Most Favoured Nation: Weaponised Uncertainty

Retroactive tariffs on Chinese EVs, why removing tariffs is fiscally irresponsible and

In 2018, Meredith Crowley and Dan Ciuriak published a paper that I think should be much more well-known that it is called “Weaponizing Uncertainty”.

They argue that one of the key trade weapons wielded by the Trump administration was uncertainty itself. On a day-to-day basis, companies and countries never knew whether the trading environment would remain the same or whether they would wake up to a new tweet from the President subjecting their exports to a tariff or other form of trade restriction.

In this world, uncertainty itself is a non-tariff barrier.

And, I am amused to say, it appears the EU has taken a leaf out of Trump’s playbook [albeit, probably not consciously.]

Earlier this week, the European Commission directed EU member state customs authorities to start registering the import of Chinese electric vehicles into the EU.

Why?

Well, as the good readers of this newsletter know all too well, in October last year the EU initiated an anti-subsidy investigation into imported China-origin electric vehicles. The investigation will conclude soonish, and will probably result in additional tariffs.

But the Commission is becoming increasingly concerned that exporters of Chinese EVs expect tariffs too, and are therefore doing a very logical thing: shipping loads of cars to the EU before the tariffs hit.

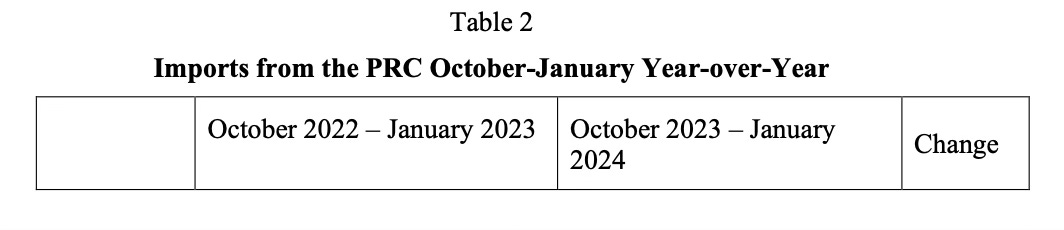

The Commission estimates that, when you compare October 2022-January 2023 [a period before the investigation started] with October 2023 - January 2024 [the period in which the investigation was initiated and taking place], imports of Chinese electric vehicles are up by 14%.1

So why are customs authorities being asked to register these arrivals? So that the EU can retroactively apply tariffs, of course!

I’m actually quite impressed by this approach, from a Machiavelian perspective. By raising the possibility of retroactive tariffs, the EU has introduced a degree of uncertainty (weaponised uncertainty, some would say) that could lead to Chinese EV exporters thinking twice about sending their cars over.

And even if the EU later decides **not** to apply the tariffs retroactively, there will still (probably) have been a chilling effect on imports, which is exactly what the EU wants.

Trump was clearly onto something.

Costly Policy Wins

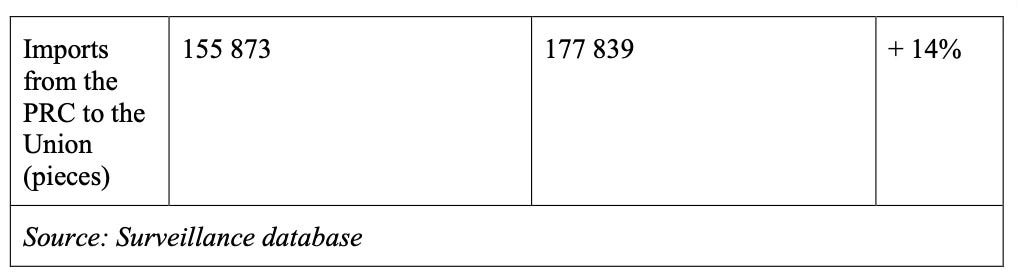

On a related subject, some of you may remember last year’s drama where, late in the day, the EU and UK decided to avoid tariffs needlessly being placed on electric vehicles by extending the application of less punitive rules of origin provisions.

This was a really good decision! Needless tariffs are bad! Well done to all involved. Etc.

Hilariously, the UK’s Office for Budget Responsibility published an estimate suggesting that this decision not to increase trade barriers will cost the UK £0.2 billion per year in tax revenue.

Which … may be true. But also the implications are amusing. If you are a fiscally constrained government looking for additional tax revenue … put tariffs on everything!

Why has no one thought of this before …

Rebalancing

Earlier this week, occasional MFN contributor Karthik Sankaran published an excellent piece arguing that concerns about trade imbalances are often driven by “narrower domestic preoccupations with the sectoral composition of such imbalances and the associated consequences for domestic politics and the international balance of power.”

I also really liked this conclusion:

There are places that have supply and places that have demand; places that are capital constrained and places that have capital to go; places that are at the technological frontier, and places that are trying to reach or surpass it. It is better to allow those processes to continue than to tie the world to a shibboleth of getting as close to national self-sufficiency as possible.

Read it:

An Imminent Trade Deal with India

No, not the UK.

According to news reports, the EFTA trade bloc (Norway, Iceland, Switzerland and Liechtenstein) are close to finalising a trade deal with everyone’s favourite WTO disruptor, India.

Keep reading with a 7-day free trial

Subscribe to Most Favoured Nation to keep reading this post and get 7 days of free access to the full post archives.