPIA case on frozen french fries ..... Colombia says it is now compliant. EU disagrees. Anti-dumping duties still being applied, albeit at lower rates than before.

The moral? Adjudication systems don't always resolve disputes. And don't go to Bogata for fish and chips.