I try not to be a luddite. I really do. But whenever I read pieces on digital currencies, blockchain, etc. and its potential impact on international trade I usually find them quite unsatisfactory. Take this World Economic Forum piece titled “3 ways digital currencies could change global trade”. The three ways are:

Speed up cross-border payments by removing the need for human interaction … up until regulators start applying anti-money laundering and combatting terrorism financing rules to digital currencies as well which will require more human interaction.

Provide SMEs with no established financial records an alternative way of demonstrating credit worthiness [can view transactions history on a public blockchain]

Allow sellers in countries perceived to be at high risk of money laundering and terrorism finance to more easily dodge sanctions …? I mean, that’s not actually what it says but it kinda sounds like that’s what it is saying.

Now this is all fine (apart from point three which I’m pretty sure isn’t fine or legal), but it doesn’t feel revolutionary. And I wonder if part of the problem with a lot of these discussions is that the starting point is wrong.

As in rather than starting from first principles and saying: “here is a problem that needs solving, perhaps *cool new thing* could be the solution, but no worries if not” instead we have “I have a *cool new thing* … I just need to find some problems to use it on.”

Because, hypothetically, there maybe are some trade issues where digital currencies, for example, could help … maybe.

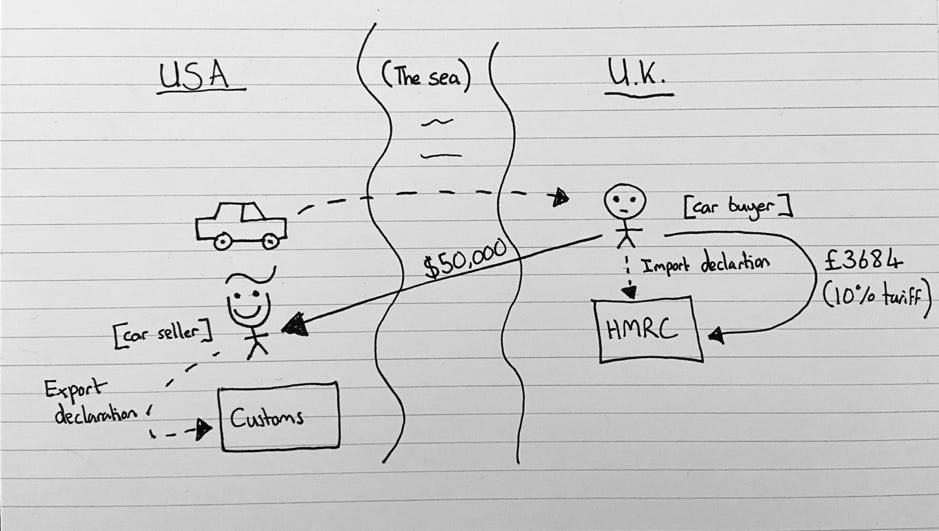

Let’s take the problem of customs declaration and payment. Here’s a (simplified) drawing of what happens when someone in the UK buys a car from the US.

[note: there’s loads of other things that happen as well, but for these purposes I’m just focusing on tariff declaration and payment]

So that’s all really cumbersome, right? You’ve got the import and export declarations on both sides of the border. You’ve got to work out the product code, its value (as per customs and valuation rules), how much duty you owe. And then you’ve got to make the payment in dollars for the car, and the payment in sterling to HMRC to cover the tariff. Gah.

Wouldn’t it be easier if this entire process could be completed at the click of a button?

And y’know, maybe, just maybe, this is a scenario in which a digital currency could help.

Let’s say the Bank of England created a digital-trade-pound. This digital currency would only be used when buying foreign goods, and would be fully programmable. The moment you paid for something, it would trigger a load of smart contracts that would, for example, work out the product code, submit the customs information to HMRC, the tariff due, trigger a payment of that tariff from your account, etc.

So something like this:

The problem here, of course, is that (for the most part) you can’t actually use sterling to buy a car from the US. You need to use dollars. So for this to work you probably need an arrangement between the Bank of England and the Fed with some sort of conversion function built in. A single currency area would obviously be preferable, but annoyingly (?) the companies trading within the obvious test case for this, Eurozone countries, don’t have to bother with customs declarations anyway. (Booo!)

But y’know … maybe? If all you had to do is pay for the good and all the customs stuff magically got worked out for you, that’d be good. And perhaps a central-bank-digital-trade currency is the way to do it.

But it also sounds kinda hard. You’ve got to first create a central bank digital currency, reach an agreement with another country that has a central bank digital currency, fully centralise and automate customs processes … a lot of stuff. And it doesn’t resolve issues relating to information asymmetry [the person exporting the good tends to have all of the necessary information, but it’s the person importing the good who is liable if any of the information, for example the value and tariff due, is wrong.]

But y’know … maybe?

I enjoy putting Most Favoured Nation together, but assembling all of the content usually takes up one of my evenings each week. So if you appreciate the MFN content, and would like to receive MFN in your inbox every week, please consider signing up to be a paid subscriber.

There are a number of options:

The free subscription: £0 – which gives you a newsletter (pretty much) every fortnight

The monthly subscription: £4 monthly - which gives you a newsletter (pretty much) every week and a bit more flexibility.

The annual subscription: £40 annually – which gives you a newsletter (pretty much) every week at a bit of a discount

If you are an organisation looking for a group subscription, let me know and we can work something out

Hate to say I told you so …

Sabine

If you’re interested in EU trade policy, and particularly some of the deeper thinking underpinning its recent push towards open strategic autonomy/developing lots of sticks to hit people with, then it’s worth reading this long interview with DG Trade’s Sabine Weyand.

A snippet on the EU-China relationship:

We remain convinced that CAI [EU-China Comprehensive Agreement on Investment] is a very good agreement and will help to correct many of the imbalances that still characterize our relationship with China.This will notably include some of the distortions created by the Trump Administration’s Phase 1 agreement, which the Biden Administration continues to defend. There is no doubt that if the agreement were in place today, we would be in a better position vis-à-vis China. That being said, there is no prospect of ratification at this time for the reasons you rightly point out, at least as long as members of the European Parliament remain under an unacceptable sanctions regime.

Faced with this deadlock, we are seeking to create new instruments as we develop our autonomous toolbox, which are not targeted at any particular country, but could be applied to China and would be useful in defending ourselves against countries that abuse our openness. At the same time, it is imperative to engage in a dialogue with China about lifting the restrictions that are currently negatively impacting our economic relationship, because cutting ties with China or refusing to engage in dialogue is not an option. But the need for dialogue is no reason to sacrifice the respect of human rights and our defense of fundamental rights on the altar of our economic interests. I believe that the Union must be able to strike a balance and act on both fronts, with China or any other country. If we only engage with countries that fully share our values and our worldview, we will soon find ourselves very much alone. This would also mean letting the world fall prey to the confrontation between China and the United States, which can only result in the weakening of our values and the sidelining of Europe.

Switzerland 4 free trade

Switzerland has announced that from 2024 it will cease applying tariffs to imported industrial goods. Which makes a lot of sense. In particular, it could push down the input cost for Swiss manufacturers seeking to remain globally competitive.

Obviously this kicked off a big argument on twitter about if the UK should do the same. To which I say, sure!

DAG

The UK is looking for organisations to join a domestic advisory group tasked with advising on the implementation of the trade and sustainable development chapters in its trade deals with the Andean community (Colombia, Ecuador, Peru), Canada, Central America (Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, Panama), Georgia, Japan, Moldova, Singapore, South Korea, Vietnam and Ukraine.

If interested, you’ve got until the 11 March.

But remember, as always, never ever tweet:

“In addition to this candidate declaration form, DIT will undertake due diligence checks on all organisations and their representatives fulfilling the criteria for appointment. Due diligence checks will include social media and internet searches. Information obtained through these checks will be considered as part of the selection process.”

Things can only get better.

According to the OECD’s services trade restrictiveness index, global barriers to trade in services decreased slightly in 2021.

Woo!

Israel call for input

You’ve got until 30th March 2022 to tell DIT what improvements you would like to see made to the existing UK-Israel free trade agreement. Submit here.

As ever, do let me know what you would like to see more/less of.

Best,

Sam

On the digital currency/trade, is the smart-contract stuff intrinsically different from just improving the existing systems to be more joined-up and require less mandatory human intervention? Currencies are of course already digital in the sense that no-one is physically moving a bunch of gold around anymore: the novelty is the decentralised ledger (who cares?) and contracts as code. But on that latter point, all code contains bugs, all datasets have errors, and (cf. point 3) I assume we still want legal oversight to happen... would conjoining currency and process really solve problems in the big picture, or just create a whole new set?