Most Favoured Nation: The Treaty of Waitangi

The Maori, fictional trade disputes with Malaysia, data adequacy, BIG RICE watch, trade remedies and the existential sadness of being a trade deal.

Hello! Welcome to the 10th edition of my newsletter, Most Favoured Nation. This one is a bit of a mammoth edition, so hopefully you find it useful. If you’re enjoying these AND would like to receive MFN in your inbox every week (instead of just every fortnight), please do consider becoming a paid subscriber.[1] I’d appreciate it.

---

I’ll be joining Dmitry Grozoubinski and Anna Isaac to discuss trade shenanigans over at Dmitry’s twitch feed on Monday at 19:30 UK time – tune in here.

And if you missed the last episode on trade and sustainability, you can catch up here

---

Everyone’s got their thing

Now that the UK has wrapped up its trade talks with Australia [ed: the negotiations aren’t actually concluded, and they’re still working out what to do about eggs, chicken and pork … but anyway], the attention of the British trade negotiating machine has shifted to New Zealand. Talks between the UK and the Kiwis have progressed slightly slower than with the Aussies, but an agreement in principle (an agreement that there will be an agreement) will probably be announced in the next couple of months.

Beyond dairy tariffs and the like, quite a bit of the recent UK-NZ face-to-face negotiation has focused on cultural exemptions, and in particular the Treaty of Waitangi exception. The Treaty of Waitangi exception is something New Zealand includes in all its trade deals, along with other provisions, to allow it to discriminate in favour of the Maori. In practice, it means that trade deal obligations can’t get in the way of any settlement or redress afforded to Maori under the Waitangi Tribunal. See Article 29.6 of CPTPP for an example of what the exception looks like on paper:

Now the UK really shouldn’t (and probably doesn’t) have a problem with this exception, seeing as it was the British crown that signed the original Treaty of Waitangi with the Maori in 1840. If anything, it is the Brits leaving the EU that has made New Zealand’s trade talks with the EU more tricky, with the EU less keen to include the exception now that the UK isn’t involved and sympathetic.

But I do wonder if the UK might want a little quid-pro-quo. The UK has its own cultural (?) issues that needs resolving: Northern Ireland. As I’ve written about quite a lot [apologies if you really don’t care], Northern Ireland has a special relationship with the UK’s trade deals because of the Northern Ireland protocol. In short, imports into Northern Ireland can only take advantage of the UK’s trade deals if they meet specific conditions. This has led the UK to include the following provision, which gives the UK’s protocol commitments precedent over the FTA’s, in the UK-Japan trade deal, for example:

Now, so far Japan didn’t really care about this, and neither, seemingly, does Australia. (It’s also possible they didn’t really understand that their agrifood exports into Northern Ireland aren’t going to be able to enter tariff-free … so no one tell them.) However, New Zealand does know and does care. Their lamb exporters are already annoyed they can’t sell into Northern Ireland tariff-free using the UK’s WTO tariff-rate quota because of reasons (explained in MFN-4).

But maybe there’s a deal to be done here. Waitangi for Northern Ireland. Everyone’s happy?

Big Rice Watch

Long-term readers of this nascent newsletter will know that I have become obsessed with the UK’s most influential lobbying group, Big Rice. Fresh from facing down the Australians, and retaining a degree of protection for one (maybe two) long-grained rice mills in the UK, Big Rice has been spotted on manoeuvres in Iraq.

Who knows what they’ll get up to next. And please, keep the sightings rolling in.

Won’t somebody please think of the orangutans

You may or may not know that Malaysia has recently opened a WTO dispute with the EU and a couple of member-states over the implementation of the EU’s upgraded renewable energy sources directive (RED II), on the basis that the EU is (allegedly) discriminating against Malaysian palm oil.

Among other things, RED II binds member-states to reduce (eventually to 0%) the gross final energy consumption share of biofuels associated with a high risk of indirect land-use change. Malaysia argues that this method, in practice, penalises palm oil, while letting domestically produced biofuel feedstocks such as rapeseed and soy off the hook. Malaysia is also challenging some individual member-state implementing measures by France and Lithuania, which explicitly single out palm oil – the French measure, for example, doesn’t consider palm oil as a biofuel, and therefore doesn’t allow transport fuels containing palm oil to qualify for a tax break.

Anyway, this got me thinking. The UK, as a former EU member, has implemented RED II in UK law and wants to accede to CPTPP, an agreement that Malaysia (if it every gets round to ratifying it, which it might not) is party to. Couldn’t this, y’know, cause some problems?

Annoyingly (from an amusement perspective), the answer seems to be “no”.

*sad face*

While the UK does estimate emissions related to indirect land-use change using the same methodology as the EU, it doesn’t seem to do anything in particular with these estimates. Instead, to reduce the emissions associated with indirect land-use change, the UK has introduced a blanket ‘crop cap’ that introduces an upper limit, by volume, on the contribution that crop-derived biofuels can make to meeting a suppliers renewable energy targets:

The important thing here is that this crop cap applies to all types of crop-based biofuels, including rapeseed, soy, etc., not just palm oil. So no discrimination. So no WTO case. So no UK problems with Malaysia when it comes to joining CPTPP. (Although I imagine someone will still bring up orangutans.)

Lawyers can tell me I’m wrong [and please do!], but I think the UK’s going to be okay here. Well done, UK.

Trade Experettes

Lots of you will be aware of Trade Experettes, a network set up by Hanna C. Norberg to promote women working in international trade. Well, the network has now grown into a fully-fledged membership organisation, with an incredibly impressive advisory board, among other things.

You can find out more here and do consider becoming a member!

Remedying trade remedies

As discussed in MFN-8, the UK’s new Trade Remedy Authority (TRA) recommended that the UK scrap steel safeguarding duties on nine (of the nineteen existing) product categories currently covered. This recommendation went to the secretary of state for sign off, and … well it seems like she overruled them. Truss, following fierce lobbying from outside of, and inside of, government decided to only scrap four of the existing steel safeguard measures, and keep the rest.

This all got a little bit complicated, because for some reason the legislation setting out what the secretary of state can do with a TRA recommendation only gives the option of accepting or rejecting, not tweaking (see here), so further secondary legislation needed to be tabled in a hurry.

But anyway, I’m kind of relieved. Not because I have strong opinion either way on the merits of the decision [I’m not a steel guy], but rather because I was starting to worry I’d completely misjudged the political economy of trade in the UK. Following the trade department’s facing down of the farm lobby (minus Big Rice) to get the Australia trade deal done, I was starting to wonder whether my assumption that domestic pressures in the UK would curtail some of the government’s trade liberalisation agenda was false. But being forced to slap tariffs on steel, that’s a bit more like it.

WTO WTAF?

I don’t really know how to describe what I’ve seen here. But the WTO is on TikTok … and … well … just watch it.

(And blame Soumaya Keynes for bringing it to my attention.)

https://www.tiktok.com/@wto/video/6979245308735671557

The existential sadness of being a trade deal

It must be quite depressing to be a trade deal. Knowing that no matter how well you perform, your impact on the economy will always be quite small, and hotly contested. On that note, a Congressional report into the impact of the multilateral Uruguay Round Agreements as well as 16 U.S. bilateral and regional trade agreements on the US economy is worth a look.

The report found that all of these agreements have resulted in US GDP being 0.5 per cent larger than it would have been otherwise.

“The Commission estimates that, to the extent quantifiable, the agreements have had a small but positive effect on the U.S. economy. In 2017 (the base year), they led to an estimated increase in U.S. real GDP of $88.8 billion (0.5 percent) and in aggregate U.S. employment of 485,000 full-time equivalent (FTE) jobs (0.3 percent), based on a model that assumes the economy is at its long-run full employment level. U.S. trade agreements have also had a positive effect on U.S. imports and exports as well, especially with U.S. FTA partners. The Commission also finds, however, that the gains in jobs were not distributed evenly, with the biggest gains in employment estimated for college-educated male workers.4 Table ES.1 summarizes the key findings from the Commission’s economy-wide analysis.”

A lot of political capital, effort and discourse for 0.5 per cent. Although, to be fair, 0.5 per cent of an incredibly large number is still quite a lot ($88.8 billion, in this case).

Good news for people who love bad news

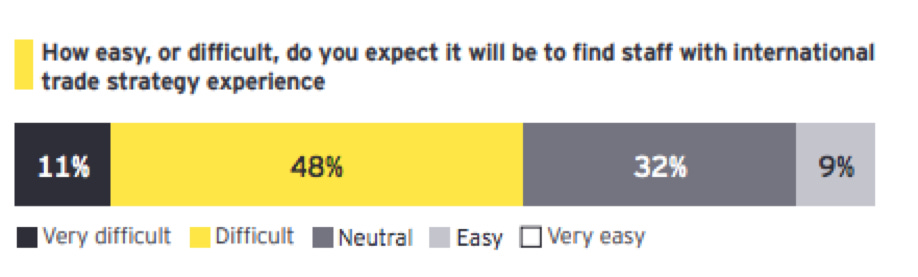

George Riddell of EY has a new report out surveying 400 UK and international firms and asking them about their approach to international trade. The good news: it’s something these firms are really starting to think about in greater depth. The bad news: they are finding it really difficult to hire people with the necessary experience.

So, if you know something about trade and trade strategy, it’s time to ask for a promotion and a payrise.

TFW your data is adequate

The European Commission finally adopted two data adequacy decisions for the UK, which means that personal data can both flow freely between the EU and UK, and that the personal data of EU citizens can continue to be stored and processed on data servers physically located in the UK.

Good news.

But the story isn’t over. The adequacy decisions have a four year sunset clause, and as my CER colleague Camino and I have previously argued, the UK’s attempt to walk the tightrope of EU data adequacy and pursue its data ambitions in other areas (such as CPTPP) might be technically doable, but will certainly lead to future political friction.

Deadlines

With the caveat that they probably won’t accept you if you’ve ever tweeted (reminder: never ever tweet), the UK’s Trade and Agriculture Commission is looking to fill 12 roles, to help the UK scrutinise new trade deals. Deadline is 4 July 2021. More information here.

Other things I’ve been reading

If you’re looking to get up to speed with what’s going on with EU trade, Iana Dreyer’s ‘ramblings on the EU’s post apocalypse trade policy’ is worth a read. Also, if you have a premium FT subscription, you should read Alan Beattie’s Trade Secrets piece about what the fishing subsidy negotiations tell us about the state of the WTO. Trade Talks also did an episode on trade and blockchain, which I haven’t listened to yet because GAH BLOCKCHAIN, but everyone keeps saying it’s excellent and I should … so I will.

---

As ever, do let me know if you have any questions or comments. And do join me, Dmitry and Anna on Monday at 19:30 UK time.

Best,

Sam

[1] If you’d really love to get the newsletter every week but can’t afford it for whatever reason, let me know and I’m sure we can work something out. Also, if you’re a CER member let me know.

'New Zealand does know and does care. Their lamb exporters are already annoyed they can’t sell into Northern Ireland tariff-free using the UK’s WTO tariff-rate quota because of reasons (explained in MFN-4).'

They may not be able to sell to 2% of the UK market & their annoyed!

Where is the evidence for your assertion?