American Trade Twitter has spent the last week or so talking about these comments Donald Trump made about the link between tariffs and inflation:

Time: When you say more than that, though: You mean maybe more than 10% on all imports?

Trump: More than 10%, yeah. I call it a ring around the country. We have a ring around the country. A reciprocal tax also, in addition to what we said. And if we do that, the numbers are staggering. I don’t believe it will have much of an effect because they’re making so much money off of us. I also don’t believe that the costs will go up that much. And a lot of people say, “Oh, that’s gonna be a tax on us.” I don’t believe that. I think it’s a tax on the country that’s doing it. And I know.

In summary: if reelected Trump wants to slap all imports with tariffs of 10%+ and no, he does not think that will be inflationary.

I think there are two questions here:

1/ are tariffs inflationary?

2/ are tariffs inflationary in the context of the US?

On 1/, let’s assume Trump does impose a 10% tariff on a widget. What happens to the price of said widget?

Well, there are a few possibilities:

a) The company exporting the widget to the US could eat the tariff, and accept a lower profit margin for its US sales. This would have no impact on the price of the widget in the US.

b) The tariff costs could get passed through to the final US consumer. This would push up the relative price of the imported widget in the US.

c) A mix of the above. This would push up the relative price of the imported widget in the US, but to a lesser extent than in b).

d) The company stops exporting the widget to the US entirely. I guess this pushes up the price, because you’d have to source it from abroad with all of the additional costs that come with this.

So, based on the above — and the fact there is a reasonable amount of evidence showing that companies do tend to pass through costs to consumers – I think you can make a fairly convincing argument, with caveats, that tariffs do tend to push up the prices of the products covered.

(Note: even if the higher price of the import leads consumers to buy a similar widget from unaffected domestic producers you can assume that the price will be higher than if the tariff did not exist due to reduced competition and … well … if the domestic product was cheaper for the same level of quality people would have probably [on aggregate] been buying it in the first place.)

BUT, for tariffs to generate economy-wide inflation they would need to result in a general increase in prices and the purchasing value of money.

And here the theory is not so clear cut. By this I mean, that increasing the cost of the import of certain products will, presumably, mean that consumers still choosing to buy those products will have to spend more money doing so. This means they will have less money to buy other things — reducing overall demand in the economy. Lower aggregate demand = lower aggregate prices. Tariffs also only apply to [some] imported goods, not services.

So there is a bit of a question as to whether the price increases of the tariffs outweigh the reduced demand caused by the tariffs and whether this creates general inflation. Even if the tariffs do push up general price levels, there is also a question as to whether the effect is particularly noticeable, given that tariffs are only applied to [imported] goods and not services, which are responsible for the bulk of output in advanced economies such as the US.

So, in general, do tariffs push up the prices of the goods covered? Yes, usually. Do they push up inflation? Like, probably, but there are some caveats.

My assumption is that the impact on tariffs is also somewhat dependent on how exposed an economy is to international trade. And this brings me to question 2/ are tariffs inflationary in the context of the US?

This is a dated chart from an old MFN post, but I think it makes the point nicely:

As an economy … the US just isn’t that reliant on international trade.

So this makes me think that even if the dynamics of an economy-wide tariff on imported goods did lead to a general rise in prices, I’m not sure anyone would really notice. Which leads me to think that a new wave of Trump tariffs would be bad, and increase the prices of the goods covered/reduce competitiveness of industries exposed to higher input costs/etc, but I would not be confident predicting that they would lead to a notible increase in inflation.

Macroeconomists, please tell me I’m an idiot in the replies below.

Other US trade stuff

On the subject of things people in the US are saying, one of the other justifications Trump folk give for tariffs is that they will lead to a weaker dollar, which will help exporters and reduce the US’s trade deficit.

has written a very good piece on why this is not right,1 and why tariffs are more likely to increase the strength of the dollar than reduce it:Lightizer wants to stop the US acting as consumer of last resort for the rest of the world. He thinks higher import tariffs would force other countries to abandon mercantilist trade strategies in favour of balanced trade. This would lower the dollar exchange rate, helping the US’s export sector and encouraging the reshoring of production to the US.

But higher import tariffs won’t lower the exchange rate. They are much more likely to strengthen it. Indeed, they did, the last time Lightizer tried this genius scheme. During the US-China trade war of 2018-19, the Chinese renminbi depreciated by 7% versus the US dollar, reflecting a 4.2% appreciation of the dollar nominal effective exchange rate (NEER) and 3.1% depreciation of the renminbi NEER

Read the full piece here:

MFN goes mainstream

If you follow me on Twitter or LinkedIn, you probably saw my incensent positing about the fact that the kind folk at FT Alphaville let me write a nerdy trade post for them.2

If not, it was about the coming tariffs on low value parcels and you can read a snippet here:

In May 2023, the European Commission proposed a swathe of changes to EU customs rules.

Among them, acting on the recommendations of the so-called ‘Wise Persons Group’ (note: this is not particularly relevant, I just think it’s amusing that this group of wise people is continually referred to in the Commission’s impact assessment), is a proposal to scrap the EU’s €150 de minimis threshold. Such a change would be in line with its 2021 removal of a similar low-value import VAT exemption.

Why?

Well, the official reason is to protect against fraud. The Commission points to a slightly dated 2016 study note (which specifically focused on VAT evasion, not tariffs) which finds that 65 per cent of e-commerce consignments are undervalued. But the actual reason (imo) is that the Commission would like to raise some more money.

And the full piece HERE.

Charts of the week

As we’ve discussed, the EU has opened a probe into China’s approach to procuring medical devices, usings its new International Procurement Instrument (IPI). If you were wondering what the perceived issue is, I think this chart by the folk at ECIPE sums it up nicely:

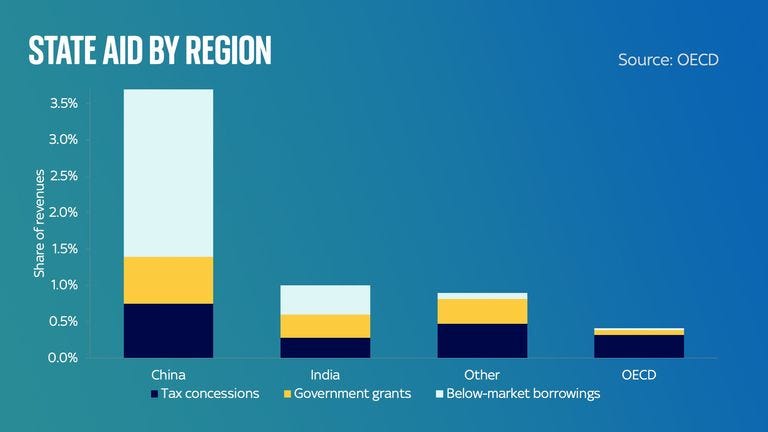

Ed Conway of writing great books about critical materials fame, published this OECD chart. Explains a lot about **waves at all recent trade policy**.

Best,

Sam

I would note that Frances is also far more bullish than me on tariffs being inflationary in the US, so she may well be one of the people in the comments telling me that I’m an idiot.

To the people who have subscribed to MFN as a result, welcome!