Most Favoured Nation: Who Wants to be a Brexit Billionaire?

Vaccines, trade conditionality, TRQs, India, foreign subsidies and how to become incredibly wealthy

Hello! Welcome to the fourth edition of my fortnightly newsletter, Most Favoured Nation. Thank you for all of the kind comments so far, they are much appreciated. And if you haven’t subscribed, please do.

I will once again be joining Dmitry Grozoubinski and Anna Isaac to discuss trade shenanigans over at Dmitry’s twitch feed – tune in here at 19:30pm UK time on Monday.

Cash Money

British firms are still struggling to navigate the new customs border between the UK and EU. Spend about 20 seconds on customs expert Dr Anna Jerzewska’s timeline and you’ll be pointed in the direction of a whole load of examples. And the border is only going to get more cumbersome as time goes on, when/if the UK actually beefs up the light touch regime currently in place.

Brexit means Brexit and all that, but it does make we wonder: where have all the tech bros gone?

Whereas before we had putting the border on the blockchain and border zeppelins. Now? Silence.

Because there’s a pretty obvious problem that needs solving: customs compliance is basically complicated form filling with consequences, and at the moment businesses are struggling to fill in the forms themselves, struggling to find people to fill in the forms for them, and if they can find people to fill in the forms for them it’s often too expensive.

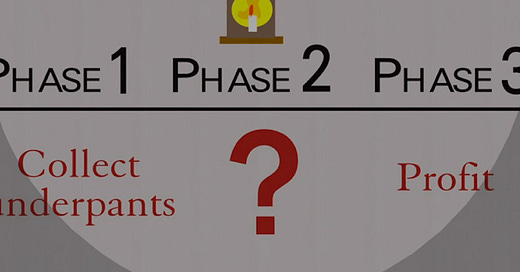

So, the rough pitch is:

Create some sort of user-friendly online platform to gather the information required by HMRC

Pay over the odds for a load of customs agents/buy out some existing customs brokers to do the hard stuff for you

Label your new software something cool/lame like #tradetech or #customstech or #bordertech (something hashtag tech) to get people pumped

Burn through millions/billions in venture capitalist funding to advertise everywhere and provide the service for free for a few years, undercutting/wiping out the rest of the market in the meantime

Hope that in those few years you can use machine learning or something jazzy to find a way to automate as much of the process as possible (never going to be 100%, but say 70%)

Once you’ve got a reasonable market share/a monopoly, and managed to drive down costs, start charging for the service

Scale up globally

Become Jeff Bezos

Easy. Now of course, there are risks: A future government could at any time scupper your plans by negotiating a better deal with the EU and removing the barriers you exist to address, for example. But risk is what makes life worth living, or something.

More TRQ trouble for Northern Ireland

Because things aren’t complicated enough, people are starting to notice that imports into Northern Ireland don’t necessarily qualify for the UK’s tariff-rate quotas. This is all pretty similar to the steel issue I wrote about previously, but to recap:

The default for imports into Northern Ireland is that the EU’s tariffs apply. However, if the importer can prove the product will stay in Northern Ireland AND the difference between the EU’s applied tariff and the UK’s tariff is less than 3% of the value of the product, then the UK’s tariff can be used.

Generally speaking this hasn’t caused too many problems so far –the EU and UK have the same trade deals and their tariffs are generally either the same or pretty much the same. Except in one instance: tariff-rate quotas.

(Tariff-rate quotas allow for a set quantity of a product to be imported at a specific tariff-rate, usually on a yearly basis. Once it has been used up, a much higher tariff applies. E.g. the first 100 tonnes of imports of x might be able to enter duty free, but any more imports of x would be subject to a tariff of 100000000%).

Here there is a problem. EU tariff-rate quotas don’t apply to Northern Ireland because reasons. This means that there will always be a tariff differential of more than 3% between whatever the UK’s in-quota tariff is and whatever the EU’s out-of-quota applied tariff is. So, as above, imports into Northern Ireland don’t qualify for the UK’s tariff-rate quotas. This means importers can’t benefit from the tariff-rate quotas in the UK’s trade deals, or the tariff-rate quotas the UK has open as part of its WTO commitments.

One workaround is to just import into Ireland instead, using the EU’s tariff-rate quotas. But that’s not always possible. I understand the UK and EU are trying to work something out (and that other, exporting, countries are starting to get annoyed), so let’s see what happens.

India update

A couple of newsletters back I speculated that the UK and India would “re-announce some investments they were going to make anyway” as a precursor to trade talks starting properly later in the year. Well that’s pretty much what happened – details here.

More interestingly, the UK and India are also going to introduce annual programmes allowing 3000 young (18-30) people work and live in each other’s countries for up to two years. Nice. More things like this, please.

The EU is also reviving its trade talks with India, and I hear on the grapevine some more detail might emerge today. Or not. Who knows.

Let’s go on a TRIP(S)

The US’s decision to support a waiver of intellectual property protections on COVID-19 vaccines (note: the US is not necessarily supporting the exact waiver proposed by South Africa and India) is easily the biggest trade news of the week.

But it has left a lot of trade nerds scratching their heads. Not necessarily because they love intellectual property protection (lots aren’t as big a fan as you might think), but because it’s not immediately obvious that waiving the protection gets vaccines into people’s’ arms as quickly as possible … which is the whole point.

If vaccinating people as quickly as possible were the priority you’d throw all of your money at the entire vaccine supply chain, buy out the pharma companies, whatever. Assuming the return on investment for every £1 spent getting the world vaccinated is greater than one to one, it doesn’t really matter how much you spend … it’s worth it. You certainly wouldn’t prioritise months/years of tortuous wrangling with other WTO members over the exact wording of a waiver that allows countries to do something the current rules probably allow them to do anyway (compulsory licensing is already allowed under TRIPS).

So is the waiver a waste of time?

Not necessarily. Not if you view the threat of the waiver as a way for the US and other countries to … encourage … pharma companies to sell their vaccines cheaply, share technology and knowhow, and license others to make their vaccines.

Anyhow, this is the probably the least original take out there and has been made by countless others - I wouldn’t be surprised if the waiver never gets finalised, but in the meantime a lot of companies discover some excess capacity (assuming there is any, which there might not be, gah).

Conditional access

The UK will probably conclude trade deals with Australia and New Zealand this year. But it will surprise no one to learn that the remaining haggling is over agriculture market access. The Aussies and New Zealanders want the UK to drop most of its food tariffs (all, preferably), but the UK doesn’t want to and is offering expanded tariff-rate quotas instead … the usual.

More interesting is that the UK is, apparently, asking them both to commit to uphold certain environmental, animal welfare etc. standards as a condition of reducing food tariffs. I have no idea what this looks like in practice – whether it’s a broad commitment to not roll back levels of protection a la the EU-UK trade deal or specific conditions attached to specific tariff-rate quotas. But it’s interesting nonetheless. Especially when you consider the UK huffed and puffed when the EU asked something similar in the Brexit negotiations.

Anyhow, this all tracks and fits with the recommendations made by the UK’s trade and agriculture commission. And I’d expect the Aussies and New Zealanders to agree to something that ticks the necessary boxes (it’s not like they have to do anything new after all, just agree not to weaken existing protections) so long as the UK’s market access offer is good enough. Duty and quota free would certainly do the trick …

(As an aside, another issue is that the UK wants Australia and New Zealand to agree that the bilateral trade deals are the end of the discussion on market access, and that they won’t come back for a second bite in the CPTPP accession negotiations. But that’s one for another time).

Foreign subsidies

This week the EU introduced its new foreign subsidies instrument, which will allow the Commission to intervene when companies operating within the single market are thought to be benefitting from unfair foreign [yes… Chinese] subsidies.

It is made up of three tools, summarised here by the Commission:

A notification-based tool to investigate concentrations involving a financial contribution by a non-EU government, where the EU turnover of the company to be acquired (or of at least one of the merging parties) is €500 million or more and the foreign financial contribution is at least €50 million;

A notification-based tool to investigate bids in public procurements involving a financial contribution by a non-EU government, where the estimated value of the procurement is €250 million or more; and

A tool to investigate all other market situations and smaller concentrations and public procurement procedures, which the Commission can start on its own (ex-officio) and may request ad-hoc notifications.

I’ve written about the general rationale and challenges previously. But in addition: while the target of all of this is quite obviously one country [China], companies in other countries could quite easily find themselves caught as well, what with the COVID-19 induced government spending splurges going on in the US and UK, for example.

One to watch.

---

As ever, do let me know if you have any questions or comments. And do join me, Dmitry and Anna on Monday at 19:30 UK time.

Best,

Sam